- Fintech Is Femme

- Posts

- 🤑 10 out of 10

🤑 10 out of 10

Tala Celebrates 10 Million Users in a Decade; $3M Raised for AI Assistant for Financial Advisors; Tori Dunlap on Redefining Money Narratives

Hey, fintech fam! 💜

I’m thrilled to announce my partnership with Nasdaq for the third year in a row to host the 2024 Fintech Trailblazer Contest! This contest highlights fintech companies revolutionizing the investment and wealth sectors through real-time financial news and data access. 👏🏽

If you’re a fintech innovator — whether in the pre-seed stage, seeking funding, or even preparing to list — this is a unique chance to boost brand awareness and set your company up for success.

Here’s what the Fintech Trailblazer winner will receive:

🏢 A featured ad on the iconic Nasdaq Tower in Times Square

🎙️ An interview with Nasdaq’s Global Markets Reporter, Jill Malandrino, on a special Trade Talks episode

🏦 VIP access to attend a live opening or closing bell ceremony

And, as a bonus, the winner will join me for a guest spot on the Humans of Fintech podcast! 😉

⬇️ Get all the details and apply here:

Good luck to all the trailblazers!

Now, onto today's news.

#TRENDING

What’s Up In Fintech

Every Thursday, I deliver the hottest fintech news and trends, keeping you updated with the most essential insights impacting the industry.

Editor’s Note: I’m so grateful to everyone who came out for the Fintech Is Femme Leadership Summit in San Francisco! I want to take the time to digest all of the insights and share what we have learned in an upcoming Tuesday column. Stay tuned!

#1 Tala Reaches 10 Million Users in 10 Years

Shivani Siroya, Founder & CEO, Tala

As Tala hits its 10-year mark and celebrates over 10 million customers globally, the company’s success offers a compelling model for women-led fintechs and their allies on how to scale with purpose—even through economic headwinds.

In a sector marked by challenges, Tala’s mission-driven approach is reshaping financial inclusion across emerging markets.

By the numbers:

$1 billion disbursed in credit in 2024 alone, with a 1.5 million new customers added across East Africa, Latin America, and Southeast Asia.

Nearly $6 billion in total credit since inception, reflecting Tala’s role in enabling economic access for the traditionally underserved.

New $48.5 million partnership with Maya Bank to increase financial services access in the Philippines, one of Tala’s most vibrant growth regions.

Product innovation:

Crypto access: Tala launched its first self-custody crypto wallet in Latin America, allowing customers to deposit and withdraw stablecoins and secure credit—a crucial offering as more customers seek financial autonomy.

New data models: By relying on mobile and alternative data, Tala maintains high 90% repayment and 95% repeat rates—a strong indicator of customer loyalty and credit efficacy in traditionally underserved populations.

Leadership as a strength:

Tala’s executive team, now 80% women, welcomed Damier Xandrine (Chief Legal Officer) and Michael Olson (Chief Operating Officer). By prioritizing diverse perspectives, Tala’s leadership reflects its commitment to a more inclusive financial system.

Insights for Fintech Leaders:

Empathy drives innovation: Founder and CEO Shivani Siroya’s hands-on experience in emerging markets.

She interviewed over 3,500 individuals and entrepreneurs across nine countries. To fully understand their financial behaviors, she began collecting alternative data by observing their daily routines, tracking their spending, and analyzing their saving habits.

This real-life experience underpins Tala’s customer-centric design. Understanding user needs on the ground fosters solutions that resonate deeply.

Breaking tradition pays off: Tala’s credit scoring, which bypasses traditional metrics, unlocks financial access for millions. It’s a reminder to question old methods and build something better where gaps exist.

Trust is a competitive advantage: With a 90%+ repayment rate, Tala’s approach emphasizes trust as foundational. It’s not just about transactions; it’s about proving you’re a financial services provider there for the long run.

What’s next: As Tala eyes 2025, the company plans to expand further into current markets, leveraging AI to scale responsibly while staying committed to unleashing economic power for the global majority.

Curious about how Shivani created Tala and her journey as an entrepreneur? She tells her story in my new book, Fintech Feminists. Get your copy here.

#2 Zeplyn’s $3M Seed Round: The AI Assistant Built for Wealth Management

/indianstartupnews/media/media_files/2024/11/14/drRaDgFfkWzQ8eLt4Yck.jpeg)

Zeplyn Co-Founders Era Jain and Divam Jain

Zeplyn just closed a $3 million funding round, stepping into the AI-powered assistant space with a solution that goes straight to the heart of financial advisors’ needs.

Co-founded by former Google engineers Era Jain and Divam Jain, Zeplyn says it promises to cut down on the time advisors spend on administrative tasks—without compromising compliance.

As AI assistants flood the market, this one actually addresses the elephant in the room: compliance.

Key stats:

10-12 hours saved per week for advisors by automating everything from meeting prep to follow-up.

60% of client data is gathered in meetings, yet less than 25% of meetings are fully documented—highlighting the lost data and productivity in traditional approaches.

$7 billion: The projected value of the AI in fintech market as of 2023, set to grow as more financial professionals embrace AI.

The standout factor:

Here’s what grabbed my attention: every time I mention using AI tools like Otter.ai (my personal go-to) to financial advisors, their immediate response is a mix of:

“sounds great” followed by “is it compliant?”

Zeplyn gets it. It’s built with financial professionals in mind, with the compliance standards to back it up. Here’s how else it works:

Purpose-built meeting assistant: Zeplyn’s AI captures unstructured meeting conversations, turning them into detailed notes and instantly updating client records.

Integrates with your CRM: From Salesforce to Wealthbox, Zeplyn plugs into the systems advisors already use.

My take on the market trends:

AI is getting crowded, fast: Zeplyn’s entry underscores a big trend—AI-powered assistants for financial professionals are multiplying, but they’re not all equal. Advisors need solutions tailored for them, which means security and compliance can’t be an afterthought.

AI-native is the new digital: With Zeplyn, we’re seeing the next wave of fintech evolution. It’s not just about going digital anymore; it’s about building fully AI-native operations that solve for industry-specific challenges, like data security and heavy compliance needs.

Women in fintech, this is your moment: As the AI in fintech market skyrockets, there’s an opportunity for women leaders to step into this space and shape it. Zeplyn co-founder Era Jain is a perfect example of the leadership needed in this area. Women in fintech have the chance to drive AI’s future by bringing diverse perspectives and ethics to the table, creating smart and genuinely impactful solutions.

#3 Rewriting Money Narratives: A Conversation with Tori Dunlap

Tori Dunlap’s story isn’t just about personal finance; it’s about reclaiming economic power. On this week’s episode of Humans of Fintech, we dive deep into the experiences and insights of Dunlap, a money expert and founder of Her First $100K.

Tori’s journey from a financially empowered child to a finance-savvy entrepreneur reflects the power of financial literacy as a tool for liberation—especially for women.

In a landscape still marred by gender bias, her message is clear: financial independence equals freedom.

Key insights:

• $1,819: The annual cost of financial illiteracy per person, adding up to $436 billion nationwide, per a 2022 National Financial Educators Council survey.

• A new generation learns on TikTok: 78% of millennials and Gen Z report greater access to financial advice through social media—driven by creators like Dunlap, who has amassed 2.4 million TikTok followers by promoting financial independence.

Tori’s journey:

Dunlap was fortunate to grow up in a household that valued financial education.

But after entering adulthood and navigating toxic work environments and gender biases, she realized the stark reality: many women don’t have access to this financial foundation.

Her corporate experience left her disillusioned, especially as she witnessed firsthand the workplace biases against women.

Her reaction? Radicalize, educate, and empower other women.

• Turning expertise into impact: In 2016, Dunlap left her corporate job to launch Her First $100K, transforming her personal finance blog into a full-time business.

• The rise of Financial Feminist: Her podcast, launched with a $99 mic, quickly became the world’s top business podcast and a go-to resource for women’s financial literacy.

Why the timing is perfect:

In 2020, the pandemic sparked a cultural shift around personal finance. Social media, especially TikTok, became an informal financial classroom. Dunlap’s accessible, practical advice filled a crucial gap for women and marginalized groups who had been historically underserved by traditional financial institutions.

According to Plaid’s 2022 Fintech Effect report, 79% of users are looking to fintech apps for help with emergency funds, credit scores, and savings habits—topics Dunlap covers extensively.

Lessons for fintech leaders:

1. Financial literacy as empowerment: Dunlap’s mission underscores a fundamental truth: financial education isn’t just about numbers; it’s about freedom. When women have money, they have choices—to leave an unfulfilling job, to start a business, or to fund causes that matter to them.

2. Break free from perfectionism: Dunlap is a vocal advocate for embracing “done is better than perfect.” The narrative that women must be flawless before taking risks is a myth, much like the 19th-century “bicycle face” myth aimed at discouraging women from cycling. Perfection is often a barrier; taking action is the real goal.

3. Money as a neutral tool: Dunlap reminds us that money, at its core, is morally neutral. Society has conditioned women to view wealth with skepticism, but her message is to own it unapologetically. Financial independence is a form of protest, and women shouldn’t hesitate to pursue wealth.

Real talk on the challenges:

From VC rooms to boardrooms, women entrepreneurs continue to face skepticism. Female founders are often asked about personal decisions, like family planning, rather than their business metrics or growth potential. This narrow lens remains a stark barrier for women who are driving valuable, innovative companies with a clear social impact.

Dunlap’s takeaway: The status quo benefits from women playing small, but that’s precisely why we need to stop. Women must advocate for themselves, celebrate their wins loudly, and inspire others by showing what’s possible.

Moving forward: As fintech leaders, we’re uniquely positioned to redefine access to financial services.

Money means options, and options mean freedom—especially for marginalized communities.

By creating products and platforms that are accessible, transparent, and empowering, we’re supporting women’s journey to financial freedom.

Dunlap says, “We won’t have equality for any marginalized group until there’s financial equality.”

Editor’s Note: This interview was first conducted in January 2024.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events! These events are perfect for meeting people, learning new things, and connecting with our fintech community. Let's add these fun events to our schedules - I hope to see you there!

MONDAY, DECEMBER 9

[NEW YORK] THE FEMMY AWARDS FOUNDERS MEETING

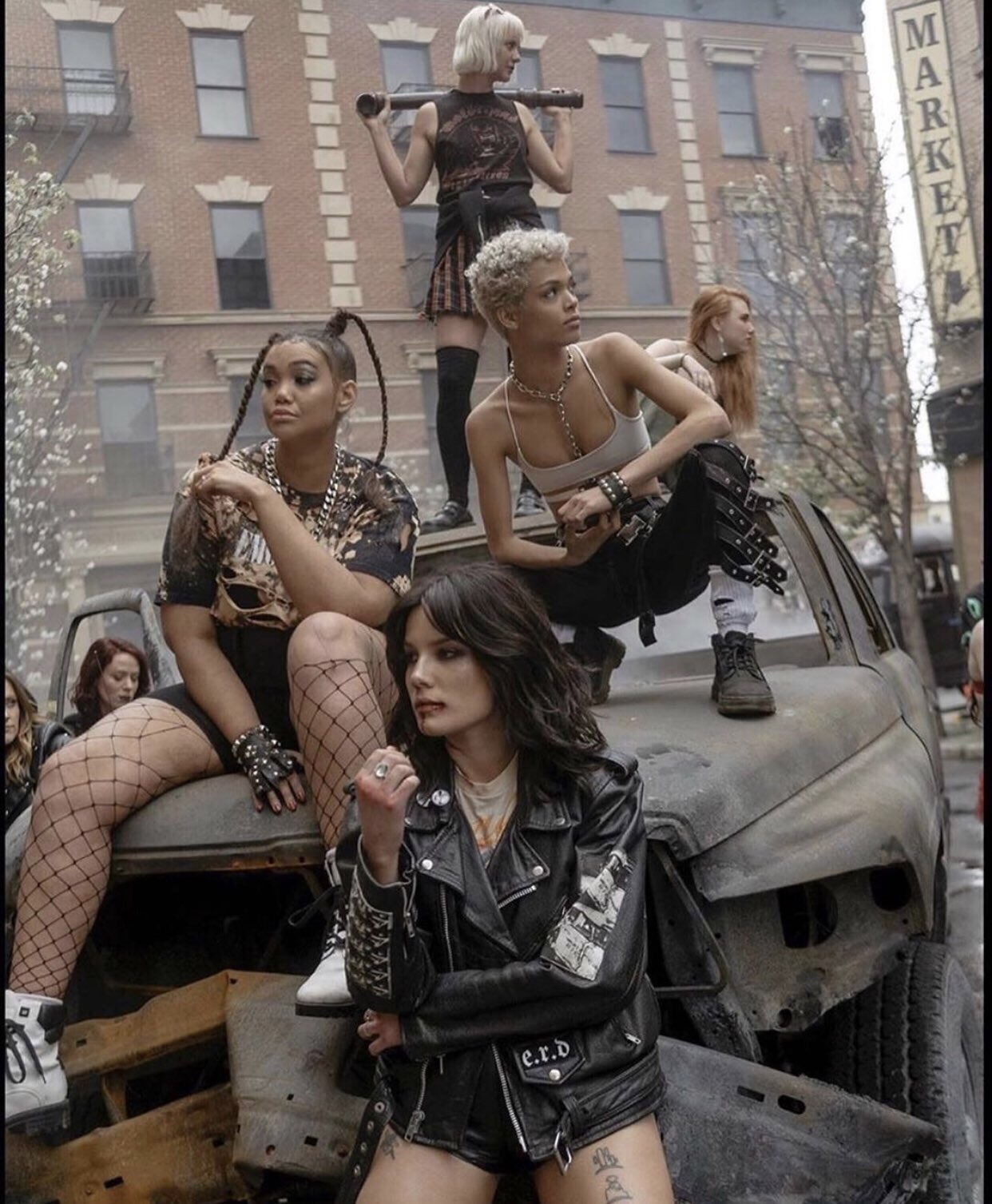

This is the vibe.

Ever wonder what the Constitutional Convention might have looked like if our founding foremothers had gathered to create a more perfect union instead of our founding forefathers?

I invite you to join us on December 9th at Rise by Barclays for the inaugural gathering of the newly established Academy of Fintech—a groundbreaking community of female leaders in fintech, united to build a better future for all.

Together, we’re creating a supportive network that empowers women to thrive in their careers, connect meaningfully, and champion each other’s success in an industry that needs more female voices at the helm. Agenda coming soon.

Let’s make history together.

Join the waitlist to receive your invitation for December 9.

FINTUNES

Throwback to this five-year-old Halsey tune at the top of my female rage playlist.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on female leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜