Hey, fintech fam! 💜

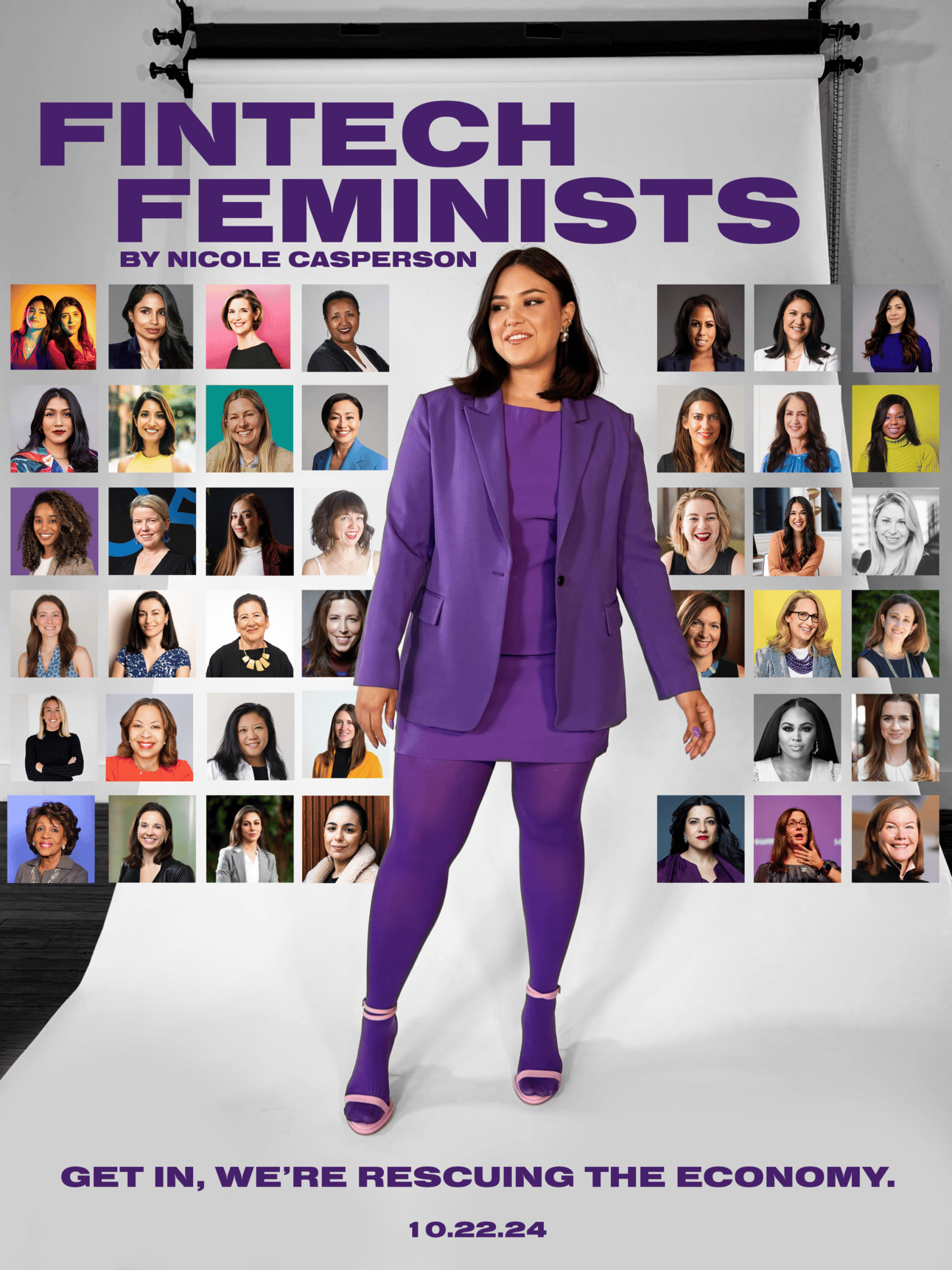

It’s finally here! Fintech Feminists is out in the world, and I couldn’t be more excited to share it with you.

This isn’t just a book—it’s a playbook for every woman in fintech who’s ready to break down barriers and claim her power.

This milestone is bigger than just me. It’s about us—the women founders, investors, and operators who are reshaping the future of finance. And the best part? We’re just getting started.

Want to keep the momentum going? Join us at the Fintech Is Femme Leadership Summit in San Francisco. It’s going to be full of powerhouse women, real conversations, and actionable takeaways.

You belong here. Let’s keep building this together.

Check out our upcoming events (I’ll also be at Money20/20) and grab your spot!

IMPACT

Kamala Harris Didn’t Wait for Permission—And Neither Should Women in Fintech

Imposter syndrome. It’s the unwanted shadow that follows many women in fintech—whether you’re founding a company, investing in early-stage startups, or operating behind the scenes.

It tells us that we’re not good enough, smart enough, or capable enough to belong in a space dominated by men.

And yet, as we watch Kamala Harris stand tall as the first female vice president (and future President of the United States) it becomes clear: we don’t have time to indulge in these doubts.

Kamala Harris Doesn’t Entertain Imposter Syndrome—Neither Should We

Let’s take a lesson from Kamala Harris, the first woman of color to hold the second-highest office in the U.S. government. Do you think she sits around asking herself if she’s qualified enough or if she deserves to be there? Absolutely not. And neither should we.

The truth is, we don’t have time for imposter syndrome. It’s a distraction. Every moment spent wondering if we belong is a moment we could spend raising capital, scaling our companies, or supporting another woman in her entrepreneurial journey.

In fintech—a field where innovation waits for no one—this wasted energy costs us, and not just individually. It costs the entire ecosystem. We must reject this narrative, not just for ourselves but all the women walking this path with us.

A Scheme to Hold Us Back

Imposter syndrome is more than just a personal struggle; it’s a systemic tool used to hold women back.

Historically, women have been excluded from the spaces where financial decisions are made—the Ivy League schools, the boardrooms, and yes, even the halls of Congress.

So when we finally break through those barriers, it’s no wonder we question whether we belong. But here’s the catch: imposter syndrome isn’t something we need to “cure” in ourselves.

Spoiler alert: there’s nothing wrong with us. The problem isn’t internal, it’s systemic.

The real problem is the system built to make us feel like outsiders. This is where Reshma Saujani’s recent op-ed rings true.

She makes the case that imposter syndrome conditions us to doubt ourselves and each other. And that’s where the real danger lies.

The minute we start hedging our bets on our own ability—or another woman’s ability—we undermine our collective power.

That’s a bigger issue we need to face head-on if we’re serious about closing the gender gap in fintech.

Entrepreneurs: It’s Time to Support One Another

When we talk about imposter syndrome in fintech, it’s impossible not to address the funding gap that still exists for female entrepreneurs.

Year over year, I report on the same statistic: Only 2% of venture capital funding goes to women-led startups. That’s not because women aren’t building great companies—they absolutely are.

It’s because they’re not being supported, both by the system at large and, if we’re honest, sometimes by each other.

As female entrepreneurs, many of us are so focused on proving we belong that we forget the power of collective support.

We tend to work in silos, heads down, chipping away at the barriers on our own.

But the truth is, none of us can do it alone. We need to do a better job of supporting one another—whether it’s making introductions, sharing resources, or pooling our collective knowledge. If we don’t uplift each other, we’re only reinforcing the scarcity mindset that says there’s only room for one woman at the top.

For Investors: Check the Bias at the Door

The same applies to female investors. There’s no excuse for perpetuating the same biases that keep us from investing in women-led companies.

Studies show that female investors are more likely to fund female entrepreneurs, but we must be mindful of how deeply ingrained bias is—even among ourselves.

Are we questioning the scalability of a woman’s startup more harshly than we would for a male-led venture?

Are we unconsciously underestimating her ability to lead and grow her company? These questions matter because they directly contribute to the funding gap.

Beyond the dollars, visibility is key.

Women entrepreneurs need to be seen, heard, and celebrated—by us.

That means more than just showing up at networking events or giving lip service to “women supporting women.”

It means actively seeking out and promoting female-led fintech companies. It involves using our platforms to highlight their achievements, utilizing our budgets to support one another, and making introductions that help them scale.

Women are underrepresented in media, with only a quarter of coverage focused on female entrepreneurs. That lack of visibility has real consequences.

How can the next generation of fintech leaders rise if they can’t see examples of success in the media, in the boardroom, or on the investment side?

To Combat the Imposter, Build Your Community

So how do we combat imposter syndrome? The answer is simple: community.

Feeling secure in ourselves is so much easier when we’re surrounded by others who have our backs.

I’ve seen this firsthand in the fintech space—women thrive when they have a supportive network.

That’s why I created Fintech Is Femme. It wasn’t just about amplifying individual stories or giving tactical advice on how to succeed (though both of those are critical). It was about building a community where women could stop questioning their worth and start acting from a place of power.

In fact, the community aspect is the heartbeat of everything we do.

None of us rise alone, and it’s time to tear down the silos. The scarcity mindset—the idea that there are only so many seats for women at the table—needs to go. The only way we create lasting change is by working together, lifting each other up, and rejecting the premise that any of us is an imposter in the first place.

Fighting for a place at the table is not enough—we need to bring other women with us.

The narrative of scarcity that pits women against each other is outdated.

As women in fintech, we have a collective responsibility to rewrite the future of this industry, not just for ourselves but for the women coming up behind us.

Building a New Blueprint

The next logical step in this journey? Building an even stronger foundation for women in fintech.

That’s why I’m launching The Academy of Fintech by Fintech Is Femme—a membership community where women can collaborate, mentor, and support each other daily. It’s a space designed for us, by us, with the sole purpose of rewriting the future of fintech.

The Academy is designed to bring female founders, investors, and operators together to collaborate, mentor, and, most importantly, build.

This is more than just networking; it’s a movement.

A movement where women reclaim their rightful place as the leading innovators we’ve been all along. Kamala Harris didn’t wait for permission to lead, and neither should we.

We’re not just creating companies here; we’re creating a new system.

No more silos.

No more scarcity.

If we’re going to close the gaps in funding, authority, and visibility, we need to do it together.

Imagine what we could achieve if we rejected imposter syndrome, stopped doubting ourselves and each other, and poured all that energy into collaboration and growth.

This is how we’ll change the future of fintech—not by questioning whether we belong, but by knowing we do and making sure every woman who follows us knows it, too.

Your seat at the table is waiting.

Join the waitlist here.

This is the movement. This is what it means to be a Fintech Feminist.

SPONSORED BY

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

WTF ELSE?

Cathie Wood unloads $10.5 million in surging fintech stock

CFPB's 1033 open banking final rule gives banks relief on liability

Fintech: Seeding LatAm payments

One Zero, the AI fintech started by the founder of Mobileye, is raising $100M, say sources

Fintech giant Stripe to buy crypto startup Bridge

I WANT IT, I GOT IT

📰 Today’s Read: Guess what? My book just hit the shelves today, and it's obviously the day's must-read!

🍿 Today’s Watch: It’s that time of year I’m rewatching Gilmore Girls.

🌍 Today’s Listen: ICYMI: A new podcast episode, Humans of Fintech, dropped last week with the icon Sallie Krawcheck.

FINTUNES

This hit has definitely already been featured in this newsletter but I’m claiming it as the official theme song of Fintech Feminists.

It’s a femme.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on female leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by pre-ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

That’s all for now! See you Thursday!

Love,

Nicole 💜