Hey, fintech fam! 💜

With Women’s History Month kicking off next week, I’m starting the celebrations in NYC at Brex HQ for a special event, then heading to Las Vegas to speak at Fintech Meetup.

I’ll wrap up the month with my first-ever international keynote and book signing in Istanbul (so excited for that!).

But I know this week has also felt heavy, especially with the cancellation of women-driven business events like Trybe. It’s been tough to watch and, honestly, surprising.

But if there’s one thing I know, it's that we keep moving forward. The antidote to anxiety and frustration is action. That’s why I’m hosting an epic Fintech Is Femme Leadership Summit on April 23 in New York City (Only 5 early bird tickets left!)

The Summit will bring together the most innovative, powerful, and curious women in fintech to create real momentum and drive action toward growing, scaling, and building our businesses.

Now is the time to mobilize and support each other. Don’t waste time. Take action, keep supporting women, and let’s keep this progress moving forward.

In today’s newsletter, I’ve got one important news story, a fresh piece of research, and a throwback podcast for you.

Let’s dive in!

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 Ellevest Transfers Robo-Advice Business to Betterment

This week, Ellevest made a move that’s got fintech buzzing. The wealth management firm, founded by Sallie Krawcheck to serve women investors, is transferring its robo-advisory accounts to Betterment.

This shift marks a departure from automated investing, with Ellevest now pivoting toward financial planning and wealth management for high-net-worth and ultra-high-net-worth clients—those with at least $500,000 to invest.

In other words, they’re focusing on big players, and Betterment, a digital investing titan, will now take the reins for Ellevest’s digital-first clients.

Betterment, with over 900,000 customers across the U.S. and more than $55 billion in assets, has grown under the leadership of CEO Sarah Levy by similar moves, like acquiring Wealthsimple’s U.S. advisory accounts in 2021 and Goldman Sachs’ Marcus Invest accounts in 2024.

Dr. Sylvia Kwan, CEO and CIO of Ellevest, explained the decision:

“As we focus on our growing wealth management and financial planning business, Betterment was the natural home for our digital-first clients,” she said in a statement. “Betterment offers features that many of our digital clients have expressed interest in, including joint accounts and other cash account options.”

"We built a platform that makes it easy to invest in a way that works for our clients' needs, goals, and values — and the same is true of Betterment under the leadership of their CEO, Sarah Levy."

Why It Matters

I’ve seen the reactions to Ellevest’s news, and yes, there’s been a wave of criticism. I get it—it’s tough to see a company that made such strides in making finance accessible to all women pivot away from that mission.

But let’s be honest: this decision more than likely wasn’t made on a whim. Krawcheck has always been a trailblazer and a staunch advocate for inclusion. She’s opened doors for women in finance. The work she’s done—whether we like the outcome or not—has created the foundation for others to build on.

We can’t expect one person or company to solve these systemic wealth disparities. Ellevest didn’t exist in a vacuum, and no single fintech can solve the wealth gap alone.

But by taking action, Krawcheck has lit the way for others to follow.

And trust me, they follow. There’s a whole generation of women-focused fintech platforms rising up—and they’re growing fast. I cover them regularly and give them a platform at events like the Fintech Is Femme Leadership Summit.

What’s Next

Ellevest was founded with one clear mission: to close the gender wealth gap and equip women with financial tools that actually work for them. But now, they’re shifting focus to serve clients with significant wealth to manage—leaving a gap for fintechs to fill.

Sure, it’s disappointing to see the old Ellevest go, but just because one company is making this shift doesn’t mean the demand for financial tools for smaller investors just poof disappears.

In fact, it’s creating a huge gap—one that women-led fintech startups are primed to fill.

Automated investing may be a fit for some—it’s that “set-it-and-forget-it” solution.

But women earning less than $500K are still seriously under-served in this space. The fintech that truly understands this will go beyond just offering automation.

It will create a platform that taps into community and content, using these as powerful levers of growth to serve the diverse needs of different groups of women.

Women need more than just a robo-advisor. We need a space to connect with others who get it—who are facing the same challenges, sharing the same financial dreams, and navigating similar paths. It’s not just about investing advice; it’s about belonging.

Ellevest’s values-based investing model also has the power to inspire its wealthy clientele to start investing in the next generation of women-led startups.

Imagine a future where wealthy women don’t just write checks for charity—but actively fund profitable ventures led by other women. That’s how we disrupt systems.

I’ve had the privilege of interviewing Krawcheck multiple times, and each conversation has left me more inspired than the last.

Her journey is legendary, from challenging Wall Street in the 2000s to building Ellevest from scratch. It’s a masterclass in turning a bold vision into action—one I explore in my book Fintech Feminists. You can also tune in to my podcast interview with her here.

Sarah Levy, CEO of Betterment, is another leader I profiled in my book. In our conversation, she shared her core values and explained how she intentionally prioritizes inclusivity and diversity as fundamental pillars of her leadership and company culture.

The progress Ellevest has driven—a platform of 3 million women investing and $2 billion in assets under management by March 2024—doesn’t vanish with a change in strategy.

Instead, the opportunities for women in this space are growing.

As the $31 trillion female economy evolves in all its dynamic diversity, the financial tools designed to serve it will need to grow right along with it.

#2 The AI Gender Gap: Why Women Are Using AI Less

Research has found that women in the workplace are using AI tools 25% less than men, creating what’s now being called the “AI gender gap.”

According to research by Harvard Business School, women seem more worried about being seen as unethical or accused of cheating, especially when it comes to tools like ChatGPT.

As the study notes, women “face greater penalties in being judged as not having expertise in different fields,” leading to a fear that using AI, even to get the right answer.

The researchers also found that A 2024 survey by the Federal Reserve Bank of New York, for example, found that half of men used generative AI in the previous 12 months, compared with about a third of women.

Across most of the studies, the share of women adopting AI tools was 10% to 40% smaller than that of men.

I came across this research via The Meteor, which suggested a very Fintech Is Femme way to combat this gap: turning to women-led AI platforms like Diem or Claude.

The article notes that these tools are designed to be ChatGPT-adjacent but focus on data privacy and, importantly, a user experience built with women in mind. Could this be the solution to the AI gender gap? It’s worth paying attention to.

Why It Matters

Every major technological advancement has had a significant pause because women weren’t represented at leadership tables.

AI is just the latest in a long line of innovations where we risk being left behind if we’re not part of the conversation. We see this now with the AI gender gap.

According to the paper, women’s reluctance to engage more deeply with AI could be a career hazard.

AI is expected to play a role in nearly every workplace in the future, and a hesitation to embrace it now could lead to a career stall later.

Women, already underrepresented in tech, risk falling further behind if we’re not leading the conversation and getting comfortable with these tools.

A reluctance to adopt AI could also end up reinforcing the same biases women have been fighting for years—especially when it comes to gender and racial stereotypes in AI systems.

Let’s not forget that most AI systems still reflect the gender and racial biases of the data used to create them. The only way to correct that? More diverse input means more voices, women, and different lived experiences.

By avoiding these technologies, we could inadvertently contribute to AI systems that perpetuate harmful stereotypes about women, from pay inequity to childcare disparities.

However, there are also valid concerns on the table.

AI isn’t exactly the all-good tech we sometimes imagine. With growing ethical and environmental concerns, alongside the reality that AI is poised to take the jobs of 79% of working women versus 58% of working men, the hesitation is understandable.

It’s not irrational to question the implications of using AI, especially if it feels like it could eventually replace your job.

But here’s the thing: We can’t afford to sit on the sidelines.

AI is going to shape the future of work and fintech.

And if women aren’t actively engaged, both in using and building it, we risk letting the systems that get built reflect only one perspective—the one that’s already dominated for far too long.

So, what do we do about it? First, we keep speaking up.

We keep using these tools and experimenting with platforms prioritizing data privacy and inclusion.

Yes, we are in charge of designing these tools to reflect our values. The AI gender gap is a problem, but we can close it. We just need to show up.

#3 Iyandra Smith Bryan’s Path to Leadership in Fintech

Dr. Iyandra Smith Bryan, COO, Quantfury

In Japan, there’s a philosophy known as kintsugi, where broken pottery is repaired with lacquer dusted with gold or silver, highlighting its cracks.

This philosophy mirrors Iyandra Smith Bryan’s career—a journey of embracing imperfections and turning challenges into strengths.

Now the Chief Operating Officer at fintech company Quantfury, Smith Bryan has spent over 14 years in financial services, championing transparency and advocating for women in finance.

Her story—starting as an attorney and evolving into a fintech leader—proves that personal growth and systemic change go hand-in-hand.

She believes that perfection is a myth and that our flaws are sources of strength.

Regular reflection on our experiences is key to adapting and evolving in the fast-paced world of fintech.

But it’s not just about personal growth—Smith Bryan also fights for systemic change, advocating for equal pay, diverse leadership, and a more inclusive industry.

For today’s story, I’m bringing you a throwback podcast episode from Humans of Fintech (with new episodes coming soon!) because there’s nothing more powerful than learning from these blueprints.

Want to hear how Smith Bryan turned every obstacle into an opportunity and built a powerful legacy for women in fintech?

Tune into the podcast here to learn more about her journey and the S.L.A.Y. method that’s helping women rise in the industry.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

TUESDAY, MARCH 4

[NEW YORK] Women’s History Month with Fintech Mavericks

We are almost at capacity! Join us for Women’s History Month at Brex HQ and the exciting launch of the new Fintech Mavericks podcast, hosted by Drew Glover and yours truly!

We’re bringing together the fintech and founder communities for a night of networking, inspiration, and powerful stories.

The first 100 guests will receive a signed copy of my book Fintech Feminists and a special gift from Brex customer Ipsy.

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

We like to have fun at our conferences.

📅 600+ attendees

🎙️ 30+ incredible speakers (99% women experts)

🔒 A second stage: the Fintech Security Summit with Frances Zelazny of Anonybit

💥 Multiple sponsors, partners, collaborators

💡 Everything—every detail, every speaker, every conversation—will deliver value to you because it's curated by me.

And we’re doing it all on April 23. No small feat, but I believe in the power of our community.

We’re in a moment of history when women are being told to play small.

So, we’re playing big. 💥

WEDNESDAY, APRIL 23

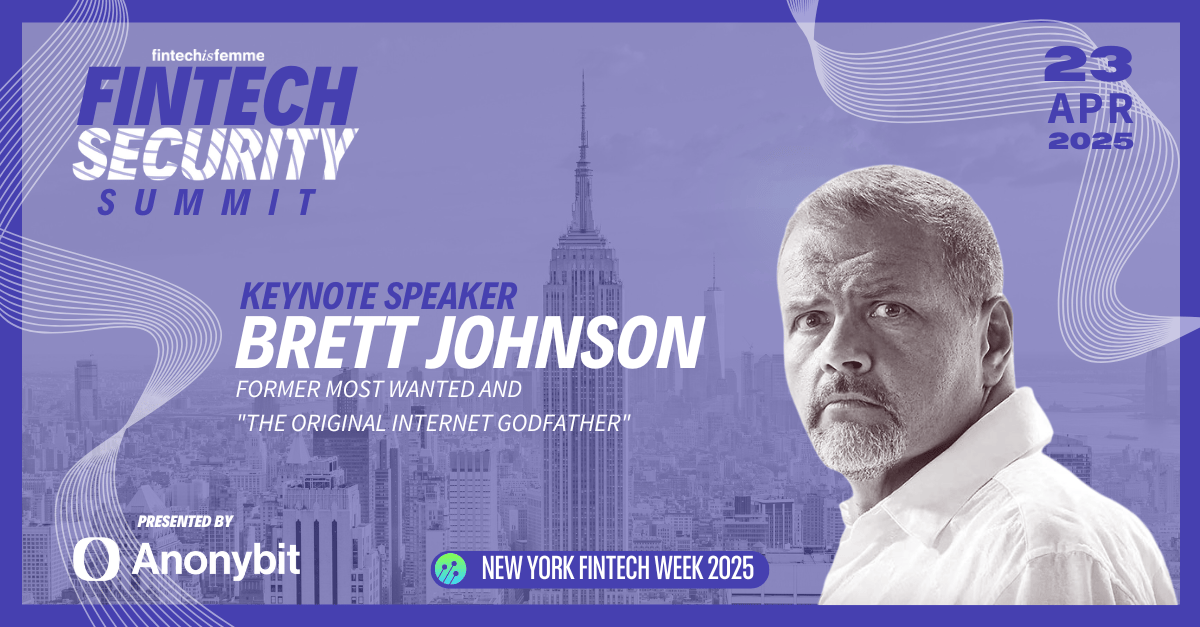

[NEW YORK FINTECH WEEK] Fintech Security Summit

I’m thrilled to announce that Brett Johnson, the Original Internet Godfather and former mastermind behind cybercrime, will be delivering the keynote at the first-ever Fintech Security Summit on April 23.

Brett’s expertise is unmatched—he helped create modern cybercrime and now works to help combat it.

If you want to understand how fraudsters think and learn how to protect your business and customers from their tactics, you won’t want to miss this.

P.S. VIP ticket holders get access to BOTH the Fintech Is Femme Leadership & Security Summit. Talk about double the impact.

FINTUNES

Did anyone else see Beyoncé's new Levi's ad? We love a queen who stands on business.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜