Hi, fintech fam! 💜

I just wanted to take a moment to express how amazing it has been to spend so much time with our incredible community this year. It has truly been a highlight for me!

Last week, I asked if any of you would be interested in contributing to our platform and community, and guess what? An incredible 75% of you said yes! I can't even begin to tell you how inspiring that is.

I've been working tirelessly to plan for the future of our platform in 2024 and let me tell you, I've got some exciting things in store.

My ultimate goal is to create a platform that addresses your most pressing pain points while deepening our connection as a community that attracts talented women and extraordinary individuals to the world of fintech.

So, stay tuned because more announcements are coming your way. I am beyond excited to see what we can achieve together!

But for now, let’s get on with the news!

#TRENDING

What’s Up In Fintech

Every Thursday, I share news stories and trending pieces I follow. Think of it as a way to quickly find the most important news in the fintech world.

#1 Fintech CEOs Team Up to Improve Financial Well-Being

Women in the fintech industry are working together, taking a page from Beyonce and Taylor Swift, to expand their businesses.

Most recently, fintech CEOs Rochelle Gorey of SpringFour and Julie Szudarek of Self Financial have teamed up in the fintech arena to make waves in the financial wellness sector.

Since 2019, their collaboration has delivered over 3 million financial health referrals to Self customers, revealing a strategic fusion of SpringFour's resource-connecting prowess and Self Financial's credit-building expertise.

Here’s how it works:

SpringFour connects individuals with a vetted list of 23,000 local government and nonprofit resources in 665 cities to combat economic challenges.

Meanwhile, Self Financial is helping customers build and rebuild credit, focusing on those in the subprime credit bracket.

The collaboration allows Self to refer its customers to SpringFour for additional financial resources, creating a comprehensive ecosystem for financial health.

It's a needed partnership, given that 83% of low- and moderate-income households are interested in receiving resources from financial institutions, and only 17% know where to access them.

What sets this partnership apart, for me, is its practical approach.

SpringFour isn't merely tossing more financial instruments at consumers.

Instead, it's linking them with real-world government and nonprofit resources—food savings, rental assistance, utility cost savings, healthcare savings, and financial counseling.

This hands-on support has proven instrumental in slashing household expenses and propelling individuals on their financial health journeys.

The tech magic happens through S4direct, SpringFour's digital self-serve product, connecting Self's customers with targeted financial health resources.

This isn't just about improving payment performance; it's about building brand trust, boosting bottom lines, and putting consumers in the driver's seat of their financial well-being.

Case in point: In Q3 2023, when Self-customers' demand for student loan counseling resources surged by 10%, SpringFour connected them to the right financial resources.

Why It Matters:

The Federal Reserve Bank of New York's recent data shows a $228 billion surge in household debt balances in Q3 2023. Consumers are getting squeezed daily, so this market opportunity continues growing (sadly).

But picture this: consumers scrolling through the apps they love, craving more financial services offerings to elevate their economic game.

Take Self's app, for instance. It's not just about building credit; it's a gateway to food, rent, utilities, and healthcare savings.

The numbers tell a compelling story—SpringFour's most popular category is people using it to save on life's essentials like health care and utility costs.

Plus, this isn't just a feel-good story—it's strategic.

For example, SpringFour's platform increases bottom lines by upping repayment rates and reducing delinquency, a challenge every bank faces.

And let's remember the bigger picture: breaking the stigma around financial challenges and busting the poverty cycle.

This collaboration isn't just about financial gain; it's a testament to the fintech industry's evolving landscape, where consumer finance is taking the spotlight amid economic uncertainties.

And there's a powerful subplot—women in fintech, exemplified by the dynamic duo of Gorey and Szudarek, working together to redefine the status quo.

Their connection, predating professional collaboration, underscores the strength of women supporting women.

"It's so important for women to be connectors."

This isn't just a philosophy for SpringFour; it's a lived reality in Gorey's personal and professional lives.

It's a reminder that when women collaborate in fintech, they don't just connect people to resources; they create a force for positive change.

#2 Apex Fintech Solutions Takes a Leap with Confidential IPO Filing

Apex Fintech Solutions has quietly filed for a U.S. initial public offering (IPO), marking a comeback for its dreams of going public.

This IPO move comes as investor confidence recovers amid market ups and downs and higher interest rates.

Based in Dallas, Texas, the company initially planned to go public in 2021 through a merger with Northern Star Investment Corp II, valued at a whopping $4.7 billion.

Unfortunately, the deal fell through.

Why It Matters:

This IPO can potentially be a significant milestone for women in fintech.

Jenny Just, Co-Founder and Managing Partner at PEAK6, owns Apex Fintech Solutions, a multibillion-dollar enterprise providing trading and technology for popular platforms like Betterment, eToro, and SoFi.

Established in 2012, Apex offers digital clearing, custody, execution, and routing solutions, managing over $115 billion in assets.

As the leader of Apex Fintech Solutions, Just's vision has powered almost 70% of the marketplace, making this IPO a potential game-changer for her status as one of the wealthiest women in America.

But who is Jenny Just, and why haven't we heard about her before?

She intentionally maintained a low profile, juggling her focus between four kids and four companies rather than seeking media attention.

Now, however, she steps into the spotlight, emphasizing the need for more female representation in finance and technology.

For Just, the true democratization of investing hinges on achieving a 50% female user base.

In 2020, she stepped towards empowerment by founding Poker Power, aiming to train one million women in Texas Hold 'em.

For Just, poker isn't just a game; it's a practical tool for understanding strategy, risk, and capital allocation—a way to boost confidence in everyday decision-making.

As Apex Fintech Solutions gears up for its IPO, Just emerges from the shadows not just as a successful businesswoman but as a guiding force for women in the fintech revolution.

You can learn more about Jenny Just and her journey as a fintech pioneer by tuning into my podcast with her here.

#3 Unlocking the Open Banking Boom: A $164.8B Market By 2032

Since the Consumer Financial Protection Bureau released its 1033 proposed rulemaking on open banking in October, the industry has been buzzing about the market opportunity.

And for good reason.

According to research released by Spherical Insights, the open banking market is set to skyrocket from $20.6 billion in 2022 to a whopping $164.8 billion by 2032.

Why It Matters

The rise of open banking represents a significant shift in the financial sector, giving control of economic data to individuals and driving innovation.

However, with this shift comes concerns about data privacy and cybersecurity.

The COVID-19 pandemic accelerated this trend, with financial institutions embracing APIs for payments and pushing the sector forward.

Payments are currently the main focus, driving revenues due to the surge in online payments and internet use.

The cloud is also crucial in this growth, enabling banks to access and process consumer data in real-time securely.

Europe currently dominates the market, but North America is set for growth, and the Asia-Pacific region is leading the charge due to rapid digital payment developments.

I will keep track and watch how this turns out.

HUMANS OF FINTECH

Jenny Just Explains Why Poker Unlocks Female Leadership

Only 7% of poker players are women.

Jenny Just, the mastermind behind the Poker Power Play App, is working hard to change this statistic.

In this episode, Jenny and I discuss the importance of women's representation in the world of poker. We explore how playing poker can help develop essential personal and professional growth skills.

Jenny shares her ambitious vision of creating a revolutionary gender-neutral poker app to achieve a 50/50 gender split among poker players.

We also delve into the critical role of women in decision-making when it comes to money.

There is an urgent need for more financial education programs in schools to support women in this area.

Join us as we dive into the exciting world of poker and discover how it can empower women in the fintech space. Get ready to be inspired!

JOBS

Picture yourself as a Sales Executive, reporting to the CRO, shaping the high-velocity growth of Anonybit. This startup seeks a self-motivated, collaborative, passionate individual ready to hit ambitious targets and elevate their sales career. Be part of a team that crafted a groundbreaking decentralized biometric platform, born from top talent in Israeli cyber intelligence and led by industry veterans. Apply here!

FINTUNES

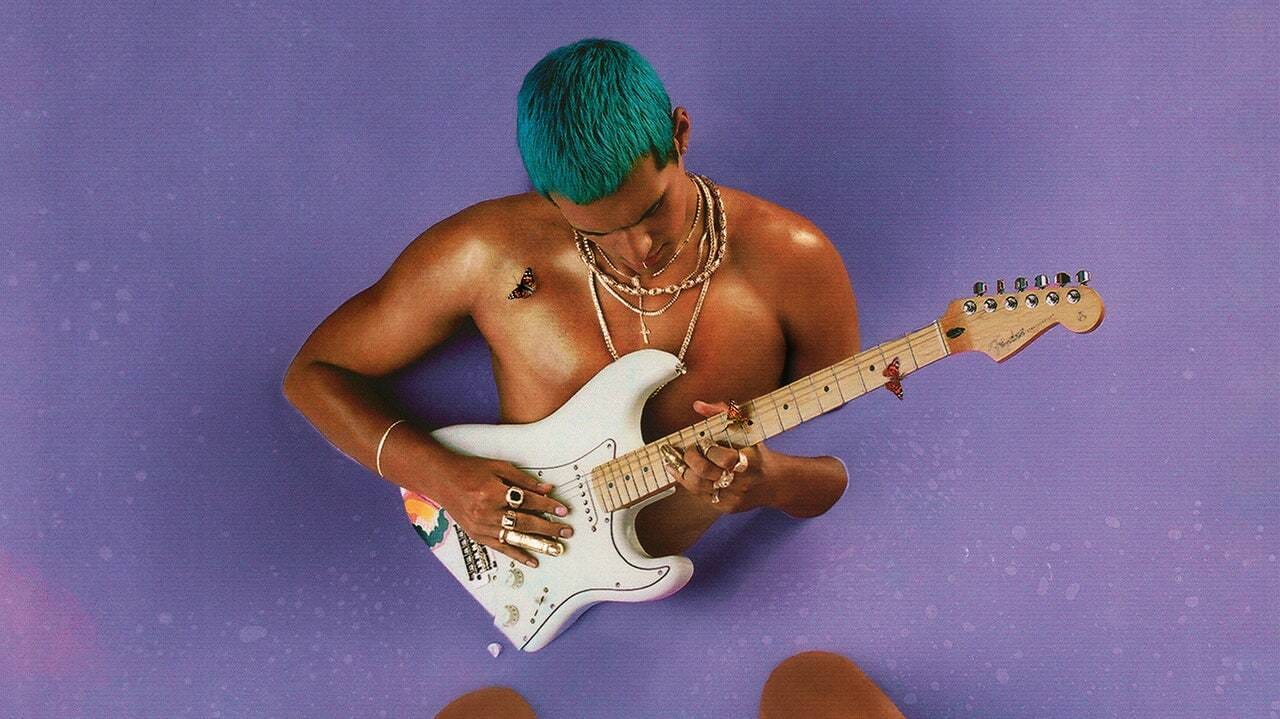

Omar, a Mexican-American artist from Indiana, has been inspiring my boo lately. We listen to this hit on repeat during our work sprints. His punchy electro-soul makes for the perfect vibe.

That’s all for now! Stay safe, everyone. Hug your loved ones. See you Tuesday!

Love,

Nicole