Hi, fintech fam! 💜

Happy Tuesday! (Or Wednesday morning, depending on when you’re reading this).

Another eventful weekend has come and gone, with the Super Bowl stealing the spotlight in more ways than one. It’s been a weekend of major wins for women:

Autumn Lockwood made history as the first Black woman coach to win a Super Bowl.

Jalen Hurts, the Eagles QB, made NFL history with an all-female management team, sharing that “having an all-female team has allowed me to see things from a different perspective… it’s honestly been a boost — kind of a secret weapon.”

And of course, Serena Williams surprised us all by joining Kendrick Lamar during his performance, while SZA stunned as the halftime show’s special guest.

Women have always been at the forefront of innovation — whether on a Super Bowl stage or in the world of fintech.

This will be a key theme at the Fintech Is Femme Leadership Summit on April 23rd! Don’t forget to grab your early bird tickets before they’re gone!

Now, let’s dive into today’s column.

INNOVATION

How I Got Scammed by Someone Who Sounded Just Like My Digital Bank

I threw open the door to my Brooklyn apartment, eager to finally be home.

After 24 hours of travel—Mexico City to JFK—plus food poisoning that hit me just hours before my 7 AM flight, I was wiped out.

The only thing on my mind? My bed.

But then, as I walked in, my phone buzzed with a text.

“Did you try to make a charge at an Atlanta, Georgia Walmart for $234.33?”

What? No, of course not. I had just come off a 5-hour flight, practically delirious. I hadn’t even been near Atlanta. In fact, I hadn’t even left Mexico City in days.

So I responded, “No.” Simple enough.

Then came the follow-up:

“We’ve detected some unusual activity on your account.”

My stomach turned. Unusual activity?

I’ve been here before.

It wasn’t the first time my account had been compromised. Over the years, people have used my credit card details to rack up fraudulent charges multiple times.

I’d seen the panic in my bank’s emails before, so it didn’t feel all that shocking.

But then, things started to escalate in ways I didn’t expect.

A call came through from SoFi—the name of my bank I’d saved in my phone. They sounded like my bank. They looked like my bank. They said they needed to verify recent transactions and address the fraud.

And as the conversation progressed, the urgency grew.

The representative rattled off charges I hadn’t made. I tried to check my account on the back end. Nothing. But the SoFi rep was insistent: this was real, I needed to act fast, and they were working to stop the transactions.

I didn’t think twice. I was exhausted, sick, and trying to fight off a wave of nausea.

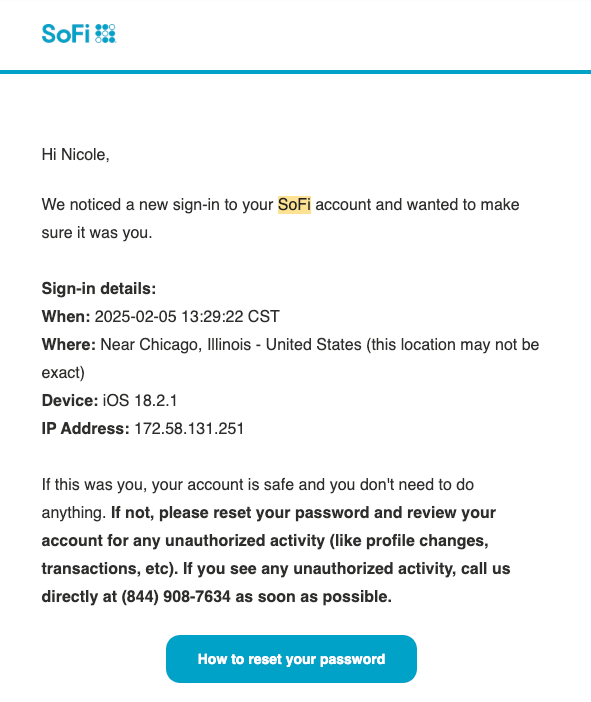

They sent me an email—official-looking, too. A string of cities where someone had attempted to log into my account. Chicago. Miami. They told me someone was trying to change my phone number.

One of the emails from the scammers.

At that moment, it felt like the walls were closing in.

The panic was real, but what hit hardest was the next step. The SoFi rep said, “We need to disable your account, but I’ll need your password.”

Wait, what?

I knew better. I’ve reported on fraud for years. I knew not to give anyone my password.

Yet here I was—half awake, stomach still in knots, and I gave them everything they wanted.

Moments later, I realized I’d just handed my bank password to someone who wasn’t my bank.

My account locked up. The phone call cut out. This was happening.

I scrambled to call SoFi again—this time, the real SoFi.

But here’s the thing: How could I be sure it was really them? The fraudster had just used SoFi’s real phone number to call me. They had mimicked everything to a T, even the emails.

I was in disbelief.

After I questioned their existence, the real SoFi locked and frozen my account. But by then, the fraudsters were already making moves—trying to transfer money from my linked accounts.

The most mind-blowing part of it all was that the fraudster had my bank’s phone number. My caller ID showed SoFi, and they also used their email system to send fake emails from SoFi.

How is this even possible?

The good news is that I was lucky. No money was taken, and my savings and investments were safe. With access still open on my mobile app, I was able to regain ownership of my account.

Today, my account is still frozen, and the whole ordeal left me questioning everything I thought I knew about the safety of my finances.

I was fortunate to catch it quickly, but not everyone is as lucky.

Fraud Is Everywhere

It’s a multi-billion-dollar problem, and it’s getting worse.

Over the past year, fraudsters caused a staggering $1 trillion in global losses. That’s not a typo. A trillion dollars. This isn’t a small issue—it’s one of the most pressing economic crises of our time.

For the fintech industry, fraud has become a daily reality. Companies are losing $51 million a year to fraud, with 1.7% of their annual revenue slipping away to criminal syndicates.

To put it in perspective, corporate spending on fraud prevention could hit $250 billion by 2031.

Yet despite the rising costs, fraud schemes are growing more sophisticated. Criminal networks offer “fraud as a service” on the dark web, providing stolen data to anyone willing to pay.

And with the rise of deepfakes, fake phone calls, and AI-driven phishing, it’s harder than ever to tell who’s real and who’s trying to steal your information.

This isn’t just about lost money. It’s about trust.

I cover fintech. I know this stuff. But at that moment, I was vulnerable. I was tired, foggy, and sick.

And the fraudster knew it. They exploited my weakest moment to gain access to my finances.

That’s how fraud works—people don’t get scammed because they’re dumb. They get scammed because they’re vulnerable.

And when that happens, it’s not just personal. Financial scams impact the bigger picture: financial inclusion and stability.

For many people, their bank account is the lifeline to their financial security. When fraud happens, it’s not just an inconvenience—it’s a setback and sometimes a catastrophe.

According to the latest data, banks and customers have already lost over $100 billion to fraud—and the costs are likely much higher when you factor in the ripple effect on businesses, reputations, and even economies.

For low-income individuals or those without access to traditional banking, these scams can be life-altering.

A lost bank account could mean losing access to rent money, tuition, or emergency savings. It’s a dangerous cycle that keeps many people out of the financial system altogether.

And the numbers aren’t going in the right direction.

We live in a world where the cost of fraud is skyrocketing, and fintech companies—the ones we trust with our money—are the most vulnerable. Fraud is so widespread that even the best companies are struggling to keep up.

So how does fintech fix this?

It’s the big question that led me to partner with Frances Zelazny, Founder & CEO of Anonybit, to create the first-ever Fintech Security Summit.

We’re bringing together experts, like Brett Johnson, the self-proclaimed “father of cybercrime,” to discuss how fintech can stay ahead of these criminals.

We can’t afford to wait any longer. The stakes are too high. And for me, this experience has been a wake-up call.

It’s not just about securing my own account—it’s about making sure we’re all protected.

This is the moment to take action.

Join us at the Fintech Security Summit and let’s get to the root of the problem together.

[NEW YORK] Fintech Security Summit

There’s no better time than now to team up with Frances and Anonybit to confront fraud at its roots by hosting the Fintech Security Summit.

Get inspired, forge meaningful connections, and get ready for a day that could change everything. This is your opportunity to step up and be part of something transformative.

P.S. The Fintech Security Summit is happening at the same time and venue as the Fintech Is Femme Leadership Summit on April 23.

Pro Tip: VIP tickets get you access to both summits—all day.

[NEW YORK] Fintech Is Femme Leadership Summit

Keynote Fireside Chat with Dr. Angel Rich-Jones, Founder & CEO, CreditRich

This year’s theme is Fintech Redefined.

Fintech is stepping up in a big way. Startups, investors, and banking partners have never been more crucial in solving some of the most pressing challenges facing our economy today.

At this year’s summit, you’ll hear from fintech’s most influential leaders, engage in high-energy networking sessions with powerhouse professionals, and walk away with actionable insights that will propel your career forward.

Expect a day filled with inspiring fireside chats, expert-led panels, and networking opportunities that will fuel your ambition.

And don’t miss our fan-favorite Evening of Storytelling—it’s going to be an unforgettable night!

These powerhouse women will show you exactly what it takes to rise to the top of the fintech world.

So, What Are You Waiting For?

Get inspired, make connections, and prepare for a life-changing day. This is your chance to step up and be a part of something big.

Want to sponsor? Click here to get involved.

WTF ELSE?

SPONSORED BY

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

I WANT IT, I GOT IT

📰 Today’s Read: I just saw this thought piece from Anthemis: Climate Insurance Underpins All Roads Leading to Net Zero cross my desk.

🍿 Today’s Food: I enjoyed an incredibly delicious bowl of ramen at the Trad Room in Brooklyn. I went on Sunday, opting for this culinary delight over any Super Bowl festivities. It was the perfect way to recuperate after last week's illness and fatigue.

🌍 Today’s Watch: Loving this interview on the power of building your own empire with Issa Rae as a way to future-proof her career (resonates with me as an entrepreneur!)

FINTUNES

Kendrick absolutely dominated the Super Bowl performance. These shows are always a masterclass in storytelling, and he elevated it to new heights. Huge congratulations!

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on female leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

That’s all for now! See you Thursday!

Love,

Nicole 💜