- Fintech Is Femme

- Posts

- 🤑 $24 Billion Power Shift

🤑 $24 Billion Power Shift

A $24.25B shake-up in payments, the future of fintech with Simon Taylor, and how Female Invest is closing the gender wealth gap—globally.

Hey, fintech fam! 💜

We’re just days away from the second-annual Fintech Is Femme Leadership Summit, headlining New York Fintech Week at The Times Center—and I’m officially getting butterflies.

As the event producer, content director, emcee, and let’s be honest, chaos coordinator of it all, I’ll admit—these last few months have been some of the hardest and most stretching of my career.

But wow—how much this team and I have grown.

You never really know what you’re capable of until you push past what feels possible. And if I’m being real with you, three months ago I wasn’t totally sure we could pull this off.

But what I did have was conviction. Belief in this community. In this brand. In the power of what we’re building together. And now? It’s happening.

Something I once only dreamed of—we’re making it real. Together.

I cannot wait to surprise and delight you on Wednesday. Every detail has been designed with intention, with you in mind.

So let’s go. 💥

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 The $24.25B Power Shift in Payments — and What It Means for Fintech

Big fintech moves don’t just shift market share—they signal strategy.

On Thursday, Global Payments, FIS, and GTCR just pulled off a three-way corporate power play that reshapes how payments will work at scale.

Reuters reported the deal: Global Payments will acquire Worldpay from FIS and GTCR for $24.25 billion, while selling its issuer solutions business back to FIS for $13.5 billion.

If your head’s spinning—same. But let’s break this down.

What just happened?

In a nutshell:

Global Payments is becoming a pure-play merchant services giant by acquiring Worldpay, combining its SMB strengths with Worldpay’s enterprise and e-commerce muscle.

FIS, meanwhile, is doubling down on its core: providing banking and issuer solutions to financial institutions.

GTCR, the PE firm that bought a majority stake in Worldpay less than two years ago, walks away with a tidy return—and a 15% stake in the new Global.

From the outside, it looks like a game of fintech musical chairs. But under the surface, it’s an aggressive move to streamline, specialize, and scale.

Global Payments CEO Cameron Bready called it “a merchant solutions powerhouse,” and it’s hard to argue.

The new Global + Worldpay combo will serve 6 million customers and process 94 billion transactions annually across 175+ countries.

Let that sink in.

What it means for FIS

This also marks a major pivot for FIS, which bought Worldpay in 2019 for a whopping $43 billion.

In shedding Worldpay now, the company simplifies its story and sharpens its focus.

“We’re turning a non-cash-flow-generating minority interest into a strategic asset with an attractive growth profile,” said FIS CEO Stephanie Ferris in an interview with Reuters.

Translation? FIS is ready to stop being everything to everyone—and start being excellent at one thing.

Ferris, who’s been at the helm of FIS during some of its most pivotal transitions, is playing the long game here.

By integrating Global’s issuer solutions into its existing debit processing capabilities, FIS can offer a fuller, more seamless suite to financial institutions—and unlock what it estimates to be $500M+ in free cash flow in year one post-close.

It’s a smart move. It declutters the business, focuses the investor pitch, and turns what was once a bloated portfolio into a precision tool.

Why this matters for fintech

This deal isn’t just a shakeup—it’s a signal.

Legacy giants are feeling the pressure from agile, API-native fintechs. They’re responding not by trying to outpace startups at everything, but by going deeper in the lanes they know best.

And that’s the real lesson here: Specialization is the new scale.

Fintech is shifting from “growth at all costs” to sustainable, streamlined models that actually work for customers and shareholders. The leaders winning right now? They’re choosing depth over breadth.

As Ferris said in my Tuesday column, “Financial services are no longer just transactional. They’re experiential.”

Consumers expect seamless onboarding, instant ID verification, and personalized services.

That requires modern infrastructure—and a clear sense of what you’re actually trying to solve.

For Global Payments, that’s merchant services. For FIS, it’s financial institution infrastructure.

And for founders? This is your signal to get even more focused, intentional, and sharp about the problem you solve—and who you solve it for.

#2 Building, Breaking, and Rebuilding Fintech with Simon Taylor

Simon Taylor is one of fintech’s sharpest minds—and coolest voices. From co-founding 11:FS to leading content and strategy at Sardine, Simon has helped shape how the industry talks, thinks, and builds.

In this episode, we go deep on:

→ Why storytelling is a strategy

→ The evolution of fintech infrastructure (and what’s next)

→ What founders really need to know about fraud, compliance, and building trust

→ And why authenticity always wins over hype

Simon’s career spans everything from blockchain R&D at Barclays to advising regulators and launching some of the most influential podcasts in fintech. So yeah—this one’s packed with gems.

If you’re building in fintech, curious about content, or just want a behind-the-scenes look at how the biggest ideas get shaped—don’t miss this conversation.

#3 Closing the Financial Gender Gap with Anna-Sophie Hartvigsen of Female Invest

On this week’s Humans of Fintech, I sit down with Anna-Sophie Hartvigsen, Co-Founder of Female Invest, for a powerful conversation about financial empowerment, community-building at scale, and what it takes to challenge a male-dominated industry from the ground up.

Female Invest isn’t just another fintech startup—it’s a movement. Since launching in 2019, the platform has reached over 90,000 women in 120+ countries, offering tools, education, and a global community to help women invest with confidence.

Just last month, Female Invest officially launched in the U.S. with a buzzy New York event—marking a major milestone following their $11 million Series A and a record-breaking crowdfunding round that raised $1 million in just four minutes. All fueled by their community.

Anna shares what it was like to build a company from a frustration—why no one was speaking directly to women about money—and turn it into a brand endorsed by Emma Watson and Hillary Clinton.

We talk about:

→ Why the finance world underestimated female investors

→ The early days of building a brand no one understood—yet

→ How they scaled with intention and community at the core

→ What this next chapter means for U.S. expansion

If you’re a fintech founder, community builder, or just someone who’s tired of old narratives in money and investing—this episode is for you.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

📍 April 23 at The Times Center

📍 400+ women (and men) in fintech

📍 One day of strategy, visibility, and real deal-making

📍 All during NY Fintech Week

This isn’t fluff. It’s funding. It’s client deals. It’s game-changing content x community that drives ROI.

So if you’re a fintech founder, investor, operator, or just tired of being the “only” in the room—come be in this room.

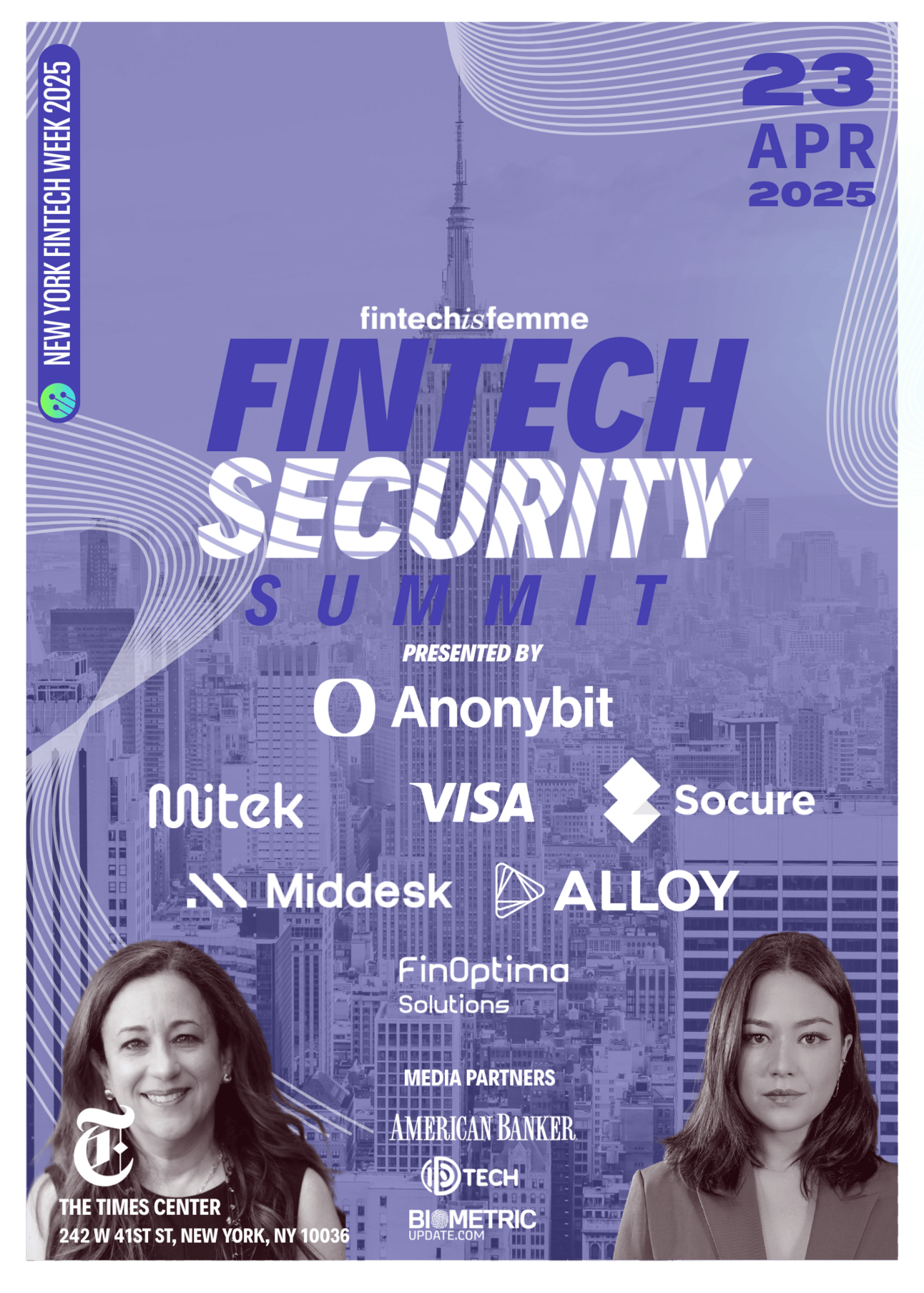

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Security Summit

🚨 Fraudsters are working faster—and smarter. It’s time we do the same. 🚨

If the last year taught us anything, it’s that security can’t be an afterthought. It’s the foundation. The differentiator. The trust builder.

We’re bringing together the brightest minds in fintech, risk, fraud, and identity for a high-impact day of strategy, innovation, and real talk.

Expect actionable insights, serious networking, and the community momentum to stay ahead of evolving threats—without compromising user experience.

💥 Space is limited and tickets are moving—secure yours today.

FINTUNES

And right in the middle of all the chaos—tomorrow (April 18) is my birthday (hello, Aries SZN 🔥)

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜