IN PARTNERSHIP WITH

Hey, fintech fam! 💜

This week, I’ve been busy curating the agenda for the Fintech Is Femme Leadership Summit and Fintech Security Summit—two powerhouse events we’re throwing during New York Fintech Week.

In case you missed it:

We’re taking over a seriously cool venue (the big reveal is coming soon!) with two stages—yes, you heard that right.

On our mainstage, we’ll kick things off with our flagship Leadership Summit, featuring fireside chats, an Evening of Storytelling with the most powerful women in fintech, and expert panels to keep your industry game strong and your network even stronger.

It’s all going down on April 23, and you won’t want to miss the opening keynotes (check out who’s speaking in the event details below).

Now, let’s get to all the news!

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 Orum’s New Payments Tool Aims to Be the Sanity Check Every B2B Needs

Orum Founder & CEO Stephany Kirkpatrick

Between recent bank failures and the whirlwind of deregulation—more on the CFPB in our upcoming stories—it’s more crucial than ever to know exactly where your funds are at all times.

And by that, I mean right now, not when they’ve vanished into the transfer abyss. As founders and operators, we need clarity and transparency about where our money is to keep our sanity intact.

I caught up with Stephany Kirkpatrick, CEO of fintech startup Orum, to discuss their new payments tool, Monitor. Officially launched this week, it’s designed to simplify the often chaotic and complex workflows that B2B teams face when managing payments.

“Think of it as a sidekick to our APIs, helping operations teams do more with less technical know-how,” Kirkpatrick told me.

No coding is required. Just automate payments, verify bank accounts and track transfers—all in real-time.

It’s like Amazon’s routing system—but for payments. Monitor optimizes factors like speed, cost, and risk while letting businesses track, reconcile, and verify funds across multiple accounts.

Enterprises can now manage their entire money movement in one unified system, whether they’re uploading files or processing a one-off transaction.

Founded in 2019, Orum’s mission is simple: make payments more straightforward, reliable, and transparent—though the tech behind it is far from simple. Kirkpatrick has raised $82 million from investors like Bain Capital Ventures and Inspired Capital to turn that vision into reality.

“We help businesses track where the money is, how it’s moving, and who’s involved,” she said.

Given the state of the economy right now, that kind of transparency isn’t just helpful—it’s absolutely essential.

For Founders on the Rise: Automation = Certainty

As companies scale, especially in fintech, automating payment operations has become a must. Gone are the days of manually tracking funds with Excel sheets or relying on vague data to piece things together.

Per Kirkpatrick, Monitor offers real-time tracking, streamlines reconciliation, and provides an auditable record—making it indispensable for industries like lending, billing, and marketplaces.

For founders—especially those beyond Series A—Monitor is a “sanity check” that helps keep operations organized, compliant, and audit-ready, she said.

Think of it as a financial GPS. It tracks funds in transit and answers those nagging questions about money movement:

What’s settled?

What’s pending?

What’s going to clear tomorrow?

“The era of patchwork systems is over,” Kirkpatrick said. “You need smart, reliable infrastructure from day one. This is about making sure you’re not scrambling when it’s time to scale.”

Bottom Line: The regulatory landscape is a hot mess right now. Between Trump’s firing of Rohit Chopra, the CFPB’s director, and the chaos of fast-moving deregulation, it’s easy to feel like you’re flying blind when it comes to financial oversight.

Kirkpatrick’s advice for founders? Make smart decisions now—lay the groundwork, automate, and keep things organized so you’re not scrambling later. It’s a long-term win, and in a world full of uncertainty, that’s something every founder can get behind.

#2 Draft Stablecoin Legislation Is Here – A Move Toward Clarity Amid Crypto Chaos

On Monday, Congresswoman Maxine Waters (D-CA), the top Democrat on the House Financial Services Committee, dropped a long-anticipated draft bill to regulate stablecoins.

After more than three years of bipartisan collaboration, the legislation reflects not just technical feedback from the Treasury Department and the Federal Reserve, but a clear push for regulatory certainty in a crypto market that’s long been a Wild West of financial innovation.

“This draft bill fosters innovation while properly addressing and prioritizing concerns I’ve long held about safeguarding our nation’s consumers from the scams that have plagued the crypto industry,” Waters said in a statement, making clear that consumer protection is at the core of the proposed legislation.

What’s in the Bill?

Here’s the quick breakdown of what this bill brings to the table:

A Regulatory Framework for Stablecoin Issuers: The bill proposes a regulatory structure for both bank and non-bank stablecoin issuers, with a significant role for the Federal Reserve in overseeing reserve requirements—hello, accountability.

Protecting the Separation Between Banking and Commerce: Non-financial commercial companies (think Big Tech—Facebook, Google, X) won’t be allowed to own a stablecoin issuer. This is Waters’ way of putting a hard line between financial institutions and tech giants looking to muscle into this space.

Sanctions and Compliance: Issuers would be directly subject to sanctions laws, and have to adhere to anti-money laundering (AML) and counterterrorism financing (CTF) regulations—meaning more scrutiny on where money’s coming from and where it’s going.

Global Oversight and Closing Loopholes: The bill goes after offshore loopholes, making sure that stablecoin issuers like Tether (who’ve historically avoided U.S. regulation) can’t sidestep U.S. laws. Not on Waters’ watch.

Leadership Restrictions: People like Sam Bankman-Fried (remember him?) would be banned from holding executive roles or significant shares in a stablecoin issuer. No more shady leadership.

Consumer Protection (Finally!): With this legislation, there’s a new emphasis on protecting consumer wallets, risk management requirements, and backup enforcement powers for the Federal Reserve—just in case someone tries to pull a fast one.

Keeps Existing Oversight in Play: Agencies like the Treasury, CFPB, SEC, and CFTC will still maintain their regulatory powers over various parts of the ecosystem—think exchanges, wallet providers, and market-makers.

Why It Matters

Stablecoins have quickly become the go-to asset for anyone who wants to deal in crypto without the volatility of, well, crypto.

They’re pegged to the dollar, meaning they’re stable by design, and they’ve hit critical mass. In fact, stablecoins processed $6.87 trillion in transactions last year. That’s more than PayPal and Mastercard combined.

But as the stablecoin market matures, so does the need for oversight. Enter Congresswoman Waters, who’s spent over three decades shaping financial policy.

Waters isn’t just talking about any regulation here—this is a direct response to the rising popularity of stablecoins and the increasing amount of consumer money flowing through them.

For fintech founders, innovators, and investors, this draft bill signals a major shift.

Regulation may feel like a buzzkill, but it’s a necessary one. While it could impose new compliance costs, its clarity is invaluable.

With rules in place, fintech companies can scale stablecoin-related services with greater confidence and less fear of running afoul of regulators.

The bill also creates a clear distinction between financial institutions and the tech giants that might want to use stablecoins as a backdoor to financial services.

By prohibiting Big Tech from owning issuers, Waters is ensuring the fintech space remains competitive and protected from monopolistic behavior.

For fintech players, that means more room to breathe—and build.

Bottom Line: This draft legislation is the regulatory structure fintech companies have been waiting for—whether they knew it or not. As stablecoins become a fixture in the global financial system, clarity on how they’ll be regulated is crucial. Waters’ bill gives us that clarity, while also addressing long-standing concerns around consumer protection, sanctions compliance, and global regulatory loopholes.

#3 Musk’s Team Shuts Down CFPB—What Does This Mean for Fintech?

First, Rohit Chopra, the Consumer Financial Protection Bureau’s (CFPB) director, was unceremoniously fired.

Now, the agency itself is effectively shut down. The CFPB, which has 1,700 employees and oversees a crucial part of the financial services landscape, is on ice. All work has been halted this week, leaving a regulatory vacuum in its wake.

Congresswoman Maxine Waters (D-CA), Senator Elizabeth Warren (D-MA), and nearly 200 other Congressional colleagues are furious.

They’ve protested this week, and in an open letter to Acting CFPB Director Russell Vought and Treasury Secretary Scott Bessent, they demand that Elon Musk’s operatives be removed from the agency, its operations be restored, and its consumer protection work continue without interference.

The letter, signed by 143 Representatives and 46 Senators, condemns what they describe as an illegal power grab by Musk’s “Department of Government Efficiency” (DOGE) team, accusing them of halting critical CFPB functions.

“Deep concern” is an understatement here.

The CFPB was established after the 2008 financial crisis under the Dodd-Frank Act, to protect consumers from predatory financial practices. Since then, over $21 billion has been returned to Americans who were scammed or financially harmed.

And now, it seems like that progress is at risk.

Coincidentally, this shutdown occurred just a couple of weeks after Musk’s X struck a deal with Visa to launch its payments platform, making the pathway for launch easier.

What’s Really Going On?

The controversy exploded when at least three Musk-linked employees entered the CFPB’s headquarters last weekend, gaining access to sensitive internal data.

Then came the bombshell: Vought, who is part of Musk’s team, ordered all work at the CFPB to stop. As of Monday, staff were working remotely, and the CFPB’s website had a broken link.

For financial services companies, this is a serious issue. The CFPB has had a monumental role in enforcing consumer protection laws, regulating everything from credit cards to mortgage debt and payday loans.

And now, there’s a very real fear that this political shake-up could leave consumers unprotected, especially with billions at stake.

Why Should Fintech Care?

If the CFPB stays down, the finalization of rules related to open banking could stall.

One of the key rules under Section 1033 of Dodd-Frank—which mandates that banks, credit unions, and fintechs make consumer financial data available on request—has already been implemented, but it’s not fully in play yet.

Larger institutions must comply by 2026, while smaller ones have until 2030.

For fintechs, the impact is huge. Open banking is supposed to give consumers more control over their financial data, and third parties would be able to access that data with consumer consent—so long as the rules regarding security are met.

It’s a step toward standardizing the data ecosystem across the board for things like payment apps and digital wallets. But with the CFPB now in limbo, there’s uncertainty over how (or even if) these rules will be enforced.

And if enforcement falters, it could further widen the gap between large fintech players and community-based institutions like small banks and credit unions.

Big institutions have the resources to comply with whatever rules are left standing, while smaller institutions could fall behind—or worse, be left without guidance.

The regulatory void raises concerns about upcoming fintech regulations, particularly consumer privacy. With CFPB oversight uncertain, how will Alphabet and Meta be held accountable for using consumer financial data? Additionally, Biden-era rules on medical debt and BNPL loans, meant to protect consumers, are now uncertain.

Senator Warren didn’t mince words, rallying outside the CFPB headquarters to demand accountability:

“We want answers,” she said. As lawmakers push back against the power grab, fintech leaders and consumers alike are left wondering how long it will take before the CFPB is back in business—and whether it will even look the same when it returns.

Bottom Line: This situation isn’t just a political fight in Washington; it’s one that will define the future of consumer protection in fintech. And if you’re in the fintech space, it’s time to pay attention. The game might be about to change.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

WEDNESDAY, APRIL 23

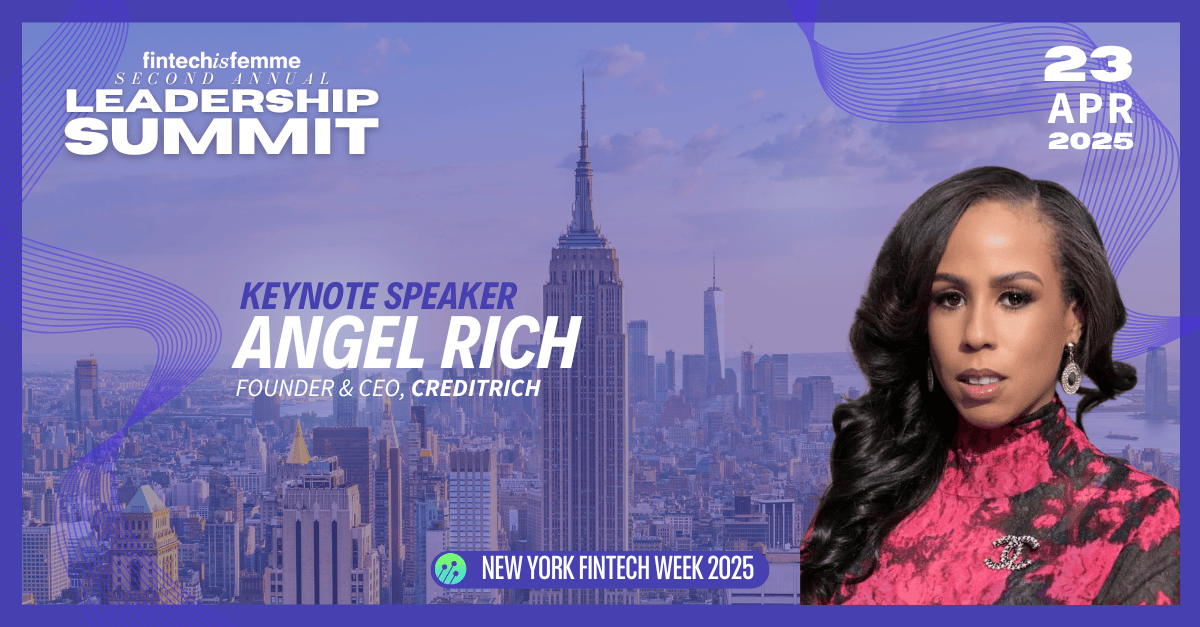

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

I’m excited that Angel Rich will open the show with me at our keynote fireside address.

She founded CreditRich, the first Black woman-owned neobank that just raised $100M in Series B funding, propelling her startup to a $1 billion valuation.

But Angel’s success goes beyond just capital—it’s about disrupting the system.

She'll reveal her strategies for building success, partnerships, and a legacy.

Don’t miss this chance to learn from the best in fintech. ✨

Early bird tickets are almost gone!

WEDNESDAY, APRIL 23

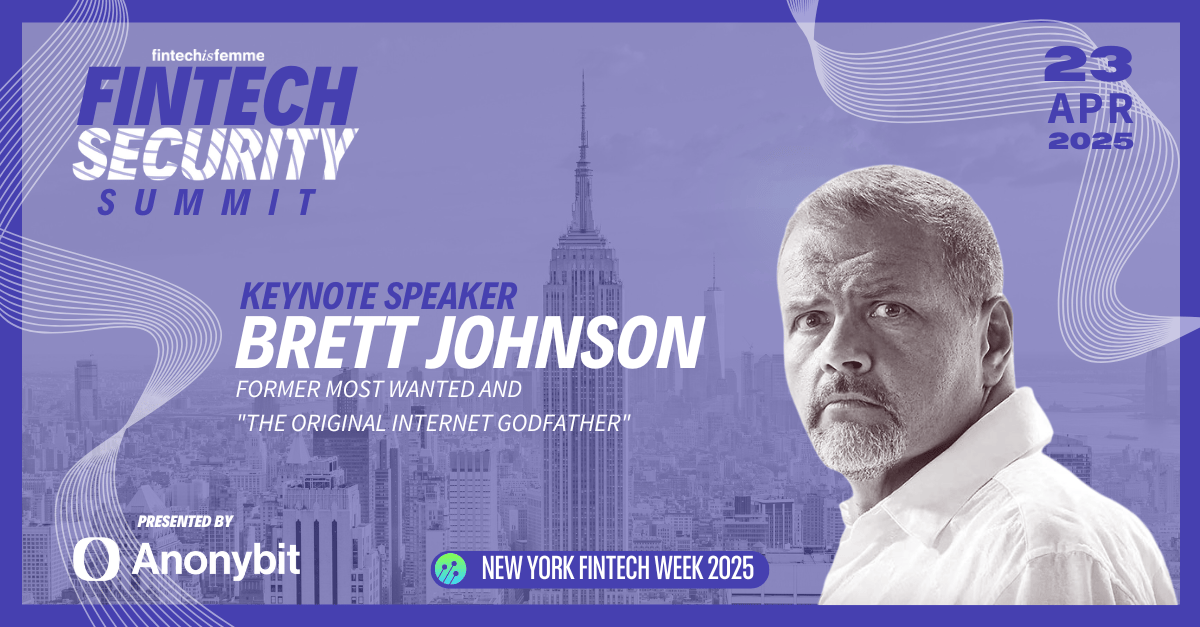

[NEW YORK FINTECH WEEK] Fintech Security Summit

I’m thrilled to announce that Brett Johnson, the Original Internet Godfather and former mastermind behind cybercrime, will be delivering the keynote at the first-ever Fintech Security Summit on April 23.

Brett’s expertise is unmatched—he helped create modern cybercrime and now works to help combat it.

If you want to understand how fraudsters think and learn how to protect your business and customers from their tactics, you won’t want to miss this.

P.S. VIP ticket holders get access to BOTH the Fintech Is Femme Leadership & Security Summit. Talk about double the impact.

SPONSORED BY TRYBE

Trybe (May 20-22, Aria, LV) is the event you need to level up your network and open doors across industries.

At Trybe, women and their allies come together to do business, learn, and forge valuable connections that push your career, business, and personal goals forward. Whether you’re looking to connect with new partners, discover fresh opportunities, or simply broaden your horizons, Trybe is the place to be. Here’s Trybe’s brochure for more details.

Why should you have a presence at the show? Simple. It’s the chance for your team (women and allies alike!) to:

• Network and Connect: Join 1,000+ women + allies from a variety of industries and unlock new partnerships, collaborations, and business opportunities.

• Make Impactful Connections: With 15,000+ meetings happening, each one is a chance to connect with clients, customers, partners, and explore new products and solutions.

• Learn and Get Inspired: With 150+ speakers, including yours truly (check out the full lineup here), you’ll gain actionable insights in business, personal growth, and professional development through sessions and workshops.

We’ve already got 150+ companies signed up, including powerhouses like Abercrombie & Fitch, AWS, Google, J.P. Morgan, Walmart, TikTok, and many more. Don’t miss your chance to be a part of this dynamic event!

Get your ticket now using my code FIF250 to snag $250 off — click here to register.

FINTUNES

I stumbled upon this song while browsing YouTube. It’s very Fintech Is Femme coded. Enjoy!

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜