- Fintech Is Femme

- Posts

- 🤑 $10.4 Million Raise

🤑 $10.4 Million Raise

How Alinea’s storytelling strategy landed $10.4M, Tanya Van Court’s mission to build generational wealth, and Ashley Fox’s bold rewrite of Wall Street’s rules.

Hey, fintech fam! 💜

Yes, I’m talking about the Fintech Is Femme Leadership Summit again—because when you’re building something this bold (and also producing a whole second event at the same venue), it kinda takes over your life.

On April 23, we’re bringing together 400+ women in fintech, tech, and financial services for a full day of strategy, storytelling, and real connection at The Times Center in NYC.

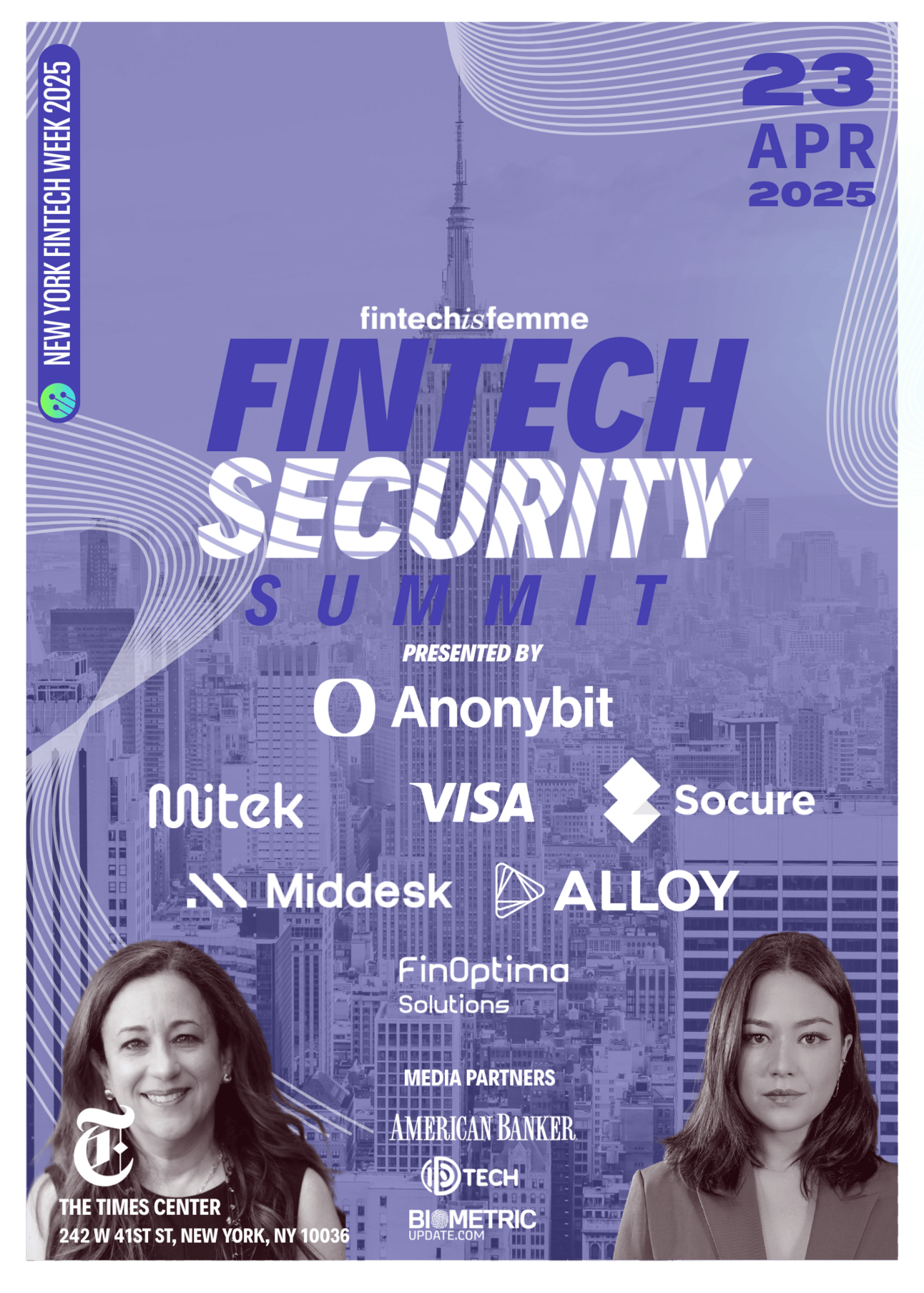

And because one summit apparently wasn’t enough for me, we’re also hosting the Fintech Security Summit on our second stage—spotlighting the fraud fighters and risk leaders building a safer, more inclusive financial future.

Juggling both events while scaling the rest of the business? It’s giving caffeine-fueled chaos and calendar acrobatics—but it’s all worth it.

For today: one big news story and two brand-new podcast episodes coming in hot.

Let’s get into it 👇

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 How Alinea Invest Used Storytelling to Raise $10.4 Million Series A

This week, in my latest Forbes column, I wrote about two Gen Z founders who just raised a $10.4 million Series A for their investing app. But this isn’t just your typical funding announcement.

It’s a case study of how a founder-led brand can break through in an industry built on sameness.

The Startup: Alinea Invest

Alinea Invest is an AI-powered investing app that now serves over 1 million users—92% of whom are women and 70% Gen Z. The company was co-founded by Anam Lakhani and Eve Halimi, two Barnard grads who met in college and later built the product they wish existed.

And the data speaks for itself:

$6 million net revenue run rate

6x year-over-year growth in 2024

550M+ views on TikTok under #AlineaApp

Alinea didn’t scale on paid ads. It scaled by telling its story—loudly, clearly, and on platforms where its audience actually lives.

“We’re not just selling a product—we’re building a brand,” Eve told me. “Young women see themselves in us.”

That’s more than a marketing philosophy—it’s the core of Alinea’s strategy. They call it the “salad and the fries”—a balance between guidance and autonomy that empowers users to build wealth their own way.

The Differentiator: Founder-Led Storytelling

Alinea is doubling down on community. From day one, the founders have operated with a simple but powerful equation: context × community = revenue.

Their content-first approach—anchored in storytelling, relevance, and real connection—has become one of their most effective growth levers. While most fintech startups and traditional financial institutions are only beginning to explore this strategy (if at all), Alinea has already proven its ROI.

In many ways, they’re not just following the curve—they’re ahead of it.

The brand isn’t built on brokerage fees or trading features—it’s built on trust, relatability, and consistency.

They show up in DMs, on TikTok, at community meetups—and now, through AI Allie, a personalized wealth coach powered by machine learning and voice interaction.

“We don’t want people to have to come to investing,” Anam said. “We want to bring investing to where they are—on their phones, in their lives, and on their terms.”

Why This Matters

It’s been a tough few years for consumer fintech. We’ve seen some major players pull back, shut down, or pivot away from their original missions.

And yet, Alinea just raised a significant round. That’s a signal.

It tells us that investors are still looking for fresh approaches—especially those that capture underserved markets like young, first-time female investors, who represent one of the largest generational wealth transfer opportunities in history.

The lesson here? Scale is not always about infrastructure. Sometimes, it’s about insight.

Alinea didn’t just identify a gap—they built a product, a platform, and a community that fills it.

And in doing so, they’ve set a new standard for what consumer fintech can look like when it’s built from the inside out.

PS: Founders like Anam and Eve are exactly who we’ll be learning from at the Fintech Is Femme Leadership Summit on April 23. If you’re serious about scaling with purpose, there’s no better room to be in. 🎟️ Get your ticket before we sell out.

#2 Tanya Van Court Is Building the Future of Youth Finance—And She’s Just Getting Started

Tanya Van Court is on a mission to close the financial literacy gap—and she’s doing it on her own terms.

As the founder and CEO of Goalsetter, Tanya has raised over $30 million to empower the next generation with tools to build real financial confidence.

Before fintech, there was television. Tanya was a senior exec at Nickelodeon and Discovery Education, creating programming for millions of kids. But it was her personal experience in Silicon Valley—when a stock market crash turned $1 million into $10,000 overnight—that lit a fire.

She wanted her kids to learn what she didn’t. That passion project became Goalsetter.

Since then, she’s gone head-to-head with sharks on Shark Tank, earned the backing of investors like Kevin Durant, Mark Cuban, Sterling K. Brown, and Nike, and built a financial education platform used by schools, banks, credit unions, and families across the country.

And the momentum hasn’t stopped.

In 2021, Tanya closed a $3.9 million seed round, with commitments from a star-studded investor list. One month later, Mark Cuban joined as a strategic partner to help one million kids—particularly Black youth—open their first savings accounts.

Then came Nike, investing $1 million as part of its $140 million racial equity initiative. For Tanya, the partnership was personal.

Today, Goalsetter is scaling with innovative features like “Learn to Earn” and “Learn Before You Burn”, gamified tools designed to help kids master money early. And with brand partnerships including Delta Air Lines, American Express, and The Edward Jones Foundation, Tanya is just getting started.

Her journey is a masterclass in purpose-led leadership—and her impact is reshaping what financial education looks like in the U.S.

Want it in person? Tanya will be taking the stage at the Fintech Is Femme Leadership Summit on April 23 in NYC.

#3 Ashley Fox Is Rewriting Wall Street’s Narrative—And Bringing Everyone With Her

Ashley Fox, Founder and CEO of Empify

This week on Humans of Fintech, I sat down with Ashley Fox, Founder and CEO of Empify, for a powerful conversation on financial literacy, community empowerment, and what it means to challenge the Wall Street status quo.

Ashley began her career as a Wall Street analyst—suits, spreadsheets, and the hustle. But something didn’t sit right. The financial world she was living in didn’t reflect the communities she came from, or the people who needed access to this information the most.

So she walked away.

She launched Empify with a mission: deliver financial education and tools to everyday people—especially those historically left behind by traditional financial institutions. Her goal? To reach the 99% that Wall Street rarely speaks to and empower them to build generational wealth on their own terms.

This episode unpacks the bold moves Ashley made to become an entrepreneur, how she’s built a thriving platform rooted in purpose, and why true impact starts with meeting people where they are—on the ground, in schools, in communities, and online.

She’s not here to gatekeep wealth. She’s here to teach it, share it, and spread it.

And guess what? You can catch even more of Ashley’s brilliance live on stage at the Fintech Is Femme Leadership Summit on April 23, where she’ll also be joining us as a featured speaker.

Her story is real, raw, and exactly what the future of fintech should look like.

📍And come see her in NYC—trust me, you’ll want to be in the room.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

📍 April 23 at The Times Center

📍 400+ women (and men) in fintech

📍 One day of strategy, visibility, and real deal-making

📍 All during NY Fintech Week

This isn’t fluff. It’s funding. It’s client deals. It’s game-changing content x community that drives ROI.

So if you’re a fintech founder, investor, operator, or just tired of being the “only” in the room—come be in this room.

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Security Summit

🚨 Fraudsters are working faster—and smarter. It’s time we do the same. 🚨

If the last year taught us anything, it’s that security can’t be an afterthought. It’s the foundation. The differentiator. The trust builder.

We’re bringing together the brightest minds in fintech, risk, fraud, and identity for a high-impact day of strategy, innovation, and real talk.

Expect actionable insights, serious networking, and the community momentum to stay ahead of evolving threats—without compromising user experience.

💥 Space is limited and tickets are moving—secure yours today.

FINTUNES

Kali Uchis is giving the Fintech Is Femme universe current vibe.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜