- Fintech Is Femme

- Posts

- 🤑 Women Are Better

🤑 Women Are Better

Research Shows Fintech Leads in Funding for Female Founders; Why Women Are Better Investors (and How to Leverage It); Fundraising, Leadership & Community Lessons from Stephany Kirkpatrick and Jon Zanoff

Hey, fintech fam! 💜

Can you believe March is already over? This month has been about honoring the women who’ve paved the way for us, learning the strategies and tactics we need to play big, take risks, and fundraise by investing in ourselves and our communities.

For today, I’ve got some new research that just landed on my desk. Then, I’ve got two killer podcast interviews you won’t want to miss, along with a guest post showcasing something I haven’t covered enough: allyship.

Dr. Daniel Crosby, behavioral scientist and bestselling author, is here to explain why women are better and how men can help rewrite the narrative to boost the economy for everyone.

And, of course, I’ve been getting a lot of questions about the Leadership Summit on April 23.

So, I’m setting the record straight and sharing some serious ROI on why this is the event you won’t want to miss. The women already registered? They’re not here to sit in the back—they’re here to make moves.

If you’re looking for a summit that will actually help you level the hell up, look no further.

We’re ditching the “girlboss” fluff. You’re getting straight-up strategy. Tactics. The real deal from women who’ve been there, built that, and are doing business their way.

Let’s get into it all.

#TRENDING

What’s Up In Fintech

Every Thursday, I bring you the latest fintech news and trends, delivering the key insights that matter most to the industry—and you.

#1 Research Shows Fintech Is One of the Best-Funded Sectors for Female Founders

The numbers are in, and—surprise—fintech is one of the best-funded sectors for women-led startups, according to research from Tracxn.

But don’t pop the champagne just yet: global funding for women-led tech startups is down, and 2024 shows some rocky trends. Still, fintech is holding its ground—and making waves.

Here’s the lowdown from the latest data:

Overall Funding: Women-founded tech companies globally have raised $309 billion. But 2024 saw a dip, with women-led companies securing just $29.6 billion—down 11% from 2023 and 21% from 2022. The fintech segment, though, still manages to pull in a significant chunk of that.

Early-Stage vs. Late-Stage: Late-stage funding has dropped 21%, but early-stage funding has actually bumped up 10%. Investors are getting into the game earlier, as the big firms play it safe. As a result, fintech startups (especially seed-stage) still managed to secure funding, though seed-stage funding dropped by 19%.

Fintech’s Golden Ticket: While overall funding may be dropping, fintech and enterprise applications are still pulling ahead. Fintech specifically secured $16.1 billion in 2024, signaling that the real opportunity is in solving problems that matter. Fintech is still the one to watch.

Unicorns and Exits: There’s a silver lining for women-led fintech startups: 14 unicorns (a 134% increase from last year) and 10% more exit activity. Notable exits include UK-based AI cybersecurity company Darktrace (co-founded by CEO Poppy Gustafsson) and China-based Biotheus (Co-founded by Joanne Sun)—proof that women are building companies investors want to cash in on.

City Hotspots: San Francisco is leading the pack with $9.4 billion in 2024, but New York ($1.9 billion) and London ($1.8 billion) are right behind, solidifying their position as fintech powerhouses.

The Takeaway?

The narrative isn’t all doom and gloom—women in fintech are still dominating the global funding scene. While we’ve got some hurdles to overcome, the momentum is there.

Women-led fintech companies are claiming more funding than ever before and reshaping how capital is invested.

So whether you’re in early stages or building a unicorn, the opportunity is ripe. The fintech world is shifting, and women are at the forefront of driving that change. The message is clear: We’re in the game, and we’re here to stay.

The next wave of fintech growth? It’s ours. Keep pushing, keep building, and trust me, the future of fintech will look a lot more like us.

#2 Women Are Better Investors—It’s Time We Act Like It

Today, I’m excited to feature a guest post from my long-time mentor, supporter, and fellow author friend, Dr. Daniel Crosby, Chief Behavioral Officer at Orion. In this post, he shares powerful stats and insights from the chapter “Listen to Women” in his new book, The Soul of Wealth.

The investing world has spent decades acting like finance is a man’s domain. The problem? The actual results tell a different story.

Women aren’t just good investors. They’re better investors than men. And this isn’t an opinion—it’s an empirical fact.

The Data Speaks for Itself

A growing body of research proves that, across multiple measures, women outperform men when it comes to investing.

Women’s portfolios generate higher returns than men’s. During market downturns, women outperform men by 1.3 percentage points, according to Openfolio.

Women trade less frequently. A landmark study by Barber and Odean found that men trade 45% more often than women, leading to excessive fees and subpar returns.

Gender-diverse investment teams deliver better results. Firms with more women in leadership roles tend to make smarter M&A decisions and avoid costly failures.

Despite this undeniable track record, finance continues to be a boys' club—and we are all worse off because of it.

The Barriers That Hold Women Back

If women are so effective at managing money, why aren’t they running the show? The reasons are deeply embedded in the culture of finance, from systemic biases to personal self-doubt.

Women are dramatically underrepresented in finance. Only 18% of CFA charterholders—one of the highest designations in the investment industry—are women.

They are often dismissed. A staggering 40% of female investors report that financial advisors ignore their input, treating them as secondary decision-makers.

Even women underestimate themselves. Despite their superior track record, only 9% of women believe they are better investors than men.

Most women aren’t involved in their household’s investments. A shocking 82% of married men report handling investment decisions alone.

In short, women’s financial power is systematically underutilized—by the industry, by advisors, and sometimes by women themselves.

The Role of Fintech in Changing the Game

The good news? Fintech has the potential to rewrite this story.

The barriers that have historically kept women from investing—exclusionary financial institutions, dismissive advisors, the lack of tailored financial education—are being challenged by technology.

But fintech companies still have a long way to go in truly meeting women where they are and recognizing their strengths rather than assuming they need hand-holding.

So here’s the real question: What if the financial industry stopped treating women as a secondary audience (that get a shoutout every March) and instead designed for them as the powerhouse investors they already are?

What if investing platforms recognized that women aren’t risk-averse, just risk-aware, and built tools that aligned with how they actually manage money?

What if fintech didn’t dumb down its messaging for women, but instead amplified the fact that they already outperform men?

What if firms took gender diversity seriously—not as an inclusion initiative, but as a performance imperative?

The evidence is overwhelming: Listening to women isn’t just about fairness—it’s about better financial outcomes for everyone.

Finance and fintech have spent too long sidelining women. It’s time to recognize the reality: Women are the investors the world has been waiting for.

#3 Mastering Fundraising, Leadership & Community: Insights from Stephany Kirkpatrick and Jon Zanoff

If there’s one skill every founder must master—it’s storytelling.

Sure, you can hire the best engineers. You can bring in top-notch ops pros.

But what you can’t hire? Founder-market fit.

You can’t outsource conviction.

That kind of clarity? It comes from lived experience. From being so close to the problem, you are the solution.

That’s exactly what I’ve learned from Stephany Kirkpatrick, founder & CEO of Orum.

In our latest Fintech Mavericks episode, co-hosted with Drew Glover of Fiat Growth and powered by Brex, Stephany breaks down how she raised over $80M as a solo founder—and how storytelling was her secret weapon.

Her insight? It’s not just about proving the business model. It’s about showing that you are the one to build it. And, trust me—she is.

Tune in to hear Stephany share the real deal on what it takes to scale, lead, and fundraise—with both EQ and fire 🔥.

Listen now:

🚀 Powered by our friends at Brex.

In another interview, I sat down with none other than Jon Zanoff, the Mayor of Fintech in NYC and founder of Empire Startups.

For over 15 years, Jon has been a cornerstone of the fintech community, bringing together founders, investors, and banking leaders through the country’s largest fintech meetup and the highly anticipated New York Fintech Week.

This year? Things are getting even bigger. The Fintech Is Femme Leadership Summit is back, and it’s going to redefine fintech as we know it.

Jon and I explain why these events are absolutely must-attend for anyone in fintech—whether you’re a founder, investor, or rising star looking to make a splash.

Plus, we share some exclusive sneak peeks into what’s coming up at NY Fintech Week and why inclusive leadership is the future of the industry.

Listen now:

MARK YOUR CALENDARS

Join us every Thursday to keep up with fintech events!

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Is Femme Leadership Summit

You might be eyeing our Leadership Summit on April 23rd during New York Fintech Week—and I get it, you’re looking for the ROI.

Well, let me give it to you straight. Last year, I created the summit I wish existed when I first started in fintech.

I asked myself one simple question:

What could one day in the right room do for your next 10 years?

Let me tell you.

Last year, a woman came to Fintech Is Femme hoping for one good connection.

She walked out with a future investor and added $1 million to her pre-seed raise.

She spent $500 on a ticket.

A few weeks later? She signed a $50k client.

That’s the kind of ROI we’re talking about at Fintech Is Femme.

When women in fintech get the visibility, support, and room they deserve? It multiplies.

This isn’t hype. This is real.

It’s what happens when 500 women in fintech come together with purpose.

Clients. Capital. Visibility.

You’re not just buying a ticket. You’re investing in your future.

Women have already claimed their seats at Fintech Is Femme.

They’re founders. They’re execs. They’re partners at top VC firms.

Here’s a quick look at who’s already registered:

Founders of Series A+ fintechs

Heads of Product and Growth at top startups

VCs from funds you follow

Operators, marketers, CFOs, engineers—and women who are hiring

And they’re not coming to sit in the back—they’re here to make moves.

If you’re looking for a summit where you can level the hell up, this is it.

Forget “girlboss” fluff. You’ll get strategy. Tactics. The real deal from women who’ve been there, built that, and are doing business differently.

You’ll hear from speakers like:

Elizabeth Gore, Co-Founder & President, Hello Alice

Meghan Kober, VP of Fintech Partnerships and Investments, U.S. Bank

Tanya Van Court, Founder and CEO, Goalsetter

Ashley M. Fox, Founder and CEO, Empify

And many more!

Pro tip: Most attendees are grabbing the Community Bundle because it’s the most value at the lowest price. You get access to my exclusive community, The Academy of Fintech, for an entire year. Talk about ROI, right? You’ll make world-class connections before and after the event.

Don’t sleep on this.

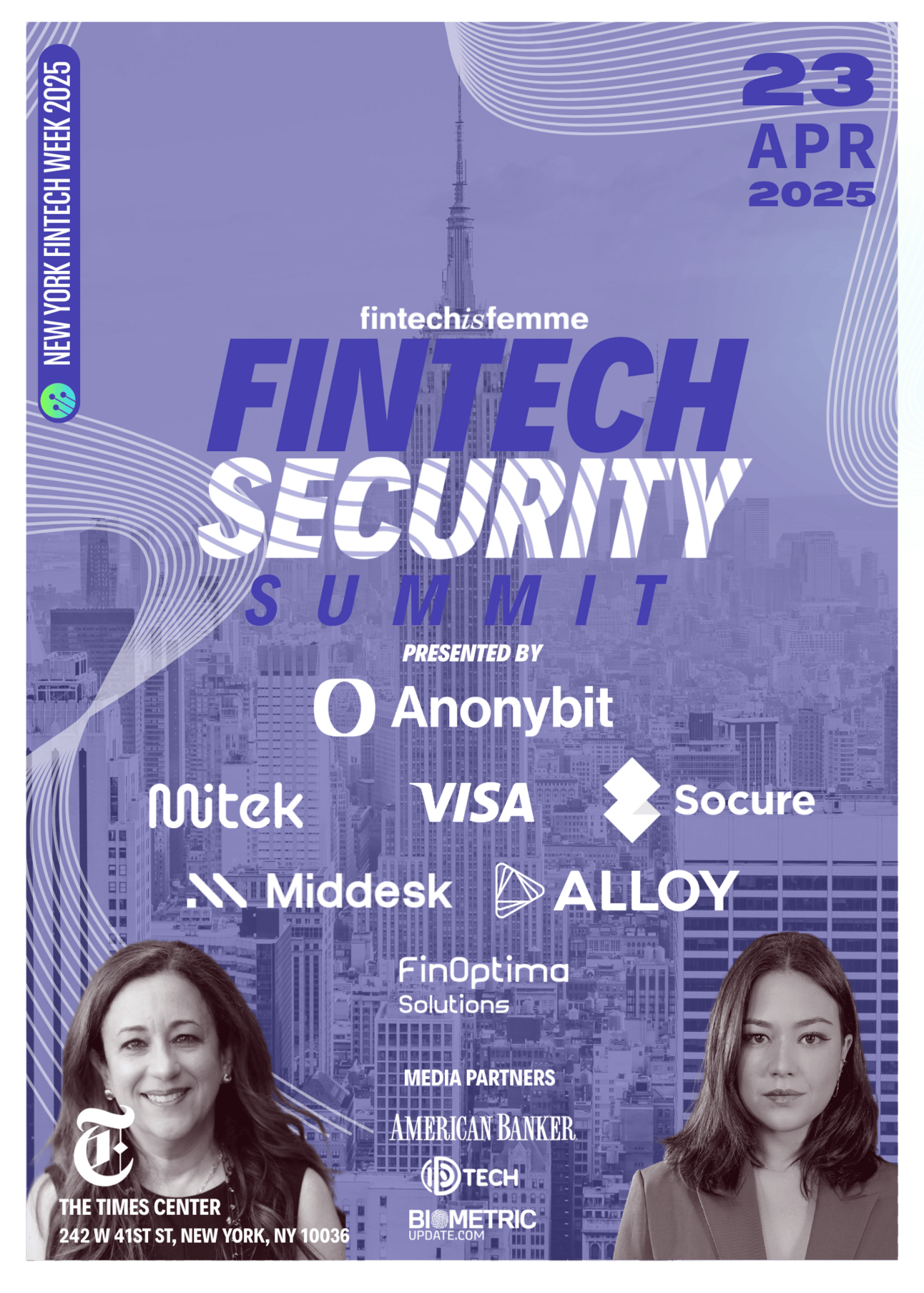

WEDNESDAY, APRIL 23

[NEW YORK FINTECH WEEK] Fintech Security Summit

Security isn’t just a concern—it’s the foundation for growth, trust, and sustainability.

With fraud and identity theft continuing to rise at alarming rates, fintech companies can no longer afford to overlook the critical intersection of security and accessibility.

If we want to build a future where everyone, regardless of background or financial status, can access and benefit from innovative financial solutions, security must be prioritized at every level.

This year’s Fintech Security Summit is tackling this urgent challenge head-on.

We’re bringing together some of the brightest minds in fintech—pioneers, risk experts, and visionary leaders—to explore how we can create a fintech ecosystem that is both secure and accessible.

Our mission? To push boundaries, spark new innovations, and ensure that security is woven into the very fabric of the fintech solutions we build.

Join us at the Summit and become a part of the movement to reshape the fintech landscape.

FINTUNES

LET’S CONNECT

📰 Share this newsletter with a friend and start growing your network.

🔗 Connect with me on LinkedIn for daily insights on leadership.

🤝 Grow your business through content & community by partnering with me.

📣 Promote yourself to 50,000 subscribers by sponsoring this newsletter.

🎤 Host an epic event by booking me as a speaker, moderator, or emcee.

📚 Increase your expertise by ordering your copy of my book, Fintech Feminists: Increasing Inclusion, Redefining Innovation, and Changing the Future for Women Around the World.

⭐️ P.S. If you’ve read Fintech Feminists (or listened to the audiobook!), I’d be so grateful if you could take 30 seconds to leave a review or rating on Amazon here. Your support means the world to me. A million thanks in advance!

That wraps up today’s edition—thanks for reading! Until next week, keep innovating and challenging the status quo. See you Tuesday!

Love,

Nicole 💜