Hey, fintech fam! 💜

First, I want to thank each of you for the incredible support you’ve shown Fintech Feminists.

From sharing the book with friends to diving into these pages with your own experiences in mind, you’ve made this journey unforgettable. Knowing that Fintech Feminists resonates with you means everything.

And I’m thrilled to keep that momentum going.

This is why I’m excited to invite you to the Fintech Is Femme Leadership Summit in San Francisco!

This summit is designed for founders, leaders, and entrepreneurs like you who drive change in fintech and beyond.

It’s a day packed with inspiring speakers, actionable insights, and a community of powerhouse women who are as passionate as you are about reshaping the financial industry.

Join us for an unforgettable day that will connect and fuel your growth. This is more than just an event—it’s a movement, and I’d love to see you there.

LEADERSHIP

Financial Independence Is Power: Lessons from Sallie Krawcheck

Let’s be real: time is our most precious resource.

As entrepreneurs, founders, and leaders, we’re constantly juggling. Running companies, managing teams, driving growth—it’s all on us. But the truth? Time is always in short supply.

We’re scaling businesses, building teams, and (let’s face it) doing everything else in between. And when it comes to staying on top of the numbers, that’s often the first thing to fall off the list.

But here’s the hard truth: knowing your financials inside and out is the ultimate power move.

You're unstoppable when you have a clear picture of your cash flow, expenses, and overall financial health.

You confidently walk into investor meetings, make decisions faster, and—most importantly—feel completely in control.

And let’s be honest, that feeling is priceless.

Still, getting to that level of financial insight takes time. And time is precisely what we can’t scale.

So, when I heard about Shopify Finance—a centralized hub designed to streamline financial management for busy entrepreneurs—I was intrigued.

Hear me out.

Imagine having real-time insights, cash flow control, and funding options in one place, right where you run your business. This isn’t just a convenience; it’s a game-changer, especially for women building lean, scalable companies.

But, as always, I take advice from those who’ve been there. Women reshaping fintech, like Sallie Krawcheck.

Sallie didn’t just break barriers—she smashed them.

In my latest interview with her, Sallie shared her mantra that stuck with me:

“Nothing bad happens when women have more money.”

She followed that with something even more powerful:

“If you’re the numbers person, they can’t ignore you.”

That wisdom guided Sallie during her years on Wall Street, and it’s advice every woman in fintech should embrace. If we want to rewrite the rules of finance, we need to be in control of our financial destinies—both in our personal lives and our businesses.

Financial Independence = Power

Here’s what Sallie’s journey taught me, and it’s a lesson every woman entrepreneur should hear:

Financial independence is about more than just having money. It’s about the confidence to make bold decisions, the freedom to take risks, and the power to lead on your terms.

Lack of clarity around the numbers doesn’t just cost us time—it costs us confidence.

I’ve been there, walking into meetings feeling like I wasn’t entirely on top of things, second-guessing my decisions, worrying about cash flow. It wasn’t until I got my financial systems that things started to shift.

Having a firm grip on your financials isn’t just good business practice—it’s the difference between leading confidently and feeling like you’re playing catch-up. When you understand your financial landscape, you’re ready to make decisions that will shape your company's future.

That’s not to say it’s easy. Like many of you, I’ve lost hours (okay, days) to spreadsheets and admin. Trying to reconcile numbers across different platforms can feel like a never-ending task.

It’s not exactly why we started our businesses, but it’s where financial independence starts: with clarity.

Financial Independence = Opportunity

Financial independence isn’t just about you. It’s about opening doors for other women.

Sallie shared this idea with me, and it stuck.

The more we take control of our finances, the more space we create for other women to follow in our footsteps.

When women have more money, they can invest in each other, fund the next generation of female entrepreneurs, and change the narrative.

Sallie saw it firsthand when she launched Ellevest in 2014. By creating a platform that served women—historically underserved by traditional financial institutions—she tapped into a $31 trillion market. Ellevest grew because it addressed a gap no one else paid attention to.

And it’s proof that when women invest in women, everyone wins.

This is the future of fintech: more women-led businesses, more female investors, and more women rewriting the finance rules.

But that future starts with knowing your numbers, being confident to push for more, and taking risks on your terms.

Lessons for Women Entrepreneurs

Let’s talk about the practical side.

If you’re like me, you probably didn’t start your business because you were excited about cash flow management and tax compliance.

But if there’s one thing I’ve learned, understanding your financials is the key to unlocking growth.

Here are three lessons from Sallie’s journey that can help us all get there:

#1 Don’t wait until you’re “ready” to take control of your financials.

So many of us wait for the perfect moment to feel “ready.”

Ready to raise funding. Ready to scale. Ready to dive into the numbers. But Sallie didn’t wait. When she launched Ellevest, she faced countless “no’s” from traditional investors, but she kept pushing. Eventually, she raised $53 million through community-driven funding.

The lesson?

You don’t need to wait until everything is perfect. Start where you are with what you have, and grow from there.

#2 Build for underserved markets—and don’t be afraid to break the rules.

Sallie built Ellevest specifically for women because she saw a need no one else was meeting.

When you build for an overlooked audience, you unlock massive growth potential. Women in fintech are in a unique position to do just that. Look for the gaps, look for the markets traditional finance has ignored, and build for them.

That’s how you grow into a $2 billion platform like Sallie did.

#3 Failure isn’t the end—it’s fuel for your next move.

If you’re in fintech, you already know the stakes are high.

But Sallie’s journey reminded me that failure is part of the process. She faced rejection after rejection while raising capital, but instead of letting it derail her, she used it as fuel.

The more you embrace the lessons from setbacks, the more resilient and unstoppable your business becomes.

So, Where Does Fintech Come In?

By now, you’re probably thinking, “Great, I’m ready to take control of my financials—but where do I start?”

Managing your financials across multiple platforms can feel like a full-time job if you're like most founders. Tracking payments, accessing funds, paying bills, and dealing with taxes—it’s easy to lose sight of the overall picture.

That’s where Shopify Finance comes in.

Launching today, Shopify Finance offers something every female founder craves: control. Control over cash flow, tax obligations, and how and when we pay our bills. All from one centralized dashboard.

Shopify Finance consolidates financial tools and insights into a single platform, giving business owners real-time access to their financial data. With this control, you can stay on top of cash flow, make informed decisions on the fly, and finally stop bouncing between platforms.

For women running lean businesses, the less time you spend managing financials, the more time you have to focus on growth—and that’s a huge win.

It’s not just about saving time—it’s about access to capital and resources that help you grow.

Take Shopify Capital, for example, which offers up to $2 million in funding with no credit checks.

As Sallie and I discussed, access to funding is one of the biggest barriers women entrepreneurs face. Shopify is breaking down that barrier by offering flexible financing options, fast approvals, and repayment terms that reward you for growing your business quickly.

And then there’s Shopify Credit, a business card designed with flexibility. Now, you can pay off your balance in full each month or pay over time based on a percentage of your daily sales. This flexibility can be a game-changer, especially when managing fluctuating cash flows.

But it doesn’t stop there. With bill payments built directly into the app, you can schedule and pay bills from where you manage your finances, reducing the mental load of juggling multiple systems.

And let’s not forget tax management—because nothing derails your plans faster than scrambling to figure out tax compliance.

Shopify Finance helps you track and manage sales tax obligations, whether you’re working locally or internationally, ensuring you’re always on top of it.

Taking Control of Your Financial Future

This is for women who are scaling fast, need access to capital on their own terms, and want to take back control of their time.

If you’ve ever felt like financial admin was dragging you down, Shopify Finance is a suite of tools that will lighten the load. It’s for women who want to stop spending time chasing numbers and focus on what really matters: building and leading.

Sallie Krawcheck taught me that women are unstoppable when they take control of their financial future.

And having the right suite of tools in place is a big part of that.

Financial independence gives you options. It gives you confidence. And it gives you the freedom to take risks and make bold decisions.

So, if you’re ready to step into that power, look closely at how Shopify Finance could help you get there.

It’s not just about keeping the lights on—it’s about fueling growth that gets you noticed.

When you take control of your financials, you’re no longer just running your business—you’re leading it.

WTF ELSE?

Goldman, GeoWealth Look to Help RIAs Build Personalized Portfolios for Clients

NC bank to buy fintech BM Technologies in $67M deal

Central Banks Are Increasingly Studying Bitcoin

I WANT IT, I GOT IT

📰 Today’s Read: Success Formula: Lessons from a Multi-Exited Founder & Super Angel Investor (who will be at the SF Fintech Is Femme Leadership Summit!)

🍿 Today’s Watch: A Neuroscientist’s Guide to Reclaiming Your Brain with Nicole Vignola (I love this for abundance mindset work).

🌍 Today’s Listen: This episode of This American Life titled "How Are You Not Seeing This?" It features people trying and struggling to see what another person sees.

FINTUNES

I'm living for the confidence Meg showcases in this new song. Put this on and remember who you are!

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on female leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

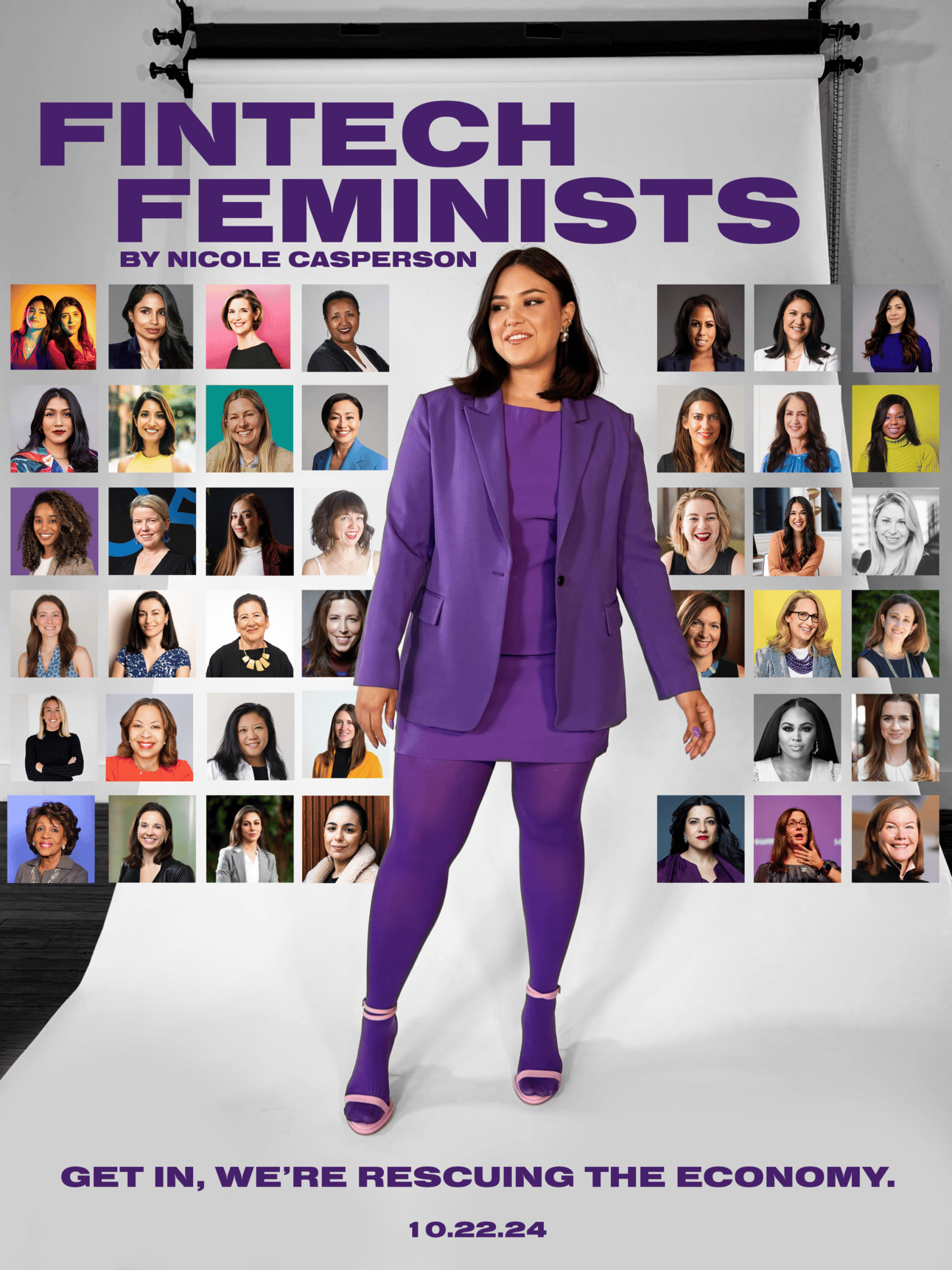

📚 Increase your expertise by pre-ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

That’s all for now! See you Thursday!

Love,

Nicole 💜