- Fintech Is Femme

- Posts

- 🤑 Looking to Lead

🤑 Looking to Lead

Discover how the CEO of Stash uses her experiences to drive innovation and lead one of the largest consumer fintech companies.

Hi, fintech fam! 💜

I’m so thrilled to announce that the full agenda and speaker faculty for the Fintech Is Femme Leadership Summit is officially here!

Our stacked agenda features:

A speaker faculty of 20+ leaders consisting entirely of women sharing insights based on their expertise, numerous fireside chats, and panels. An unforgettable dance party and an evening brimming with captivating storytelling.

Our summit on April 8 in New York City features expertise from women in fintech, such as Elise Brown, CMO and Partner of Anthemis; Cleve Mesidor, Executive Director of The Block Found; Asya Bradley, serial entrepreneur and iconic investor; and more! Grab your ticket here.

And if you’re looking for more ways to hang out together:

On March 19, I’m hosting a virtual event showcasing Trailblazing Women in Fintech, with an afternoon of virtual learning and networking. Grab your virtual seat here to hear from industry icons like Betsy Cohen and more!

Now, let's reveal the story of one of the keynote speakers at the Fintech Is Femme Leadership Summit.

WHY UPGRADE?

For our premium members, I send out updates 3x a week through our new column, "On Performance.” These columns will provide tactical advice to improve your entrepreneur and business leader performance.

Plus, premium members support female-led journalism and keep this work going. Because of your support, Fintech Is Femme is more than just a newsletter; it's a media empire and community for women to connect, learn, and support one another.

ICON

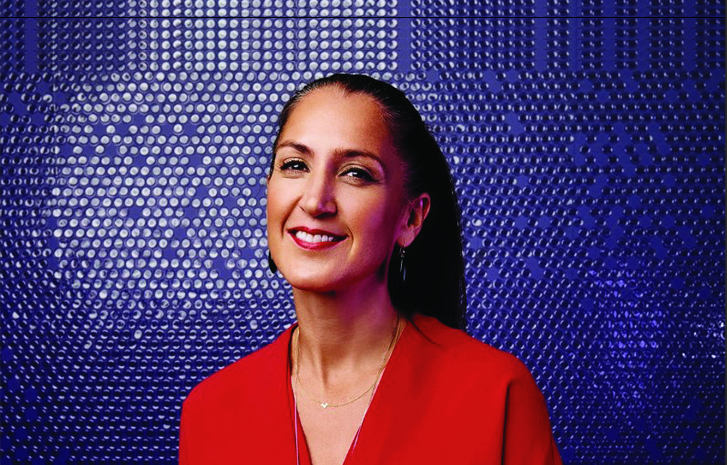

Meet Stash’s CEO, Liza Landsman

With only 24% of leadership roles in financial services held by women, we still have a ways to go to achieve gender parity at the top.

However, some women have been in the game & holding the door open for decades.

Liza Landsman, CEO of Stash, is among them.

This is her story.

Liza is an inspiring innovator, powerhouse operator, and esteemed VC investor, all wrapped together.

The choice to bring her on as Stash’s new CEO in February of 2023 was a no-brainer.

And like many of us, Liza didn’t start out in fintech, rather she found belonging through a series of fortunate events.

Early in her career, Liza started out working at a literary agency. But she soon caught the ‘digital bug’ and made a career move to working in deep tech.

She had many friends during that time who worked in finance, and at first, she did not get the hype.

She thought, boring Wall Street types in suits and heady financial jargon? Not for me.

After a while, she decided to work at Citi, believing it would be a good gig while raising her young children.

Then something unexpected happened.

She discovered behavioral economics and became really compelled by the notion that the way people spend, save, and invest their money is, in fact, the purest expression of their values.

This fascination turned what Liza assumed would be a short sprint in finance into a marathon.

After working at Citi for ten years (8 years longer than she expected to), Liza went on to lead as:

Managing Director of Digital for BlackRock Global

Chief Marketing Officer at E*TRADE Financial

President of Jet.com

General Partner at New Enterprise Associates (NEA)

A SquareSpace Board Member

And now, Chief Executive Officer of Stash.

Stash has roughly 2 million subscribers. In a 2021 venture round, Stash had a $125 million raise at a $1.4 billion valuation.

In my podcast interview with Liza, I asked her why she left the TradFi sandbox to play with the cool kids in fintech (cause, let’s be honest, that’s where access is happening).

Liza told me that after working in executive leadership in several prominent financial institutions, she began to see the cracks in the larger operation.

Liza observed that structurally, all of these businesses were set up to serve the mass affluent extremely well, while most households that didn’t meet that criteria were left dramatically underserved and with so much less made available to them.

This logic never made sense to her.

She saw what small scrappy tech companies in other categories were doing to push the envelope regarding access and was ready to truly yield the power of technology as a disruptive force in finserv.

So when Stash called, Liza gladly picked up the phone.

Stash promotes an easy way for anyone to get involved in the capital markets by investing a small amount consistently over time in a diversified portfolio.

The app now has over six million customers, and manages $3B in assets. Tell me again how direct-to-consumer fintech is dead?

Because it seems alive and well to me.

Beyond the economic proof that this type of investing works, Liza fell in love with Stash because its model also psychologically understood investor behavior.

She explains that Stash’s founders modeled the fintech after Weight Watchers, understanding that as humans we easily get overwhelmed by major changes in our behavior–especially anything that feels restrictive.

Just like Weight Watchers breaks down the idea of losing 30 lbs at once to just losing 1lb a day for its users, Stash proposes that you don’t need $3000 to invest but rather as little as $5.

Stash does the work for its customers of constantly rebalancing its Smart Portfolio based on market conditions. Hence, all investors need to succeed truly– to invest a small amount of $ over time.

With Liza as CEO, Stash and its core mission are in excellent hands.

Beyond sharing her incredibly impactful story, Liza also dropped some serious wisdom in my conversation with her that all of us looking to lead and innovate in this space need to hear.

Let’s cover some of the highlights.

#1 Doubt is for other people

When I asked Liza about navigating doubt, her response was that when you are part of a startup's leadership team, you shouldn’t let doubt in the room.

Yes, there should be space for intellectual curiosity, but “if you don’t have complete conviction in the mission of your business, you probably should invest your time elsewhere.”

#2 Hope isn’t a replacement for planning

Liza believes there is nothing more hopeful than creating a product you believe will make the world a better place for you and others.

However, she warns that hope isn’t a replacement for sincere planning and intention.

“Give people a plan and a set of actions to do that lead them to that better future, don’t just hope for it.”

#3 I repeat: Consumer fintech is not dead

As long as we believe that consumers are going to want to buy and sell stuff in order to have money later in their lives–no matter what the capital markets are doing–then this criticism will remain a fallacy.

There are billions of underserved people who don’t have access to financial services–the power of fintech is its ability to bridge this gap.

Case closed.

#4 It’s always easier to be cynical than it is to be aspirational

The scarcity mindset is deeply ingrained in all of us.

Why? Because it’s fundamental to our culture’s ability to keep people afraid of what is possible for themselves, especially those of us historically left out of opportunities to build wealth.

Liza confirms that one of the biggest obstacles to getting people engaged in investing is overcoming the initial ‘fear of the dark.’

People don’t invest in their retirement because they don’t intellectually understand the benefits. More likely they refrain from investing because they:

Don’t have the money and, therefore, are afraid they can’t afford it

Don’t know how to do so properly and are afraid they will look stupid or make a mistake

Direct-to-consumer fintech companies are responsible for finding the right way to lead the public safely through the dark so we can begin to turn on the lights.

#5 Keep snowballing women into the room, because its working

When I asked Liza about the challenges of being a woman in this space, she said

“It’s not as good as it could be, but it’s far better than it was, both in terms of representation and just openness.”

Though it’s a slow, painstaking process, each woman who breaks through that glass ceiling creates more momentum and leaves the window open for others to follow.

#6 Don’t concern yourself with critics on the sidelines

With all the obstacles ahead, particularly for women, Liza emphasizes the importance of only listening to those with skin in the game and participating in making our economic system more democratic.

She’s not interested in the opinions of those criticizing her from the sidelines, and we shouldn’t be either.

Love Liza’s story and want to learn more from her? Join us at the Fintech Is Femme Leadership Summit, where Liza will drop her wisdom. Secure your spot here.

WTF ELSE?

Ellevest’s Survey: The great wealth transfer will make women more affluent and more confident than ever

19 ways financial institutions can offer inclusive banking options

Human-AI collaboration to mitigate decision noise in financial underwriting: A study on FinTech innovation in a lending firm

Over $1.3B was raised this week in 34 FinTech deals, as CyberTech dominates

Even in fields where women dominate, men outearn them by $176 per week on average. Here's why

I WANT IT, I GOT IT

📚 Today’s Read: Forget the accolades and pleasantries and pay us by Theodora Lau, founder of Unconventional Ventures. You must follow and read Theo's work. How she speaks truth and intertwines fintech and cultural happenings is a huge inspiration to my work. Thank you for this important piece, Theo!

👀 Today’s Watch: I took some time off this weekend to watch a film called "Damsel" starring Millie Bobby Brown. I really enjoyed this unique twist on a non-traditional fairytale narrative. Naturally, our protagonist relies on her intelligence to stay alive, as women have always done. It's a lovely movie, perfect for a casual viewing, and I highly recommend it.

🍣 Today’s Eats: Looking for Korean BBQ with a little flair? Head to Barn Joo in Union Square (or bookmark for your next visit to NYC!)

FINTUNES

I am really enjoying Ari's new album, "Eternal Sunshine." This song captures two elements that I absolutely love about music. It manages to evoke both a sense of sadness and a desire to get up and dance simultaneously. I truly appreciate how Ari has grown as an artist - it's a natural progression that comes with the rollercoaster of life's experiences.

That’s all for now! Stay safe, everyone. Hug your loved ones. See you Thursday!

Love,

Nicole

📰 Newsletter | 🔗 LinkedIn | 🤝 Partnerships | 🎤 Speaking |📱 @fintechisfemme | Get in front of 50,000 readers