Hi, fintech fam! 💜

I hope you're having a fantastic week! As for me, I'm still in my writing zone, working on completing my manuscript for my upcoming book, "Fintech Feminists," scheduled to be released this October!

With just over a week left and still plenty of work to do before my deadline, I am feeling extremely prepared to finish this enormous project (consisting of 75,000 words, to be precise) and deliver this book into your hands. You can pre-order your copy here!

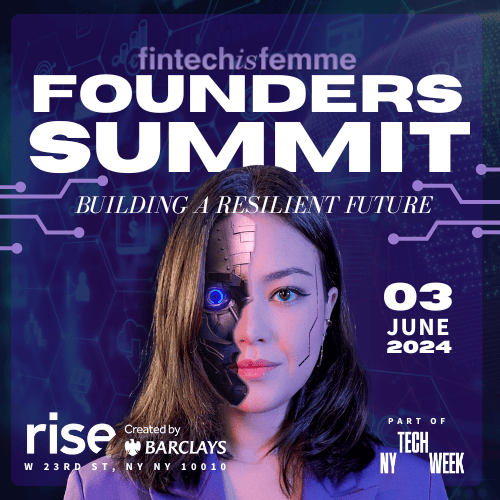

Regarding our next in-person event, be sure to secure your ticket for the Fintech Is Femme Founders Summit on June 3, which will take place during NY Tech Week. Secure your spot here!

Now, let's dive into the latest news!

WHY UPGRADE?

There’s a big difference in how the mainstream media covers fintech and how I do. Every week, I will provide you with the latest fintech news (minus the BS), profiles of inspiring women in fintech, and insightful analysis to help you stay ahead of the competition.

For our premium members, I send out updates 3x a week through our new column, "On Performance.” These columns will provide tactical advice to improve your entrepreneur and business leader performance.

Plus, premium members support female-led journalism and keep this work going. Because of your support, Fintech Is Femme is more than just a newsletter; it's a media empire and community for women to connect, learn, and support one another.

#TRENDING

What’s Up In Fintech

Every Thursday, I share news stories and trending pieces I follow. Think of it as a way to quickly find the most important news in the fintech world.

#1 Fintech Startup Plenty Launches To Modernize Financial Planning With Your Partner

Plenty Co-Founders Emily Luk and Channing Allen

How much money is required to have a child? What should your financial situation ideally be before considering purchasing a house? How much should you save for a wedding?

With the power of fintech, there is no need for anyone to pay $1,000 or more to obtain answers to these questions from a financial planner. Emily Luk and her husband, Channing Allen, announced today the launch of Plenty, their co-founded fintech platform specifically tailored to address couples' financial needs.

The platform, Plenty, offers a singular dashboard that adopts a "Yours/Mine/Ours" approach to building wealth. It encompasses various aspects such as cash flow management, goals planning, and long-term, values-based investing. Users can access a joint dashboard, allowing both partners to view their financial situation or manage their finances through a singular option independently.

Connecting accounts to Plenty automatically loads and categorizes the past two years of data from existing accounts (from banking to investing and retirement), giving a clear picture that sets a great baseline for everything a modern couple requires.

Plenty makes its public debut with $5 million in new funding after a year in private early access. The platform is available for couples and individuals at $100 per person per year. The app is currently offered in a desktop version, with a mobile app coming soon.

Why it Matters

In a world where financial independence and shared responsibilities often dance a delicate tango, couples face a crucial challenge: navigating the financial intricacies of their relationship. And it’s not just about romantic getaways; it’s about building a stable financial foundation that supports dreams, aspirations, and unexpected turns.

Plenty is directly addressing this issue – with Millennials making up most of its user base, given that we are all about coupling up these days.

65% of Millennials are in relationships, and 5 million are getting married this year. Living together without being married is also a growing trend among couples in the United States – the number has nearly tripled in the past two decades, with around 17 million adult unmarried partners.

We’re also feeling the sting of a changing economic landscape that hadn’t set us up for success like it did our parents’ generation when they were in their 30s – which means that, unlike generations before us, a whopping 80% of us are in relationships where both partners are working.

It’s a built-in independence that comes with two sources of income, but that doesn’t mean we don’t still want to do things together.

But the solutions out there for couples, unmarried or married, are basically joint accounts.

A joint account could work, but what happens if the relationship ends? While it may be tempting to think a joint account is what couples need, it also seems like a general pain to split and manage a joint account when we have the technology to make things easier.

We don’t need to live in the world 20 years ago when the default was that couples fully joined and one person managed the finances. Couples need transparency together yet the privacy and independence to manage their own finances while planning for the future. This is what Plenty solves.

It’s no secret that money is the second leading cause of divorce. In that light, money transparency leads to less divorce, which, in turn, leads to less economic abuse of women.

Ultimately, this leads to greater financial independence for women and a population of fewer humans not marred by financial trauma.

It’s no wonder that the importance of financial transparency is growing in today’s economy.

Less financial trauma means happier humans running this world. Research shows that couples who merge finances tend to be happier than those who do not.

Plus, if a couple talks about money at the very beginning of the relationship, it’s more predictive of relationship satisfaction and divorce than how much they discuss cash down the road. I really like Plenty’s behavioral finance-backed approach to this.

That’s because money talks point to a difference in values. If you don’t get those values at the front, it will only compound and become more of an issue over time.

This is when education comes into play. Two types of education are critical to incorporating behavioral finance into fintech products that Plenty addresses:

Meta Knowledge: Effectively knowing what you don’t know. For example, I know I do not know how to build a fence. Knowing that means I will try and get help when I need a fence built instead of putting myself in danger.

Just In Time Education: Intervention at the moment when it’s most direly needed.

There’s this massive gap between knowing what to do and doing the right thing. That’s where behavioral finance and fintech come into play.

It helps us overcome capacity constraints and ensures we are educated and ready at the point of a decision.

Last year, I had Luk on my podcast, Humans of Fintech, where we chatted about the current state of wealth management for couples and how, with over 65% of millennial couples partnering up, it’s more relevant than ever before.

#2 Fintech’s Role In Financial Inclusion For Moms

Reshma Saujani.

Financial inclusion, a promise of fintech, is about solving demographic issues to spur a more equitable economy. It's a stark reminder that true financial inclusion hinges on addressing earnings disparity and burdensome household inequalities—starting with motherhood.

With Mother’s Day approaching, I began thinking about the societal — and business — issues deeply intertwined with the motherhood penalty.

While 86% of women become mothers by the age of 45, men receive a 6% pay raise for each child they have, while women face a 4% pay decrease per child.

This disparity is a critical factor preventing women from achieving pay equity. Plus, the high cost of childcare in the US, where women make up the majority of caregivers, often forces difficult trade-offs between work and family.

Ahead of Equal Pay Day in March last year, the reintroduction of the Paycheck Fairness Act once again brought the issue of gender pay inequality to the forefront.

This legislation aims to close the remaining loopholes in the Equal Pay Act, a measure that has passed the House four times over the past 25 years but has consistently faced hurdles in the Senate. The closest it came to passing was 13 years ago when it fell just two votes short. If ever passed, the legislation would end pay secrecy and strengthen the available remedies for those wronged.

Why It Matters

The gender pay gap is still starkly evident in the US today, with women making, on average, just 77 cents for every dollar men earn, amounting to a loss of $11,782 per year for women, according to UN Women. And for women of color, the gap is even more severe.

So, what are the most significant barriers to addressing these pervasive gender inequities?

Truthfully, it's societal norms. The bias that women take on the sole caregiving roles of households. This problem is so deeply ingrained in our society that Claudia Goldin made history when she was awarded the Nobel Memorial Prize in Economic Sciences for her groundbreaking research into women's progress in the workforce.

Goldin’s research shows that when men and women begin working in the same job at the same level of college education, they earn the same wages. Therefore, it is unreasonable to think that women would willingly choose less-paying jobs. This idea is simply absurd.

Goldin’s research shows that pay equity drops sharply following the birth of a woman's first child and continues to widen.

Reshma Saujani, founder of Girls Who Code, Mom's First, and PaidLeave.ai, have dedicated their work to recognizing that gender pay inequality is not just a problem for women; it's a systemic issue that affects us all.

When organizations merely cut a check at the end of the year to address the pay gap temporarily, they fail to address the problem systematically. To bridge the gap, we must focus on paying and recruiting equitably, providing opportunities, advocating for women in the workplace, and promoting talent consistently throughout the employee lifecycle.

We also have to be innovative in how we think about the issue of pay equity.

As often suggested, it's not solely a "woman's problem" or a "lack of confidence" issue. Too often in society, women are told to act like men to get ahead. So, please repeat after me: The problem is not women. The problem is a broken system that perpetuates cycles of inequities. It's that simple.

As female founders, we face numerous obstacles in business, from being told our companies are too "hyper niche" to being denied capital for being deemed "high-risk." Yet, the same category of founders continues to underperform despite being funded a whopping 98% of the time.

It's time to innovate our thinking and support the true innovators - the moms and female entrepreneurs building companies to cater to the needs of half the world's population.

Let's face it: the current distribution of venture capital money is deplorable, with less than 2% going to female entrepreneurs. We should be ashamed of ourselves for not injecting more funds into innovative solutions and, instead, causing economic disarray at the expense of the consumer.

It's time to shift our mindset and start investing in the future of diverse and inclusive businesses because that's where the real gold lies.

But until then, the most critical aspect of achieving pay equity is supporting and empowering each other.

Women often fear competition among themselves, but it's essential to recognize that the real competition should be based on skills and talents, not compensation. Sharing information about pay, experiences, and strategies can help build a supportive sisterhood.

Saujani sets a fabulous example. She shared that she advocated for her Girls Who Code successor – Tarika Barrett – to receive higher compensation than she did as CEO, challenging the notion that women should only advocate for themselves. The point is to create opportunities for women.

The path to pay equity is not limited to individual actions. Corporations must take concrete steps to address systemic issues that perpetuate gender pay disparities. A deep audit of pay structures and policies is necessary.

Companies should eliminate promotions based solely on time, as this can disadvantage women who take time off for caregiving. Redefining the concept of family care to accommodate diverse caregiving structures is another vital step. Providing childcare and flexible benefits programs can alleviate some of the burdens working mothers face, reducing inequality in pay.

Saujani's latest initiative, Moms First, addresses these three critical pay equity aspects: paid leave, affordable childcare, and equal pay. By tackling these structural issues, she aims to create a more equitable playing field for women in the workforce. Saujani's vision highlights that pay equity is not just a social issue but fundamental to our economy.

Fintech companies have an opportunity to aid women post-childbirth and close the gender pay gap. They can offer flexible savings and investment accounts, personalized financial planning and education, and return-to-work support programs. These initiatives enable women to make informed financial decisions, maintain their career paths, and achieve economic equality.

Benefits include greater security, improved literacy, and a more equitable society.

How else can fintech play a role in pushing for pay equity? Here are a few ideas:

1. Fintech for Pay Transparency: One fundamental way that fintech can contribute to closing the gender pay gap is by enabling greater pay transparency. Fintech platforms can develop tools and applications that allow employees to access information about salary ranges, compensation structures, and bonus criteria within their organizations.

This transparency empowers individuals, especially women, to make informed career decisions, negotiate salaries effectively, and identify pay disparities. By promoting transparency, fintech can help shed light on hidden gender pay inequalities and encourage companies to rectify them. Has anyone built this yet? I'd sign up in a heartbeat.

2. Fintech for Equal Pay Audits: Fintech solutions can streamline and automate the process of conducting pay equity audits within organizations. These audits can analyze data, considering factors such as job roles, years of experience, and performance metrics, to identify discrepancies in compensation.

By leveraging data analytics and machine learning algorithms, fintech platforms can offer real-time insights into pay disparities and provide actionable recommendations to companies. This data-driven approach not only helps organizations identify and rectify gender pay gaps but also ensures ongoing monitoring and compliance with pay equity standards.

3. Fintech for Inclusive Benefits and Financial Wellness: Fintech companies can play a pivotal role in promoting financial wellness and inclusive benefits programs that benefit women in the workforce. By offering innovative financial planning tools and educational resources, fintech platforms can help women manage their finances more effectively, plan for future financial goals, and navigate significant life events, such as maternity leave.

Additionally, fintech can provide benefits like flexible spending accounts for childcare expenses, enabling working mothers to balance their careers and caregiving responsibilities without sacrificing financial stability. These tools help empower women to achieve financial security and reduce the motherhood penalty that often leads to pay disparities.

#3 Bloom Money: Bridging Financial Gaps With Trust And Tech

Picture a world where trust isn’t just a word but the cornerstone of your financial security.

Enter Bloom Money, a UK-based fintech on a mission to digitize the “rotating savings and credit association” (ROSCA) practice, deeply embedded in ethnic communities worldwide.

ROSCA is the kind of system that unites communities. It’s about people coming together to create a financial support network, saving and lending among themselves. It’s a beautiful concept, except for one glaring issue: conventional banking systems often discriminate against minority communities. Nina Mohanty, Bloom Money’s CEO, knows this all too well.

“Some of it is just blatant racism,” she says in TechCrunch. “We don’t have clear red-lining like in the U.S., but there are definitely postcode look-ups.”

Mohanty, a daughter of immigrants herself, moved to the UK and experienced firsthand the financial challenges faced by immigrants. Her passion for economic justice and opportunity ignited Bloom Money.

Why It Matters

Bloom Money isn’t your typical fintech; it’s a catalyst for financial inclusion and empowerment.

Their digital platform, offering “Bloom circles” for sharing and saving money, goes beyond finance; it paves the way for a communal way to build generational wealth for communities who need it most.

In a world where trust and security are paramount, Bloom Money safeguards funds through an electronic money institution, ensuring peace of mind for users.

Despite initial misunderstandings and even prejudice from investors, Bloom Money’s unwavering dedication to diversity shines through.

Their cap table boasts nearly 70% women, almost 50% from minority backgrounds, and about half as first or second-generation immigrants.

In essence, Bloom Money isn’t just a fintech; it’s a force for a fairer financial future, combining trust and technology to drive financial inclusion and empowerment for all.

Do you love this platform? Nina is opening up allocations for Bloom Money’s biggest supporters. Check out this LinkedIn post to learn more.

MARK YOUR CALENDARS

Join us every Thursday to stay updated on the weekly top fintech events! These events are a great way to network, learn, and connect with our fintech community. Let's fill our calendars with these awesome events - I would love to see you there! If you have an event to share, please inform me!

MONDAY 6/3

If you’re interested in Fintech Is Femme’s Founder’s Summit: save your spot NOW! Space is limited.

You’ll hear stories from fintech founders, but founders aren’t the only ones who will benefit from this summit.

The stories and techniques you’ll learn on June 3rd can be applied to ANY women in finance, tech, or fintech at any stage of your career. Join us!

SPONSORED BY

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

FINTUNES

That’s all for now! Stay safe, everyone. Hug your loved ones. See you Tuesday!

Love,

Nicole

📰 Newsletter | 🔗 LinkedIn | 🤝 Partnerships | 🎤 Speaking |📱 @fintechisfemme | Get in front of 50,000 readers