Hi, Fintech Fam! 💜

There’s a lot to be excited about in our community right now, and it’s all about elevating you.

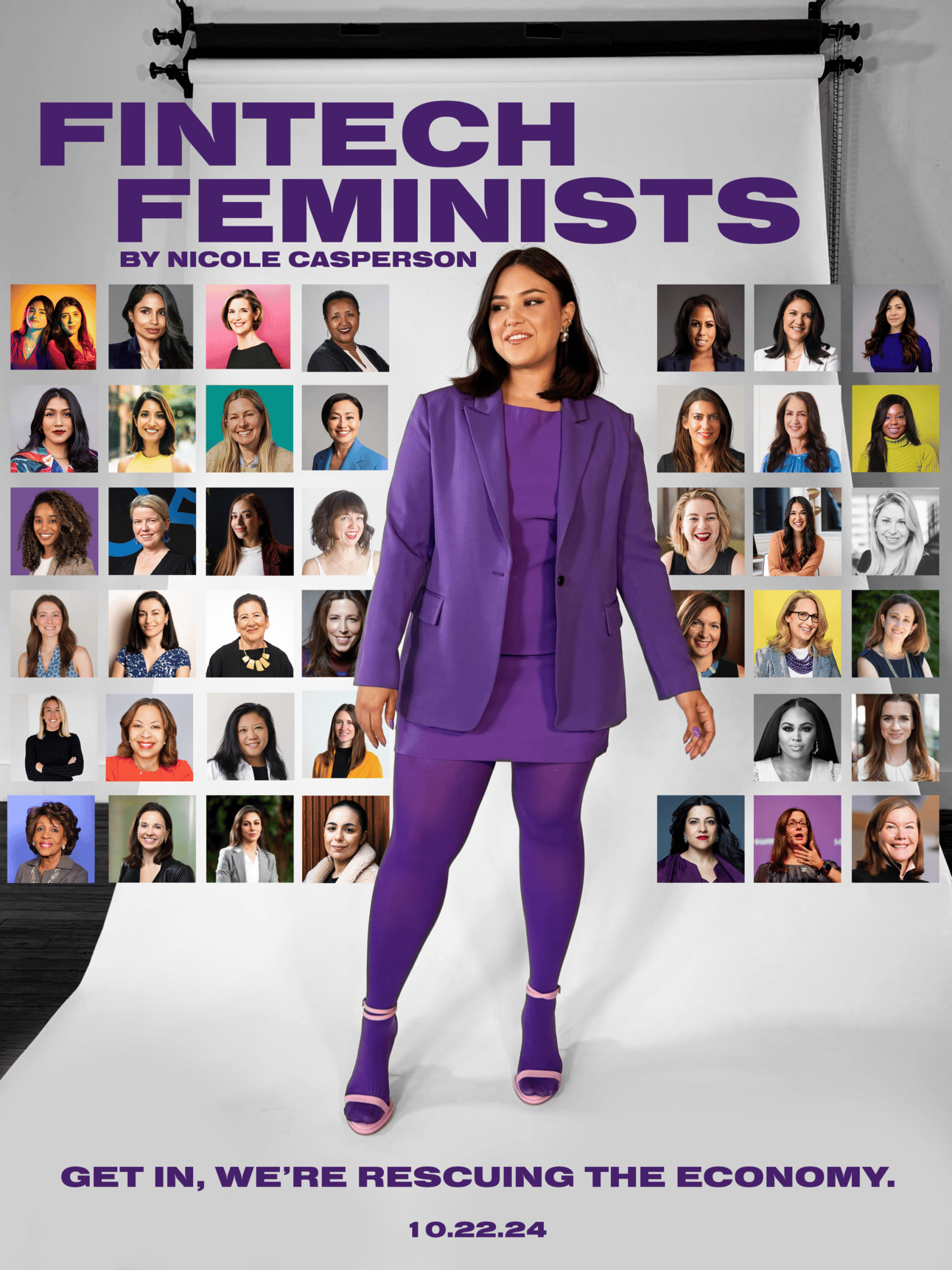

In just one week, Fintech Feminists—a book that dives deep into the past, present, and future of women in fintech—officially launches.

This book isn’t just a celebration; it’s a blueprint for driving real change, featuring stories of trailblazing women who are redefining our industry.

Fintech icon and VC legend Amy Nauiokas gave it the first review, saying,

“From history, to current, and to weave in those stories so effortlessly! Well done - it was a joy to consume!”

To celebrate, we’re hosting the Fintech Feminists Book Launch Party next week, and you’re invited!

Join us for an evening of lively conversation, where Amy and I will dive into the book and discuss what’s next for women in fintech. Plus, we have some exciting appearances lined up, an open bar, sushi plates, and a live musical performance.

This is your chance to connect, celebrate, and be at the forefront of our growing community. Don’t miss it!

INNOVATION

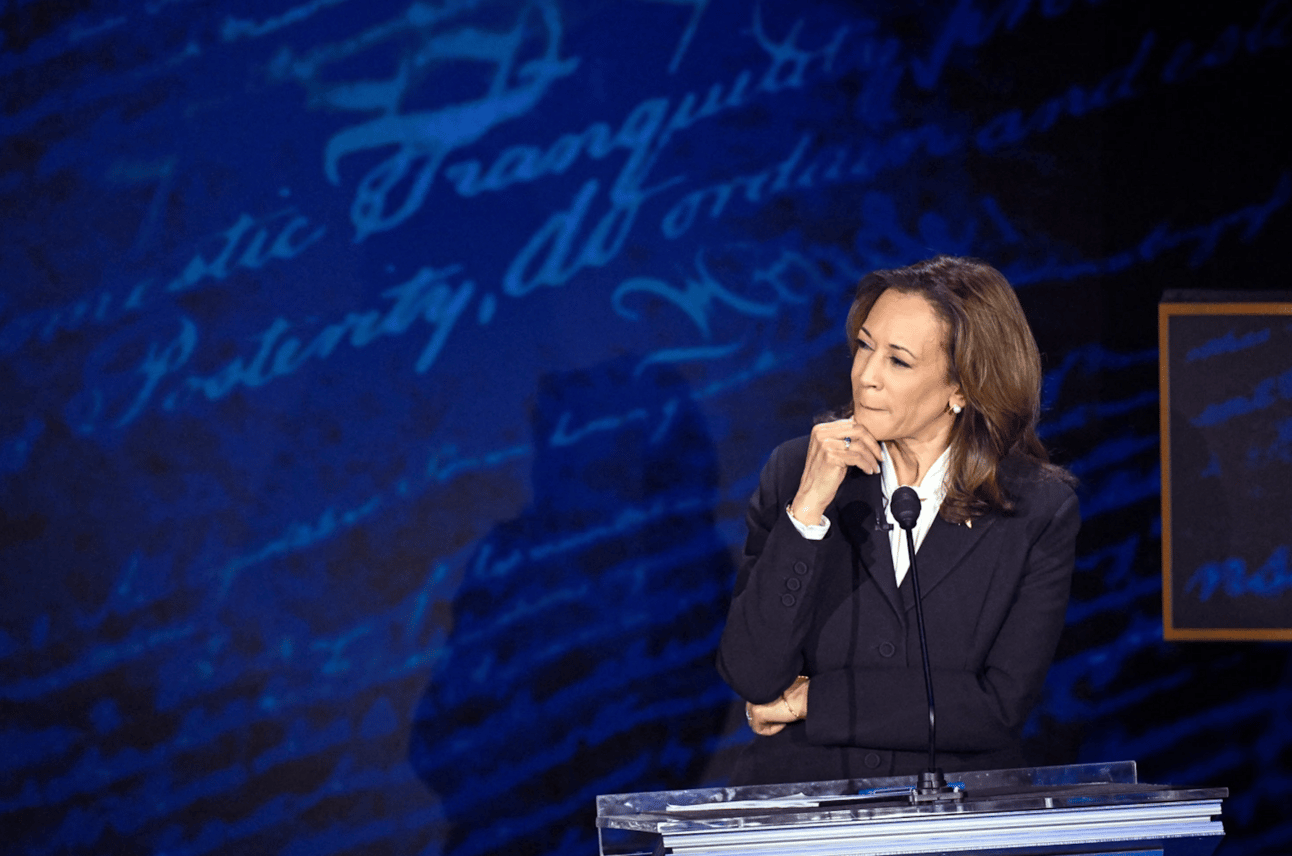

Breaking the Myth of Meritocracy—Kamala Harris, Women Founders, and the 2% Problem

At an event recently, one of the women founders—let’s call her Sarah—asked me, “Why do women still only receive 2% of venture capital funding?”

Her question had a tinge of exhaustion. It’s 2024, for crying out loud.

Female founders generate higher returns and outperform their male counterparts, and all the data backs this up.

Yet here we are, facing the same frustrating statistic year after year. Sarah’s question lingered in my mind, but it didn’t hit me until I saw the recent news about Kamala Harris.

Kamala Harris, one of the most experienced, qualified, and, dare I say, badass candidates running for the highest office in the land, has raised over $1 billion in less than three months. Yet, her presidential race is still tight.

Despite everything—her track record, history-making fundraising haul, and sheer experience—she’s still viewed as an underdog. How can that be?

And then it hit me. Kamala Harris’s candidacy parallels the experience of women founders—highly qualified, backed by facts, with all the potential to succeed, yet perpetually underestimated and underfunded.

It’s not a meritocracy; it’s bias at work. I'm tired of pretending that this same bias doesn't permeate our fintech and financial services system.

The Myth of Meritocracy

Let’s be real for a second. The myth of meritocracy is alive and well, and it’s hurting women.

The idea that we live in a world where the best and the brightest automatically rise to the top is nothing more than a fairy tale.

If meritocracy were real, Kamala Harris would be leagues ahead in the polls, and female founders wouldn’t be stuck at 2% of venture capital funding.

When only 2% of VC dollars go to women, despite the overwhelming data showing that they are better investments, we aren’t just facing a “gap”—we are looking at a system that was designed to exclude.

This isn’t an issue of women needing to try harder or network better. It’s about facing a biased system built by and for men.

Look at the numbers. Kamala Harris has more government experience than Ronald Reagan, JFK, Barack Obama, and Trump did when they ran for office. By all accounts, she is overqualified.

Kamala Harris's years of experience are compared to other favored POTUS.

The same is true for female founders—they check all the boxes, but they still aren’t getting the funding.

The question is: Why?

Bias by Design

Much like the political one, the venture capital system wasn’t built with women in mind.

The patterns we see today didn’t appear overnight. They’ve been in the making for decades—centuries even.

The first venture capitalists were wealthy men investing in railroads, oil, and steel in the late 19th century. Fast forward to the 1950s, when Silicon Valley became a tech hub, again dominated by men.

The networks of these early days solidified relationships among male investors and founders.

By the 1970s, venture capitalists were still overwhelmingly men. By 2021, 85% of venture capitalists were men. The pipeline for funding flows where the relationships are strongest—male founders, backed by male investors, continuing a loop that has largely excluded women.

And this isn’t just an “old boys’ club” problem—it’s pattern recognition.

Investors fund what looks familiar to them.

Historically, that’s been young, white men from prestigious universities. What gets lost in the shuffle? Women, founders of color, and anyone who doesn’t fit the mold of the “successful” entrepreneur.

But the real issue isn’t just that women founders aren’t getting funding; the economic consequences come with it.

When female founders are excluded from venture capital, we all lose.

It’s not just about equity or fairness—though that should be reason enough. The fact is, entire businesses aren’t getting built, problems aren’t being solved, and entire markets are being missed.

Venture-backed companies shape our economy, drive innovation, and create jobs. But when 98% of funding goes to male founders, we are essentially cutting off half of the population from participating in that innovation economy.

The data speaks volumes. A 2018 Boston Consulting Group report showed that startups founded by women deliver more than twice as much per dollar invested than those founded by men—yet they receive a fraction of the capital.

Imagine the economic opportunity we’re missing by sidelining these businesses.

A McKinsey study further quantified this, estimating that $12 trillion could be added to global GDP by 2025 if we advanced gender equality and gave women equal access to opportunities, including capital.

These missed opportunities aren’t just theoretical. For every woman founder who doesn’t get funded, there’s a product that never gets developed—a solution that might have solved a massive pain point in fintech, healthcare, climate tech, or countless other sectors.

Think of the fintech sector alone: women now control 32% of the world's wealth, totaling a staggering $72 trillion. This figure is expected to grow at a rate of 7% annually, outpacing the overall growth of global wealth.

But products that cater specifically to their financial needs remain scarce. It’s no coincidence that women aren’t building the companies that could serve them—they aren’t being funded to do so.

In venture capital, we often hear the term “pattern recognition”—investors look for founders who resemble past successes.

Historically, that has meant funding white men from prestigious universities. And therein lies the problem. This reliance on pattern recognition creates a bias that prevents women and founders of color from breaking through.

When investors repeatedly fund similar founders, they perpetuate inequality and leave billions of dollars on the table. We’re stifling innovation, missing out on potential unicorns, and ultimately slowing economic growth.

Simply put, the world is missing out on solutions that could transform industries, and economies are missing out on growth opportunities. Bias isn’t just a moral issue; it’s an economic one.

This is precisely why I’m building a Fintech Is Femme membership community to address this problem. The solution isn’t just about women trying harder—it’s about building a community and network of women founders, leaders, and investors who can support each other, share resources, and create opportunities.

We need to break the closed loops of pattern recognition by creating new networks.

This community will communicate daily, help one another, and create a stronger ecosystem to ensure women aren’t excluded from the next wave of innovation.

Want an early invitation to the membership community? Reply to this email, and I’ll add you to the list.

How Do We Change the 2%?

So, how do we fix it? How do we ensure women's funding is equitably distributed, especially in capital-intensive industries like fintech, where funding is essential to survival?

Disrupt the Networks:

We need more women check writers in venture capital. When women make decisions, they fund women. The statistics don’t lie—female VCs are twice as likely to invest in female founders. It’s time to break the cycle of men funding men, starting with getting more women into decision-making roles.

How do we get women into these roles? By ensuring they are financially independent and empowered to invest, lead, and build.

It starts with creating more wealthy women who have the resources, confidence, and connections to shape the future. That’s why initiatives like Fintech Feminists are so important—when we invest in educating, connecting, and celebrating women, we’re laying the groundwork for a more equitable, innovative, and profitable fintech ecosystem.

Let’s keep building a world where women ask for the check and write it.

Address the Pattern Problem:

Pattern recognition is comfortable, but it’s dangerous.

VCs need to intentionally fund founders who don’t look like the status quo. It’s not enough to say, “We fund the best ideas.”

If the majority of those ideas come from men, something is wrong with your vetting process. Start looking for talent outside the usual networks, and you’ll find it.

Advocacy & Policy:

Policymakers have already stepped in to address the gender gap in some areas, but more needs to be done.

Public pressure works, but so do regulatory measures. Look at the progress made in corporate board diversity when California passed a law requiring women on boards. Between 2018 and 2022, the percentage of women on boards of California public companies increased from about 15% to 29%.

What could happen if similar steps were taken to address venture funding inequities?

Education:

Women founders need access to the same networks, mentorship, and guidance that men have enjoyed for decades.

This means formalizing mentorship programs, creating incubators focused on diversity, and establishing training programs beyond the basics.

We can’t wait for venture capital to fix itself. Like Kamala Harris’s campaign, women founders need to push boundaries, challenge the system, and rally their own resources to ensure they get the funding they deserve.

The Future is (Still) Female

As we’ve seen with Kamala Harris, it’s not about being qualified or experienced enough or even outperforming the competition.

Women in fintech and beyond have the data, the returns, and the vision to create transformative businesses—yet the funding isn’t following.

The time for waiting is over. We need to challenge the myth of meritocracy and start building new systems that lift women up—not just in politics, but in every corner of our economy.

In my book, Fintech Feminists, I dive deep into this pervasive issue and present story after story of women in fintech who have defied the odds.

These women are reshaping the fintech space and our entire financial system.

This is not just a women’s issue—it’s an economic issue that fundamentally shapes the fabric of our financial system and society at large.

If we want to see real change, we need to address the 2% funding figure as the barrier to growth and innovation that it truly is.

That’s why I’m thrilled to announce the first-ever Fintech Is Femme Leadership Summit in San Francisco on November 12, with the theme “She Writes the Check.”

It’s time to shift the narrative, create new systems, and ensure that women are leading the charge—not just asking for funding but writing the checks. Join us as we redefine the future of fintech.

Let’s build the future we deserve—where women get the funding, recognition, and opportunities they’ve more than earned.

See you in San Francisco!

SPONSORED BY

It’s time to STOP using Honey and Credit Karma

🍯 Honey? More like yesterday's news. 🐝

💳 Credit Karma? So last season.

🍎 Apple Pay? Please, we're just getting started.

Meet Kudos: The free browser extension that's about to make your wallet feel like it just hit the gym. 💪

Maximize rewards at 3M+ stores

Discover credit card deals so hot, they're NSFW

One-click checkout faster than you can say "take my money"

Available on desktop and iPhone. Why settle for less when you can Kudos your way to savings?

Use code "EARN" to get $20 back after your first eligible purchase. Your wallet will thank you (probably with cash).

WTF ELSE?

Bank of America Folds Fintech Investment Banking Team Into Tech

BCG Report: Global Payments Growth Slowing as Fintechs Rise

Financial Firms Bet Big on AI with 57% Boosting Hardware Spend

Embedded Fintech Makes Innovation a Two-Way Street for Banks

Lilly Ledbetter, and the wage gap that followed her to retirement and death

I WANT IT, I GOT IT

📰 Today’s Read: Is all career advice for women a form of gaslighting? Perhaps, in a system that isn’t supportive, it could be. It's a fascinating read.

🍿 Today’s Watch: I watched the movie Suzume over the weekend, which was an intense and beautiful rollercoaster. Anime just hits differently.

🌍 Today’s Award: NYC Fintech Women has opened nominations for the Inspiring Fintech Females 2024! I was honored to receive this award in 2022, and it has been a significant driver of my networking and success in the industry. Be sure to nominate yourself (or a woman who inspires you)!

FINTUNES

The lyrics are relatable for every woman.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on female leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by pre-ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

That’s all for now! See you Thursday!

Love,

Nicole 💜