Hey, fintech fam! 💜

Earlier this week, I had the privilege of joining a webinar where a fantastic host/interviewer asked me some thought-provoking questions about my new book, Fintech Feminists, especially in the context of today’s world.

Will the glass ceiling ever be shattered? Will we ever achieve true equity? What’s next?

My answer: I’ll continue to rewrite the narrative with my pen because the women before us pushed forward, making strides. We can—and will—do the same. There’s still so much work to be done, and it’s up to us to pick up the torch and build.

It’s one of the reasons I’m taking on the biggest challenge of my career by producing and expanding the next Fintech Is Femme Leadership Summit and the first-ever Fintech Security Summit.

More on those events later. But first, let’s dive into the latest news!

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 Stacy Brown-Philpot Launches Cherryrock Capital, a $172M Fund to Support Underinvested Entrepreneurs

Stacy Brown-Philpot

After an accomplished career as a tech leader, Stacy Brown-Philpot is making waves again with the launch of Cherryrock Capital, a fund dedicated to investing in underinvested entrepreneurs at the Series A and B stages.

In her announcement this week, Brown-Philpot shared that she has already raised $172 million from a range of notable investors, including Goldman Sachs Asset Management, J.P. Morgan Asset Management, MassMutual, Top Tier Capital Partners, and Melinda French Gates’ Pivotal Ventures.

High-profile individuals such as Mellody Hobson, Reid Hoffman, and Sheryl Sandberg have also backed the fund.

Cherryrock Capital is focusing on high-growth industries with nascent markets, particularly digital health, enterprise SaaS, the future of work, B2B2C, and, of course, fintech.

The fund is looking for companies with early product-market fit, poised for the kind of growth that could lead them to $100M+ in revenue.

“I started Cherryrock Capital with my partner, Saydeah Howard, with a vision to change the face of wealth creation by generating above-market returns for our limited partners through investments in the very best software companies,” Brown-Philpot said in the company announcement.

Brown-Philpot always dreamed of becoming a venture investor—a vision she outlined in her Stanford Business School application.

But, as is often the case, her path didn’t follow the traditional route. Before founding Cherryrock, she held leadership positions at companies like Google and TaskRabbit, where she ultimately became CEO.

Brown-Philpot joined Google when the company had just over 1,000 employees, and in 2013, she was recruited to TaskRabbit, where she led the company to major milestones, including a successful sale to IKEA. Under her leadership, TaskRabbit grew more than 10x in revenue and expanded globally.

When it was time for her to move on, Brown-Philpot turned down multiple opportunities to lead other companies. Instead, she asked herself one pivotal question:

“Why lead just one company when I could help build hundreds of companies led by the next generation of entrepreneurs?”

Why It Matters

The timing of Cherryrock Capital’s launch is refreshing, especially when many companies are scaling back on initiatives to support diversity and inclusion in the wake of political shifts.

Brown-Philpot, however, is focused on the long term.

“Administrations come and go,” she told Bloomberg. “I’m building something for the long haul.”

While many early-stage investors are focusing on pre-seed and seed rounds, few funds are dedicated to Series A and B investments led by underinvested founders.

These underestimated teams are driving innovation at an unprecedented pace—11x more likely to build businesses worth $1B+—yet they often lack access to the capital and resources needed to reach their full potential.

This is where Cherryrock Capital comes in. By offering scaling, board, and networking expertise, the firm aims to bridge this gap.

Brown-Philpot’s role as a board member for companies like HP, Nordstrom, Noom, StockX, and Joy has given her a broad perspective on how small and large companies operate across different industries. And it’s already paying off.

Cherryrock Capital’s first investment was in Coactive AI, a multimodal AI company that helps businesses search and analyze images, videos, and audio.

The firm co-led Coactive’s Series B with Emerson Collective. Their second investment was in Vitable Health, a Y Combinator-backed company that provides affordable primary care-driven health plans to businesses with hourly workers.

Cherryrock led the Series A round, joining Citi Impact Fund and First Round Capital on the cap table.

The firm is also nearing deals in the future of work and fintech sectors, with plans to invest $6-10 million.

Bottom Line: While the current political landscape makes it clear that DEI and investments in underinvested communities aren’t priorities for the Administration, and as some big tech companies bend the knee, Brown-Philpot is proving that playing the long game—focused on business strength, leadership, and innovation—will outlast any presidential term. She shows us there’s no reason to slow down when building funds that strengthen and diversify our economy, especially when those funds are led by diverse founders who see the gaps others overlook.

#2 Global Fintech Investment Dips, But There’s Still Room for Optimism

Fintech investments saw a global slowdown in 2024, according to KPMG’s Pulse of Fintech H2’24 report, which revealed a total of $95.6 billion across 4,639 deals.

While both the total investment and deal volume fell to levels not seen since 2017, there’s still plenty of reason to stay optimistic.

The second half of the year saw a drop in investment from $51.7 billion in H1 to $43.9 billion in H2.

However, global fintech investment showed signs of life between Q3 and Q4, climbing from $18 billion to $25.9 billion. So, while the market is cooling, it’s far from freezing.

The Americas Lead the Way, Despite a Dip in Investment

The Americas continued to dominate the global fintech investment scene in 2024, pulling in a total of $63.8 billion—nearly two-thirds of global funding.

The U.S. accounted for $50.7 billion of that, though down from $72.8 billion in 2023. Meanwhile, Canada set a new record with $9.5 billion, largely driven by the major buyout of Nuvei.

While investment dipped across the U.S. from H1 to H2, the fourth quarter saw a sharp rebound, with fintech funding nearly doubling from $10.8 billion to $20.2 billion.

Payments Still the Heavyweight Champion

No surprise here—payments continue to be the biggest winner in fintech funding, raking in $31 billion in 2024, up from $17.2 billion the previous year.

This surge was driven by consolidation and defensive acquisitions rather than the expansion of new companies.

Notably, the two largest deals of the year were the $12.5 billion buyout of Worldpay and the $6.3 billion acquisition of Nuvei.

The trend of large-scale consolidation suggests investors are betting on the financial sector’s stability over rapid growth—at least for now.

Digital Assets See a Resurgence

After a turbulent 2022 and 2023, digital assets and currencies seem to be bouncing back. The sector attracted $9.1 billion in 2024, the highest total since the boom years.

The majority of investments were funneled into digital market infrastructure and tokens, with companies like Stripe making moves to expand their stablecoin infrastructure.

The Americas led the charge, securing four of the five largest deals in H2, including a $1.1 billion acquisition by Stripe and a $525 million raise by Praxis.

A Mixed Bag for EMEA and ASPAC

The EMEA region experienced its lowest fintech investment in nearly a decade, with total funding falling to $20.3 billion, down from $27.6 billion in 2023. The UK remained the dominant player in the region, but Germany, France, and other key markets saw significant declines.

The ASPAC region, on the other hand, recorded its lowest level of investment in ten years, dropping from $14.6 billion in 2023 to $11.4 billion in 2024.

India was the standout with $4.1 billion in investment, largely due to a $1.5 billion raise by WSB Real Estate Partners. China, however, saw a dramatic decline, with investment plunging from $2.6 billion to just $687 million.

Looking Ahead: As 2025 approaches, the fintech market remains cautiously optimistic. While the payments space will continue to be the dominant driver of funding, digital assets, AI, and regtech are all expected to see increased attention in the coming year.

Emerging sectors like AI and cybersecurity are also positioned to benefit as investors look for innovative solutions that can address rising global challenges.

So, what does this all mean? While the pace of deals may slow, fintech investors are still eyeing key areas like payments, digital assets, and AI—proving that even in uncertain times, there’s still plenty of opportunity for those who know where to look.

#3 Indonesia’s Digital Transformation: AI and Financial Inclusion

In a World Economic Forum article by Vincent Henry Iswaratioso, Co-Founder and CEO of fintech company Dana, Indonesia’s digital transformation is getting a major glow-up.

With over 280 million people across 17,504 islands and a whopping 180 million smartphones in use, the country is officially killing it when it comes to connectivity.

Internet penetration reached nearly 79% in 2024, and financial inclusion is up to almost 84%, a huge leap from a decade ago when nearly half of Indonesia’s adult population was still unbanked. Talk about progress!

So, what’s driving this? It’s a mix of smart government policies, a thriving fintech scene, and an explosive digital economy.

With projections putting gross merchandise value between $200 billion and $360 billion by 2030, Indonesia is on track to dominate the Southeast Asian market.

Of course, Artificial Intelligence (AI) is playing a huge role in making all this happen, especially in financial services.

Think fraud detection, risk assessments, and personalized customer experiences—all supercharged by AI.

AI’s Big Moment

When AI isn’t just a buzzword; it’s actually helping underserved communities get the financial services they’ve been missing.

Companies like DANA are all-in on AI, with their “AI Everywhere” initiative, which is literally embedding AI across everything they do.

Engineers are tackling challenges from scam detection to better customer service, using AI to build a more inclusive, cashless society.

If you’ve ever thought AI was just for the big players, think again.

But here’s the thing: AI can be a double-edged sword. The rapid growth of AI means we need to be super careful about privacy, cybersecurity, and the transparency of AI-driven decisions.

If AI systems aren’t clear about how they make decisions (like whether you get approved for a loan or not), trust starts to erode, and that’s a huge problem for financial inclusion.

It’s about ensuring its AI is transparent and that data is locked down tight, so people feel safe using it.

Making Sure AI Stays in Check

As much as AI can make life easier, it also requires a regulatory framework that keeps things balanced.

Indonesia’s not messing around—back in 2023, the government introduced a national AI code of conduct, and there’s also the Indonesia Payment System Blueprint 2025–2030, which aims to make digital financial systems secure and interoperable.

But here’s where it gets real: AI is a data-hungry beast.

So, Indonesia’s stepping up its game in personal data protection, making sure citizens are shielded as everything goes digital.

The goal here isn’t just innovation for innovation’s sake; it’s about making sure that while AI is growing, it’s still serving the people it’s supposed to help.

And, yes, data management is crucial here. Protecting that sensitive info will be the key to keeping the public’s trust in all these new AI-driven services.

Collaboration Is the Name of the Game

Here’s the thing: Indonesia’s got a chance to lead the conversation on AI adoption, not just in Southeast Asia, but globally. The country’s approach to AI governance is all about collaboration—between fintech pioneers, regulators, tech companies, and even regular folks.

It’s about making sure that everyone gets a say in how AI impacts their daily lives. With its massive cultural and geographic diversity, Indonesia could be the blueprint for how other developing countries balance innovation with consumer protection.

The way forward is clear: keep working together, stay transparent, and don’t be afraid to adjust as AI continues to evolve. Indonesia’s got big plans, and if it can nail this balance, it’ll lead the way in closing the gaps between the haves and the have-nots, using AI to build a more inclusive economy.

Indonesia’s journey is a reminder that technology can be a force for good. If AI is used responsibly, with robust safeguards in place, it can transform the digital future in a way that uplifts everyone.

The world’s watching—and Indonesia could just be the model we all need.

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

TUESDAY, MARCH 4

[NEW YORK] Women’s History Month with Fintech Mavericks

Kick-off Women’s History Month at Brex HQ and join us for the exciting launch of the new Fintech Mavericks podcast, hosted by Drew Glover and yours truly!

We’re bringing together the fintech and founder communities for a night of networking, inspiration, and powerful stories.

The first 100 guests will receive a signed copy of my book Fintech Feminists, and a special gift from Brex customer Ipsy.

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

We like to have fun at our conferences.

I am proud to share I’m taking the biggest bet on Fintech Is Femme this year

We’re scaling up to take over New York Fintech Week in the most powerful way possible with the Fintech Is Femme Leadership Summit 2025:

📅 600+ attendees

🎙️ 30+ incredible speakers (99% women experts)

🔒 A second stage: the Fintech Security Summit with Frances Zelazny of Anonybit

💥 Multiple sponsors, partners, collaborators

💡 Everything—every detail, every speaker, every conversation—will deliver value to you because it's curated by me.

And we’re doing it all on April 23. No small feat, but I believe in the power of our community.

We’re in a moment of history when women are being told to play small.

So, we’re playing big. 💥

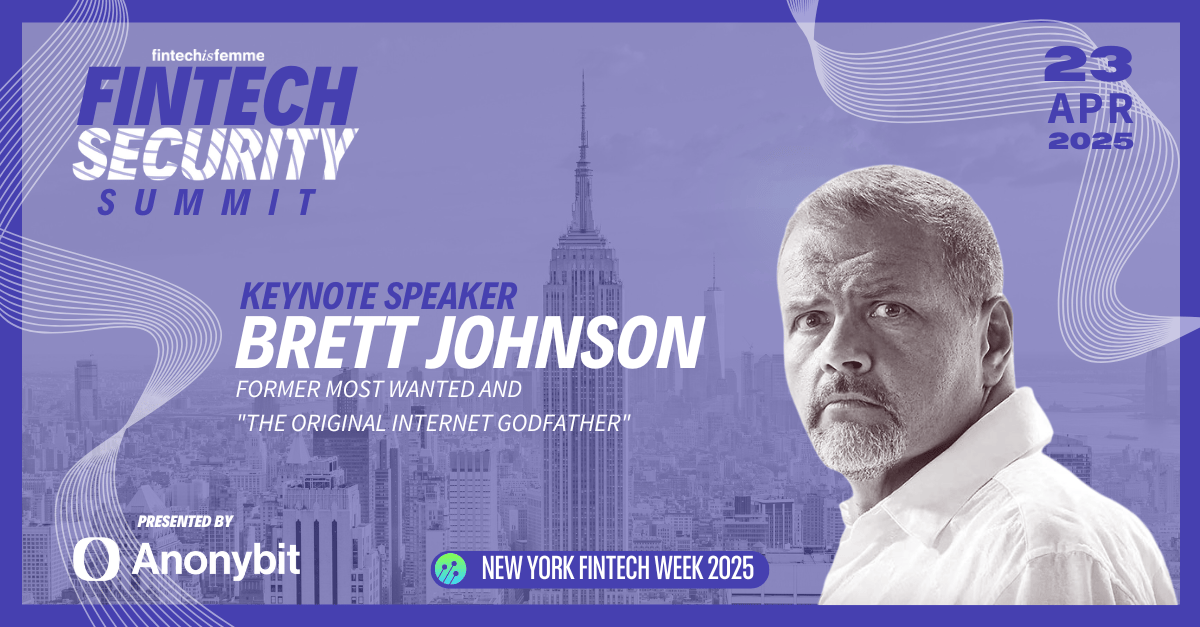

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Security Summit

I’m thrilled to announce that Brett Johnson, the Original Internet Godfather and former mastermind behind cybercrime, will be delivering the keynote at the first-ever Fintech Security Summit on April 23.

Brett’s expertise is unmatched—he helped create modern cybercrime and now works to help combat it.

If you want to understand how fraudsters think and learn how to protect your business and customers from their tactics, you won’t want to miss this.

P.S. VIP ticket holders get access to BOTH the Fintech Is Femme Leadership & Security Summit. Talk about double the impact.

SPONSORED BY

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

FINTUNES

After experiencing Alicia Keys' Broadway musical last week, I'm still in a nostalgic mood. Give it another listen and let it inspire you.

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜