Hi fintech fam! 💜

Reflecting on the past two years of building Fintech Is Femme, one powerful lesson stands out: ownership is everything.

As iconic figures like Barbie, Beyonce, and Taylor Swift take control of their identities, voices, and futures, I have been inspired to do the same with my own media company.

My authentic vision for Fintech Is Femme is to provide fintech news through a female lens, which requires 100% ownership of the brand, and I have been working tirelessly behind the scenes to bring this to fruition.

And what a ride it has been - from starting with zero subscribers to reaching over 50,000, hosting sold-out events, and speaking on international stages.

Today, I am incredibly proud to announce that I am the sole owner of Fintech Is Femme, ready to infuse it with my complete creative and operational direction.

But I cannot do it alone. I need your support to keep this platform thriving. So please check out the new website where you can connect with me for partnerships and speaking engagements, access the podcast and newsletter, and be a part of this exciting journey.

I am so grateful to all of you, the readers, who have been a part of this journey thus far. You’re the reason I get to live out my dream of ownership, and I assure you, I will do everything in my power to support you in return.

So here's to embracing ownership, taking control of our destinies, and all the possibilities.

Are you ready for it?

Was this email forwarded to you?

Liquid Assets, Solid Returns

If you're tired of traditional investment options that offer little diversity and unpredictable returns, it's time to consider the world of fine wine and whiskey investing. Vinovest makes it easy for anyone to invest in high-quality wines and whiskies with the potential for excellent returns. It's why the ultra-wealthy have invested in fine wine and whiskey for centuries and now it’s your turn to do it too. Start investing today.

GENDER PAY GAP

Fintech’s Role In Nurturing Financial Independence For Moms

Financial inclusion, a promise of fintech, is about solving demographic issues to spur a more equitable economy. It's a stark reminder that true financial inclusion hinges on addressing the earnings disparity and burdensome household inequalities – starting with motherhood.

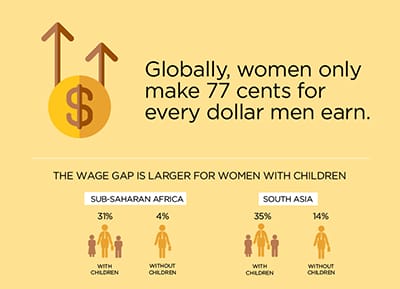

It's a societal – and business – issue deeply intertwined with the motherhood penalty. While 86% of women become mothers by the age of 45, men receive a 6% pay raise for each child they have, while women face a 4% pay decrease per child.

This disparity is a critical factor preventing women from achieving pay equity. Plus, the high cost of childcare in the US, where women make up the majority of caregivers, often forces difficult trade-offs between work and family.

Ahead of Equal Pay Day in March this year, the reintroduction of the Paycheck Fairness Act once again brought the issue of gender pay inequality to the forefront.

This legislation aims to close the remaining loopholes in the Equal Pay Act, a measure that has passed the House four times over the past 25 years but has consistently faced hurdles in the Senate. The closest it came to passing was 13 years ago when it fell just two votes short. If ever passed, the legislation would end pay secrecy and strengthen the available remedies for those wronged.

The gender pay gap is still starkly evident in the US today, with women making, on average, just 77 cents for every dollar men earn, amounting to a loss of $11,782 per year for women. And for women of color, the gap is even more severe.

So, what are the most significant barriers to addressing these pervasive gender inequities?

Truthfully, it's societal norms. The bias that women take on the sole caregiving roles of households. This problem is so deeply ingrained in our society that Claudia Goldin made history last month when she was awarded the Nobel Memorial Prize in Economic Sciences for her groundbreaking research into women's progress in the workforce.

Her research cast light upon the historical journey of women in the labor market. It has also unveiled a disconcerting contemporary challenge: the insidious gender wage gap that persists, even when individuals occupy the same professional strata.

Historically, disparities in earnings between genders could be chalked up to divergent educational and occupational choices. Yet, Dr. Goldin's meticulous research, spanning two centuries of American data, presents a different narrative.

Today, the bulk of the gender earnings chasm resides within the identical occupational spheres, and it ruthlessly widens its maw after the birth of a woman's first child.

Reshma Saujani, founder of Girls Who Code and Mom's First, and Pat Wadors, a seasoned HR executive and Chief People Officer UKG, have been at the forefront of this initiative.

Both leaders recognized that gender pay inequality is not just a problem for women; it's a systemic issue that affects us all.

When organizations merely cut a check at the end of the year to address the pay gap temporarily, they fail to address the problem systematically. To bridge the gap, we must focus on paying and recruiting equitably, providing opportunities, advocating for women in the workplace, and promoting talent consistently throughout the employee lifecycle.

We also have to be innovative in how we think about the issue of pay equity.

As often suggested, it's not solely a "woman's problem" or a "lack of confidence" issue. Too often in society, women are told to act like men to get ahead. So, please repeat after me: The problem is not women. The problem is a broken system that perpetuates cycles of inequities. It's that simple.

As female founders, we face numerous obstacles in business, from being told our companies are too "hyper niche" to being denied capital for being deemed "high-risk." Yet, it's the same category of founders who continue to underperform despite being funded a whopping 98% of the time.

It's time to innovate our thinking and support the true innovators - the moms and female entrepreneurs building companies to cater to the needs of half the world's population.

Let's face it: the current distribution of venture capital money is deplorable, with less than 2% going to female entrepreneurs. We should be ashamed of ourselves for not injecting more funds into innovative solutions and, instead, causing economic disarray at the expense of the consumer.

It's time to shift our mindset and start investing in the future of diverse and inclusive businesses because that's where the real gold lies.

But until then, the most critical aspect of achieving pay equity is supporting and empowering each other.

Women often fear competition among themselves, but it's essential to recognize that the real competition should be based on skills and talents, not compensation. Sharing information about pay, experiences, and strategies can help build a supportive sisterhood.

Saujani sets a fabulous example. She shared that she advocated for her Girls Who Code successor – Tarika Barrett – to receive higher compensation than she did as CEO, challenging the notion that women should only advocate for themselves. The point is to create opportunities for women.

The path to pay equity is not limited to individual actions. Corporations must take concrete steps to address systemic issues that perpetuate gender pay disparities. A deep audit of pay structures and policies is necessary.

Companies should eliminate promotions based solely on time, as this can disadvantage women who take time off for caregiving. Redefining the concept of family care to accommodate diverse caregiving structures is another vital step. Providing childcare and flexible benefits programs can alleviate some of the burdens working mothers face, reducing inequality in pay.

Saujani's latest initiative, Moms First, addresses these three critical pay equity aspects: paid leave, affordable childcare, and equal pay. By tackling these structural issues, she aims to create a more equitable playing field for women in the workforce. Saujani's vision highlights that pay equity is not just a social issue but fundamental to our economy.

Ultimately, both Saujani and Wadors express hope and optimism for the future. They believe change is possible, mainly as high-profile figures like Barbie, Taylor Swift, and Beyoncé contribute their voices and resources to the cause. These women are not just symbols of empowerment; they inspire others to take action. The movement for pay equity is gaining momentum, and it's time for all of us to join in.

Credit: UN Women

Enter fintech, the game-changer in this formidable battle for pay equity. Fintech companies possess the tools to craft innovative solutions to bolster mothers in pursuing financial independence, particularly during the pivotal post-childbirth period.

Fintech companies have an opportunity to aid women post-childbirth and close the gender pay gap. They can offer flexible savings and investment accounts, personalized financial planning and education, and return-to-work support programs. These initiatives enable women to make informed financial decisions, maintain their career paths, and achieve economic equality.

Benefits include greater security, improved literacy, and a more equitable society.

Here are six fintech firms working to provide mothers and families with the necessary tools. Keep your eye on these:

UOB: The Singapore-based UOB bank is pioneering the "Lady's Savings Account," providing women with insurance coverage tailored to female-specific health concerns, all based on their savings. This initiative nurtures financial prudence and safeguards women's health and well-being.

BMPB: Access Bank's "Better Mama, Better Pikin" (BMBP) mobile wallet in Nigeria offers micro-savings and insurance services for expectant mothers. With minimal monthly savings requirements, this program provides vital financial protection to women and their families.

Goalsetter: In the United States, Goalsetter is a financial education company empowering parents, including mothers, to learn about money via a mobile app. This ingenious approach instills financial responsibility from a young age, with parents in the driver's seat.

Women's World Banking: This organization is at the forefront of promoting safe savings for underbanked women. Initiatives like "BETA Savings" in Nigeria and "Pafupi Savings" in Malawi facilitate women's savings through accessible channels with no minimum balance or monthly fees.

Kiya.ai: Indian fintech Kiya.ai collaborates with the NGO ARMMAN to provide pregnant women and mothers access to preventive information and services. This initiative empowers women with accessible and affordable healthcare, bolstering maternal well-being.

Mums & Co: Australia-based Mums & Co is a digital sanctuary for entrepreneurial mothers, fostering connections, providing guidance, and offering essential resources to fuel their ambitions.

How else can fintech play a role in pushing for pay equity? Here are a few ideas:

1. Fintech for Pay Transparency: One fundamental way that fintech can contribute to closing the gender pay gap is by enabling greater pay transparency. Fintech platforms can develop tools and applications that allow employees to access information about salary ranges, compensation structures, and bonus criteria within their organizations.

This transparency empowers individuals, especially women, to make informed career decisions, negotiate salaries effectively, and identify pay disparities. By promoting transparency, fintech can help shed light on hidden gender pay inequalities and encourage companies to rectify them. Has anyone built this yet? I'd sign up in a heartbeat.

2. Fintech for Equal Pay Audits: Fintech solutions can streamline and automate the process of conducting pay equity audits within organizations. These audits can analyze data, considering factors such as job roles, years of experience, and performance metrics, to identify discrepancies in compensation.

By leveraging data analytics and machine learning algorithms, fintech platforms can offer real-time insights into pay disparities and provide actionable recommendations to companies. This data-driven approach not only helps organizations identify and rectify gender pay gaps but also ensures ongoing monitoring and compliance with pay equity standards.

3. Fintech for Inclusive Benefits and Financial Wellness: Fintech companies can play a pivotal role in promoting financial wellness and inclusive benefits programs that benefit women in the workforce. By offering innovative financial planning tools and educational resources, fintech platforms can help women manage their finances more effectively, plan for future financial goals, and navigate significant life events, such as maternity leave.

Additionally, fintech can provide benefits like flexible spending accounts for childcare expenses, enabling working mothers to balance their careers and caregiving responsibilities without sacrificing financial stability. These tools help empower women to achieve financial security and reduce the motherhood penalty that often leads to pay disparities.

WTF ELSE?

A Fintech Titan In Community Banker's Clothing

Fintech Firms Continue to Raise Funding to Expand their BNPL Products Globally

Revolutionizing Wealth Management: How M1 Finance's CEO Is Redefining The Future Of Fintech

Fintech Founders Pair AI and Client Prospecting in New Platform for Financial Advisors

I WANT IT, I GOT IT

👀 Today’s Watch: This refreshingly real response addressing the challenges of raising as a female founder from Camilla Cloëtta Falkenberg the founder of Female Invest.

📚 Today’s Read: Interesting deep dive into the way the creator economy is outpacing legacy media by Washington Posts’s Taylor Lorenz.

🍣 Today’s Eats: If you’re every in New York City and looking for the best ramen — look no further than Ichiran. Lucky me, I have one in my neighborhood.

FINTUNES

In my era of ownership where we don’t get sad, we get even. Cheers to new beginnings and no upper limits. Queen shit only.