Hi, fintech fam! 💜

Welcome to the New Year! Can you believe we're entering our third year as a community?

As we keep growing, I'm thrilled to announce premium features that will support you and your business in 2024.

These changes align with our mission to advance a generation of leaders who create fintech solutions that improve the world (and rescue humanity)!

So, get ready for the next chapter of Fintech Is Femme!

Here’s what’s coming in 2024:

Our new "On Performance" column will be sent every Sunday, giving fintech entrepreneurs and executives simple and actionable steps to improve their leadership skills, such as building their personal brand and improving public speaking.

Our new "On Community" column will be sent every Friday, giving you the blueprint to making community your competitive advantage.

Also, you will get early access to live events (including free tickets!), an invite to my private community channel, warm intros to other members, and monthly coffee chats with me.

And, of course, my weekly Tuesday and Thursday insights will always keep hitting your inboxes for free.

Because you're part of my ride-or-die fintech fam (thank you!), I want to give you access to these special features before anyone else.

Today, as our special early offer, you can upgrade your subscription to premium and secure your spot as a FOUNDING MEMBER for only $4.99 a month or $30 for the entire year (friends & fam discount)!

Ready to level up together?

Need marketing assets? Like Yesterday?

Maybe your brand launch is tomorrow.

Maybe you have no hiring budget (been there).

Or maybe your team is simply understaffed and overworked.

Regardless, if you need designs ASAP, you need Superside. They deliver high-quality, on-brand assets in as little as 24 hours.

Yup, Superside hires the top 1% of creatives across the globe, so you don’t have to vet freelancers or make any hasty hires in a pinch.

Why Superside?

Graphic design, websites, ad copy–it’s all on-brand and on-time

Used by over 450 companies like Google, Meta, Reddit, and Shopify

Transparent pricing from the start to save you up to 50%

TL;DR: It’s a design subscription service tailored for MM and ENT companies.

Start using Superside!

INNOVATION

"You should consider renaming your brand to 'Fintech Is Finished.'"

It was Friday, March 10, the start of the 2023 banking crisis. I remember receiving this text from a founder saying our industry was nearing its end.

I think we can all agree it was a weekend from hell. However, during it, I witnessed an inspiring unity within the fintech community.

Fintech, media, and venture capital leaders dedicated their weekend hours to publishing invaluable resources, including loans, payroll, and banking assistance for struggling startup founders.

The result? We bounced back swiftly.

Take Silicon Valley Bank, for example. By March 27, 2023, First Citizens Bank had acquired it, and all 17 branches reopened under a new name. Similar stories unfolded with Signature Bank and First Republic Bank.

Contrary to the prediction that fintech was finished, the industry survived and thrived because we came together as a community.

I'm revisiting this pivotal 2023 moment as a forward-thinking strategy.

Understanding the challenges we've overcome better equips us to navigate future obstacles.

Fast forward almost 10 months later, as we step into a new year, it's crucial to address the current downturn in the fintech industry head-on.

Beyond the obvious factors like rising interest rates and sluggish investment flow, a deeper issue persists—transcending mere numbers.

It's about congruence.

Congruence means aligning our values with our actions.

Achieving this requires tuning into the world around us.

The world is holding up a mirror, reflecting three glaring issues that fintech can help solve:

Climate change (2023 was the hottest year on record),

widening wealth gaps in the economy,

and mental health stressors exacerbated by financial worries.

Pretending that our fintech roles are isolated from broader societal issues is a dangerous fantasy perpetuating a vicious cycle.

This incongruence interferes with our internal compass, distorting how we operate, scale our businesses, design products, and make investments.

Which has manifested in our industry as mass layoffs, crypto scandals, attacks on diversity, equity, and inclusion (DEI), and shutdowns.

We must confront these harsh realities, identify toxic systems, and take tangible action to break free from this cycle.

As fintech innovators, we should tap into humanity's inherent goodness to create positive change.

I'm here to offer step-by-step guidance on achieving this by working together.

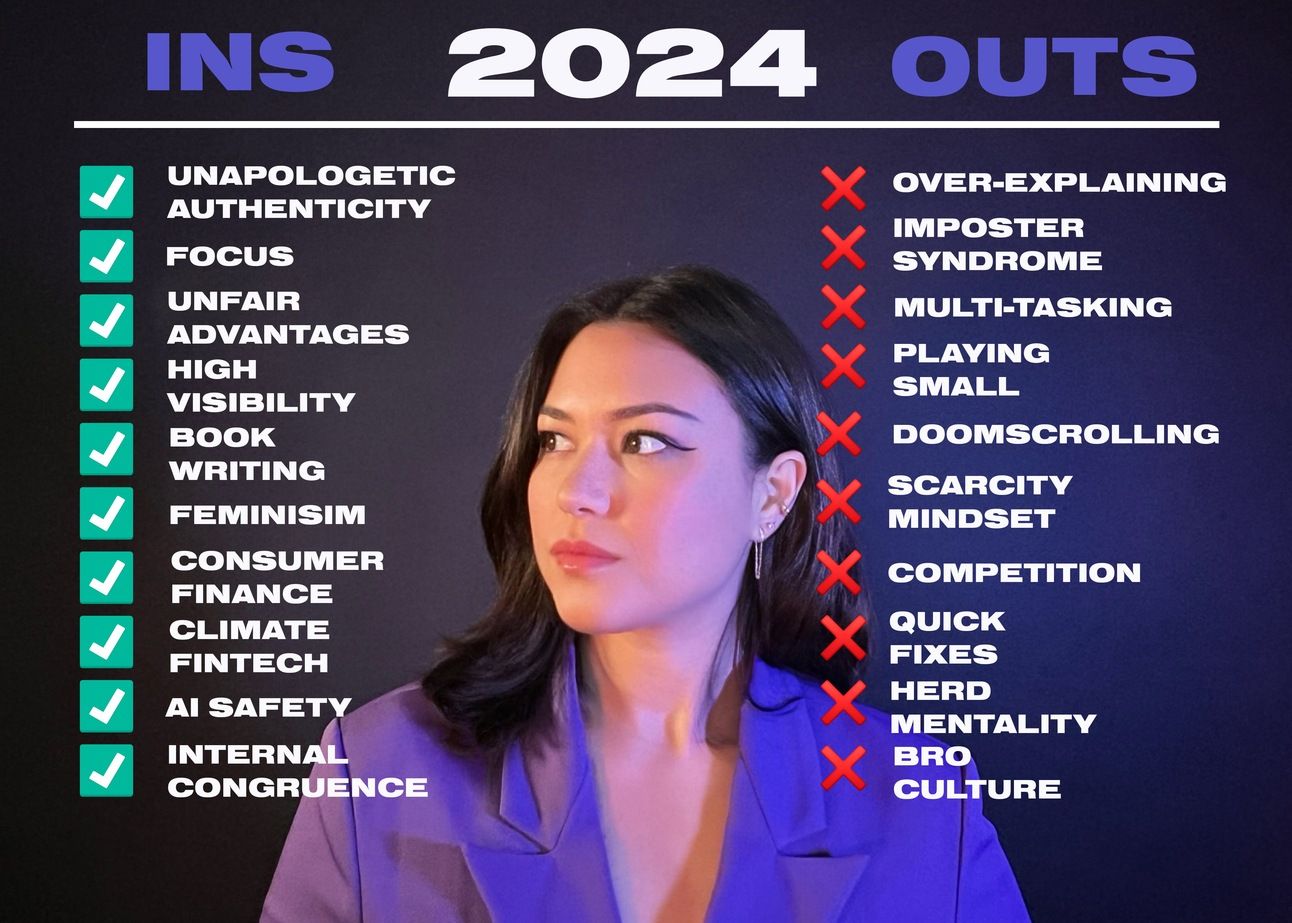

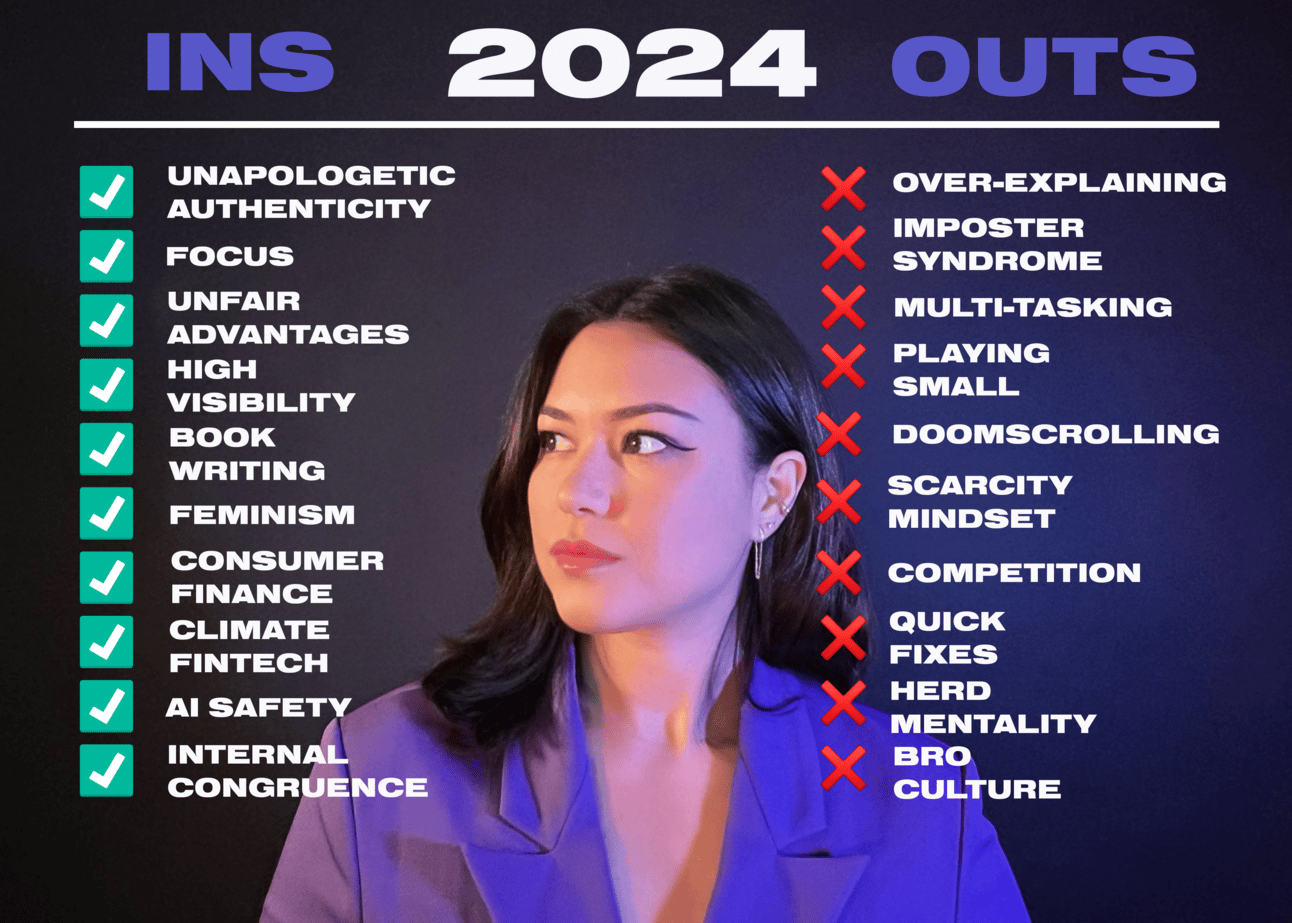

Welcome to the 2024 "Ins and Outs" list:

Let's dive into a couple:

Unapologetic Authenticity > Over-explaining

Our economy falters when less than 3% of funding supports female founders and people of color, and less than 10% of fintech leadership comprises women.

This fractured economy results in a ripple effect:

Venture capital favors only one type of founder, spurring an obsession with revenue and operating with a scarcity mindset harmful to the planet.

We need to increase funding dollars to women in fintech. No more tiptoeing around.

Cease over-explaining why we belong here and be direct, honest, and unapologetically authentic.

We don’t have any time to waste.

As Beyonce wisely puts it, power is knowing that you only need permission from yourself.

It's time to take ownership of our economy and industry by supporting one another and embracing ourselves.

Here’s how to do that.

Unfair advantages > Imposter syndrome

In 2023, Reshma Saujani dispelled the myth of imposter syndrome.

This year, focus on your unfair advantages – those unique qualities that set you apart. Yours could be anything from your background to your personality traits or special skill sets.

For example, my multicultural background and media expertise are some of my unfair advantages. I leverage these as my strengths, creating a distinctive identity and platform in this fintech world.

A pivotal moment in my success trajectory was when I shared my experiences as someone with a multicultural background on fintech’s biggest stage, Money20/20.

Take a moment to think about your unique strengths, advantages, or skills that give you an edge over others.

You can use a pen and paper, a Google Doc, or your smartphone to write them down.

Once you identify these qualities, you can leverage them to drive innovation and create new opportunities by sharing your insights with others in your day-to-day, on social media, and even on industry stages.

Building trust with others and increasing your chances of success in this business is easier when you connect with your unfair advantages and share them publicly.

It gives people a reason to care about you.

High visibility > Playing small

The lack of funding for women in fintech stems from a need for higher visibility (among other complex systematic issues).

Representation matters, so when you receive a “win,” big or small, step into the spotlight – when you do, you pull more women into this fintech party.

Use a platform where you engage with the fintech community most. I personally find LinkedIn to be the best platform for win-sharing and authentic community building.

Did Taylor Swift, Beyonce, and Barbie get to control the narrative and our economy because they stayed hush-hush?

Nope – and neither should you.

Now that you know how to innovate your actions, here are 3 fintech trends I predict (and hope) will advance in 2024.

#1 Consumer Finance

I anticipate a consumer finance resurgence this year as macroeconomic trends point toward increased consumer finance stressors.

Innovation is ultimately evolving beyond a mature counterpart. Investors have learned from previous experiences that acquiring customers and making a profit in consumer fintech can be expensive and challenging.

With those lessons learned, investors better understand how to evaluate and support these businesses.

Consumer finance also remains ripe with opportunities, as no fintech has truly tackled the very personalized nature of personal finance experiences.

We've yet to meet specific consumer needs precisely when financial assistance is required, such as reshaping capital priorities after the return of online student loans.

While consumers have established their digital banking foundation, a pressing need emerges for an intelligent layer optimizing spend, providing insights, and addressing tax and wealth management needs.

This necessity aligns perfectly with the rise of generative AI in tech.

As consumer finance evolves, the current era needs to learn how to leverage generative AI to understand spending and wealth management, addressing fundamental questions about personal finance that existing apps struggle to answer, like “What do I do next?”

The changing economic landscape also directs attention to employers, gig marketplaces, property managers, and financial institutions for additional value.

In navigating consumer finance's landscape, focus on foundational financial services, ensuring consistent revenue.

#2 AI Safety

60% of Americans believe AI will revolutionize financial services in the next five years, but 7 in 10 prefer reviewing AI's decisions before trusting it fully.

Users having trust issues with AI makes sense, given some investigations into AI algorithms, such as the Pulitzer Center's examination of a Rotterdam fraud detection system, revealed AI biases perpetuating ethnic and gender discrimination in our most vulnerable welfare communities.

On top of that, in late 2023, the New York Times filed a lawsuit against OpenAI and Microsoft for copyright infringement.

Looking ahead to 2024, it's clear that the financial services industry must prioritize AI safety, address biases, and tackle copyright issues head-on.

By doing so, we can create a future in which AI chatbots can effectively address consumers' basic financial needs and pain points while simultaneously bringing more people into the fold and expanding access to financial services.

With a commitment to these priorities, we can be confident that AI will be a powerful tool for innovation and progress in the financial sector without excluding anyone from its benefits.

#3 Climate Fintech

2023 was the hottest year on record.

In the first eight months of 2023, the U.S. experienced $23 billion in climate disasters, impacting approximately 200 million people annually and perpetuating financial exclusion.

The magnitude of the global climate change challenge demands focus from the fintech industry, which has the power to provide vital financial assistance, transparent data analytics, and comprehensive risk assessment tools to drive forward climate initiatives.

However, the industry must confront obstacles such as the deceptive practices of celebrity-backed companies, commonly known as "greenwashing," to foster transparency in sustainability efforts.

Looking ahead to 2024, I envision significant opportunities in environmental, social, and governance (ESG) investing, not only facilitating these investments but also intensifying our commitment to the aspects of ESG that prioritize gender equality.

This is because gender-lens Investing (GLI) represents a promising avenue to mitigate the risk of detrimental financial outcomes by focusing on women-founded/led companies, those offering women-centric products, and those championing inclusive workplace practices.

Despite facing challenges in fundraising, climate fintech investments are on the rise, experiencing a year-on-year growth of 2.4 times, reaching $2.9 billion in 2022.

Companies that support female-led companies will reap favorable outcomes as they play a pivotal role in driving sustainable development.

WTF ELSE?

How Google Pay defied the odds in India

Unlocking the promise of AI for loyalty in banking

Anthemis Group partner Ruth Foxe Blader started her own firm

Vestwell raises $125M Series D

VC firm Exponent Founders launches with $125M to invest

UK fintech startup ecosystem emerges from a difficult year after funding fell by 63% in 2023.

JOBS

Marketing Fellow, The Artemis Fund

The Artemis Fund is a venture fund that invests in tech companies founded by women in the US. The Marketing Fellow will help promote The Artemis Fund and its portfolio companies to entrepreneurs, investors, the venture capital community, and the technology and financial press. This is a great chance to gain marketing and venture capital experience!

Reply to this email if you’re interested, and I’ll connect you to their team!

I WANT IT, I GOT IT

📚 Today’s Read: Financial Feminist by Tori Dunlap. I’m excited to share that I’m interviewing Tori this week! Stay tuned for her insights on feminism, finance, and entrepreneurship, coming soon. In the meantime, read her book!

👀 Today’s Watch: I was fascinated by Netflix’s new show, You Are What You Eat: A Twin Experiment. The show has nearly convinced me to go vegan. Who’s seen it? What do you think?

🍣 Today’s Eats: After its shoutout on Netflix, I’m intrigued to try Plantega — a bodega serving classic NY sandwiches but all plant-based. Is 2024 the year I try vegan? Open to all recommendations.

FINTUNES

Maeta, with her incredible talent and unique style, has quickly become one of my favorites. And what better way to start off the year than with her mesmerizing rendition of Freddie Mercury's iconic song? Brace yourself for an extraordinary musical experience that will undoubtedly leave you in awe.

That’s all for now! Stay safe, everyone. Hug your loved ones. See you Thursday!

Love,

Nicole